Coronavirus: China devours one-third of all our farm exports

China accounts for a third of all Australia’s food and agricultural exports — the highest proportion since Britain in 1958 — amid rising political tensions.

China accounts for a third of all Australia’s food and agricultural exports — the highest proportion since Britain in 1958 — as warnings grow of an over-reliance on the nation’s biggest trading partner amid rising political tensions.

Rabobank head of food and agribusiness research Tim Hunt said “extracting one in three of our export dollars from one market” brought considerable risk for the food and agricultural sector.

This heavy exposure to China was particularly problematic in the current environment, in which political tensions between our two countries are running high after Australia led the push for an independent inquiry into the provenance of the COVID-19 virus, earning the ire of the ruling Chinese Communist Party.

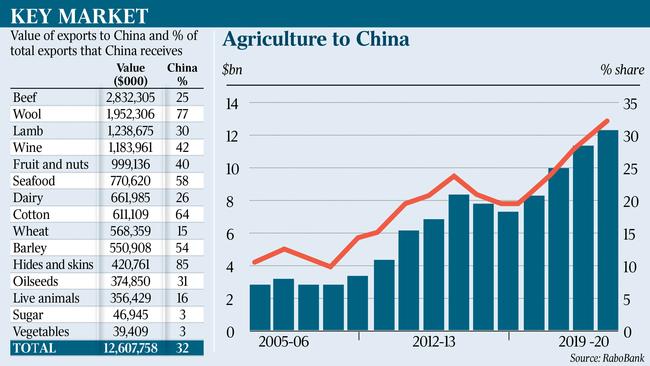

More than $12.6bn, or 32 per cent, of the nearly $40bn in food and agricultural international sales in 2019-20 were to the Asian giant, Rabobank analysis showed.

The overall figure concealed some wide variations within individual markets, with 77 per cent of wool exports going to China, or $2bn worth, while the $1.2bn in wine exports to China represented 42 per cent of our total international wine sales.

A quarter of beef exports went to China in the most recent financial year, and 30 per cent of lamb exports.

“We haven’t been this exposed to one market since the 1950s, when we were still joined at the hip to the UK,” Mr Hunt said. “And that was a very different political relationship. The industry will have to decide how to balance the unique opportunities still available in China versus market diversification.”

China this week launched an anti-dumping investigation into Australia’s wine export industry, which carried with it the threat of punitive tariffs.

Scott Morrison on Wednesday rejected “any suggestion there’s been any dumping of Australian wine in China, whatsoever”.

“And we don’t believe there’s any evidence to support that,” the Prime Minister said.

The move against Australian wine producers follows China slapping higher import taxes on Australian barley and the suspension of four meat exporters.

UTS professor Warren Hogan, who has completed a report for the Australian food manufacturing and groceries industry, said China was unlikely to extend its protectionist stance to Australian food exports, which he said the Asian giant depended upon for its own industry.

“The great bulk of our agricultural exports are still primary products, and they need it,” Professor Hogan said.

While Australia’s historically extreme exposure to China has become problematic, there is no denying the relationship has brought huge benefits to our agribusinesses over the past 10 years.

The launch of the China Australia Free Trade Agreement in December 2015, in particular, has made an “enormous” difference to the sector, Mr Hunt said. “China has underwritten most of the growth in the Australian industry over the past decade. It’s also provided a unique opportunity, beyond volume growth, to sell premium products.”

But diversifying our markets remains a major challenge, and exporters and the Department of Trade are seeking opportunities to deepen trade relationships within our region.

Barley producers, for instance, have looked to Indian brewers to replace Chinese demand. India in May recognised a quarantine treatment for malting barley – an announcement the government said meant Australian barley producers were “poised to become major players in the Indian brewing industry”.

Trade Minister Simon Birmingham told The Australian the Morrison government’s focus on pursuing trade and economic agreements with, for example, Indonesia, Vietnam and India, was “all about giving our exporters maximum choice”. “From that choice, those businesses make their decision about with whom they trade, but that choice also gives them the capacity to build maximum resilience,” he said.

Mr Hunt said Australia’s food and agriculture industry’s reliance on China had likely “peaked”, in part because the bigger wheat season this year will provide a “huge boost” to shipments of a product typically sold outside China. The anti-dumping duty on barley will also lead to exports redirected elsewhere over the coming 12 months, he said.

The food and agricultural industry had been “flexible and adept enough to navigate shifts in its customer base over many decades”. “This may prove to be the start of the next phase in that journey. We are surrounded by the heavily populated, economically growing Southeast Asia region that also presents enormous opportunities.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout