‘Don’t bet against America’: Cbus’ top stockpicker keeps faith

The new head of the $100bn construction-aligned industry fund major intends to keep deploying cash in the US.

Despite a major cooling toward the US markets under Donald Trump, the new investment boss of one of the nation’s biggest super funds is still a big believer in the American economy, and intends to keep deploying cash there.

Leigh Gavin has been named as the new chief investment officer of the $100bn construction industry aligned-Cbus Super, and while the near term outlook for the US will be marked by a period of more volatility, the long-term trends will continue to deliver for members.

“I think you’d write the US off at your peril,” Gavin tells The Australian. “I remember coming out of the GFC, people thought the American story was dead. It’s still an enormously entrepreneurial country full of very smart people, very good companies, and there’s probably no other country that turns GDP growth into EPS growth better than the US”.

In a wide-ranging interview, Gavin outlines why private markets are increasingly important for investing and sees the bottom on commercial property. He says ESG-investing still counts but is evolving, and says he is prepared to keep backing Australia as an investment destination.

Gavin steps into the role from deputy chief investment officer of the fund, he takes charge from long-serving investment boss Brett Chatfield who has taken up an opportunity outside the fund with a private investment office.

Even so, at these levels the fund is sitting in the investment “sweet spot,” Gavin says.

Cbus has more than 920,000 members, the overwhelming majority are construction industry and trades workers and apprentices. Gavin who joined Cbus two years ago from Australian Super, grew up in a trade household – his father was a carpenter.

The Wayne Swan-chaired Cbus is the nation’s sixth-biggest industry fund, but still relatively dwarfed by mega-funds including the $360bn AustralianSuper and the $310bn Australian Retirement Trust.

The Cbus restructure follows a tough year for Cbus, with regulator APRA looking at the fund’s ties to the militant union CFMEU. It is also involved in a legal battle with corporate regulator ASIC around slow payment of death benefits claims. Fund giant Australian Super is also facing a similar claim.

$150bn target

Cbus chief executive Kristian Fok has outlined a target for the fund to hit a target of $150bn by the end of the decade. There is also a plan for around half of the funds to be managed in-house, up from around a third currently.

“We genuinely believe that at $100bn, we’re big enough to do almost anything we want internally, but we’re still small enough to do things externally. We can invest in every asset class, and we’re not capped out in any particular asset class,” Gavin says.

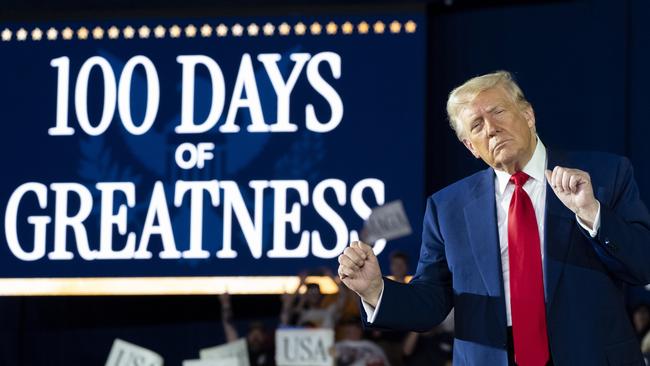

The near-term outlook for US shares under Trump will be marked by heightened volatility, and the swings will move in both directions. While Wall Street crashed in the days following Trump’s ‘Liberation Day’ tariff announcement the S&P 500 falling some 15 per cent, but markets are now around 2 per cent below their starting point.

“It feels rather bizarre that things fell so quickly and have rebounded so quickly back. But to be honest, if the first 100 days are any indication of what we might have in store in the next three and three-quarter years, I think that this sort of volatility is here to stay”.

“Markets will wax and wane between believing that the Trump administration can put the genie back in the bottle, versus the secular challenges of deglobalisation, which are not going away”.

Private markets

Gavin says private markets investment including infrastructure, private credit and commercial property really showed its resilience while shares were crashing.

About 33 per cent of Cbus’s fund is in private markets, 50 per cent is in equities and the rest is in cash and fixed income.

While Cbus wasn’t getting the upside when Wall Street was returning 25 per cent in back to back years, private market investments were delivering consistent positive returns during the sharp sell off. Cbus’s no-frills MySuper growth option has so far delivered 4.5 per cent in the financial year to date – even in the face of the heavy Wall Street sell-off.

“We still believe a diversified model with diversified sources of growth, assets, rather than just all our eggs in one basket being equities, comes into its own in years like this, and has stood the test of time over the last 40 years”.

With rising criticism about big super funds not investing more of their billions in Australia, Gavin says 50c in every dollar of his fund goes into local investments ranging from equities, private markets, including infrastructure, or bonds.

“That’s still going to be the case for the medium term,” he says. The reason why more isn’t spent here particularly in equities comes down to returns for members.

The difference would come down to allocating more to a “very expensive” Commonwealth Bank which offers marginal earnings growth, or investing in a US bank at a lower price which offers far more upside for earnings.

ESG risk

Cbus is still a big investor in energy markets, which ultimately means renewable energy. But Gavin says the focus is on opportunities and the right assets that don’t rely on government subsidies and they need to “stand on their own two feet” as an investment proposition.

Gavin too is watching policy settings in renewable energy. He was speaking as a surge in renewables generation was under scrutiny for a mass blackout across Southern Europe. Gavin says Cbus remains committed to a net-zero emissions target by 2050 and a 45 per cent decline in emissions by 2030.

However, he notes Cbus “can’t meet that target in isolation on its own” and would need to part of the right policy settings.

Industry funds have been blamed for pushing companies ahead of the community on so-called ESG (environmental, social and governance) issues. Donald Trump has led the attack on corporate diversity measures in the US.

The ESG landscape is changing, Gavin says, but this doesn’t change that the fund has a fiduciary duty to incorporate material risks – including the issues that fall under ESG – when it comes to delivering on the best interest for members.

Climate change, adaptation and resilience remain a big part of this given the fund’s long-term investment horizon, he says.

The construction industry aligned fund is more skewed to property than others big funds. It also has its own in-house development arm. The exposure means it is more exposed during downturns, although Cbus’ investments are likely to deliver to low-to-mid single digit property returns this year. Property should be viewed as a counter-cyclical investment, although there is a broad view the market has bottomed, he says.

Moving to a bigger internal investment team is the big aim in coming years. Cbus has a target of 50 per cent internalised management, from about 35 per cent currently. This means half of the funds will be managed by Gavin’s own team making it one of the biggest in-house managers of funds.

There are two reasons behind this: the first being able to invest a bigger pool of money while saving on expensive fees. Gavin estimates Cbus has already saved around $1bn in management fees since 2017 as the fund started moving more investment functions in-house.

The second is it makes the fund a better investor. The insights and themes coming out of one investment team are shared across the fund helping other teams be they in infrastructure property or debt get a fuller picture of the environment. In the long run this translates to better returns.

“Any economies of scale that we capture go directly back to our members net returns, and those 920,000 members deserve every last basis point they can get,” Gavin says.

eric.johnston@news.com.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout