ATO to crack down on people rorting early super scheme

The ATO says people are rorting the early super scheme to avoid paying tax.

The Australian Taxation Office says it is cracking down on people rorting the early release of super scheme by using system loopholes to dodge paying tax.

A document released by the ATO highlights a weakness within the country’s tax framework in relation to the federal government’s COVID-19 financial assistance measure, which was initially designed to assist Australians facing financial hardship due to the pandemic.

According to the ATO, a super fund member is able to request payment through the scheme at a tax free rate, and in the same financial year make a voluntary contribution from their income at the superannuation tax rate of 15 per cent, which would result in a certain amount of income avoiding the marginal tax rate.

For example, a person on a salary of $100,000 could access $10,000 tax free through the scheme and then salary sacrifice $10,000 into their super account, resulting in $10,000 of income earned for the financial year to be taxed at 15 per cent rather than 37 per cent.

The ATO said it is monitoring for signs of people trying to evade tax by withdrawing funds and then making a voluntary contribution to their retirement savings, or contributing an amount of super to claim a tax deduction and then withdraw the amount at a tax free rate.

It is also targeting taxpayers who are artificially arranging working conditions to meet the scheme’s eligibility requirements.

“We have seen some COVID-19 early release of super examples where people are doing the wrong thing,” the ATO said.

“In some cases, we have stopped applications and prevented super money from being released.”

The Treasury initially estimated that roughly 1.5 million Australians would lodge applications for early release of super in the 2020 and 2021 financial years, which would sap the country’s retirement pool of about $27bn.

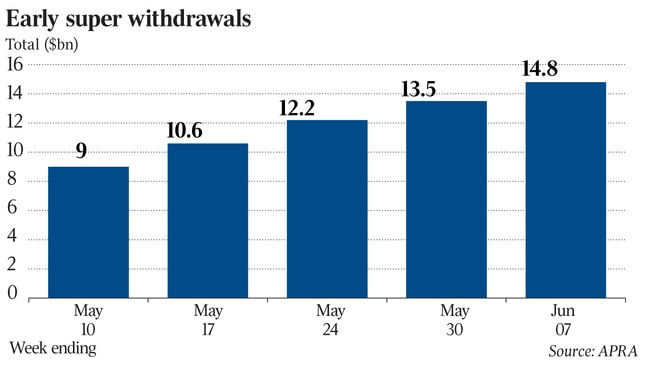

According to the Australian Prudential Regulation Authority nearly two million account holders have requested early withdrawals, totalling to $14.8bn

The federal government implemented the early release scheme as a measure to assist Australians who have become unemployed or experienced a reduction in working hours due to the pandemic.

The Australian understands that no documentation needs to be submitted with the application to prove whether or not a person is eligible for the scheme, and that access to the scheme is a self assessment process.

It has previously been reported that approximately 40 per cent claims are from people who had not suffered a fall in income due to COVID-19.

Curb the amount of false claims

Industry Super Australia has welcomed the ATO’s apparent strengthening of enforcement efforts to curb the amount of false claims.

ISA, which represents 15 industry funds, said bank data has shown that money accessed via early withdrawal requests is being spent on discretionary items such as alcohol, furniture and gambling.

ISA chief executive Bernie Dean noted that the early release scheme should be viewed as a last resort and that a weaker superannuation sector would result in more people being reliant on the aged pension rather than their retirement savings.

“Ineligible applicants undermine the credibility of this emergency scheme and could be holding up payments for those that desperately need money now,” Mr Dean said.

The ATO said it is gathering information from Single Touch Payroll, income tax returns, information provided by funds and data from Services Australia and Home Affairs.

Both Senator Jane Hume and Minister Michael Sukkar have been contacted for comment.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout