APRA set to ease clampdown on bank, insurer dividend payouts

The bank regulator will relax some of the restrictions imposed on dividends paid by the financial sector, but still wants ‘prudence’.

Investors cooled on major-bank stocks, despite the prospect of the Australian Prudential Regulation Authority easing the tight clamps on dividends when it updates its guidance on capital management next week.

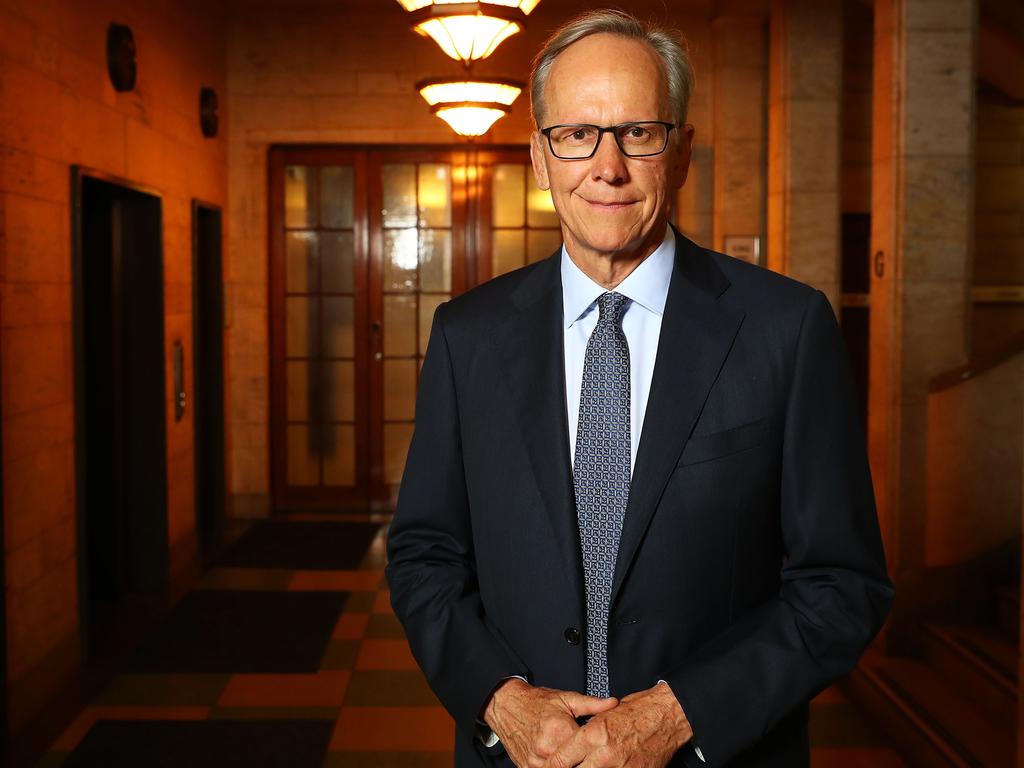

While some analysts said the dividend outlook had brightened as a result of a speech by APRA chairman Wayne Byres on Wednesday, others said it was likely that dividends would again be deferred at key reporting dates next month.

Commonwealth Bank, which announces its annual profit on August 12, was in a category of its own, nursing $5bn in surplus capital as a result of asset sales.

Mr Byres signalled in a speech to the Trans-Tasman Business Circle that the COVID-19 crisis had moderated since April, when APRA told banks and insurers they should seriously consider deferring dividends.

The level of uncertainty in the domestic economy remained high, but the APRA chief said it had fallen overall.

“We will modify the guidance, and extend it for the remainder of this calendar year, shifting from the immediate, short-term emergency response in April to a setting with a somewhat longer-term outlook,” he said.

“Our goal is to combine ongoing prudence with flexibility: that is, to ensure capital management practices clearly have regard to the continuing uncertainty in outlook, that stress scenarios can be overcome without having to resort to cutting business activity, and that regulated firms are not unduly constrained from raising capital if and when needed.”

On Tuesday, The Australian flagged APRA’s intention to update its formal guidance on capital management and dividends in the coming weeks, with Mr Byres to lay down some broad markers on Wednesday.

Some senior bankers and investors expected final guidance in Mr Byres’ speech, which led to share-price weakness in the sector when it failed to materialise.

All four major-bank stocks were down in a range of 0.5 per cent to one per cent, with sentiment not helped by a record daily increase in COVID-19 cases in Victoria.

Credit Suisse analyst Jarrod Martin said in a note that, overall, Mr Byres’ comments were positive for the sector.

“There will be more certainty about the capital management framework and a more clearly defined dividend outcome for the full-year,” Mr Martin said.

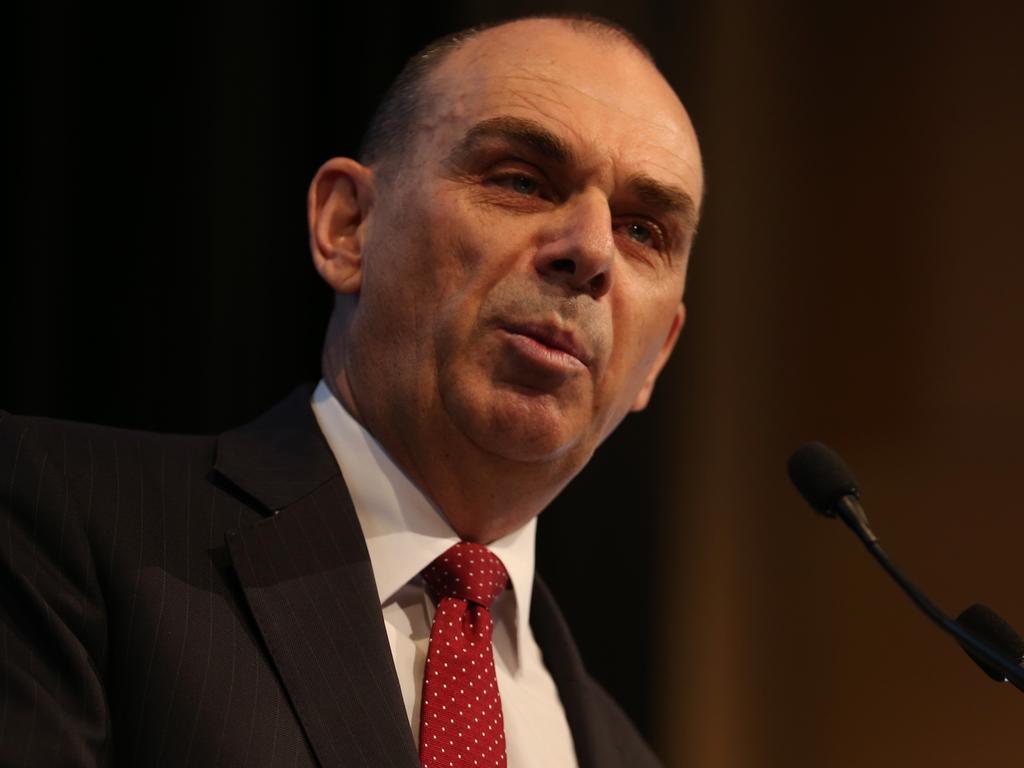

Jefferies analyst Brian Johnson had a different view, saying dividends were more likely to be deferred until APRA could quantify the looming COVID-19 loan loss cycle.

Prior to the regulator’s emergency April guidance, CBA was able to announce and pay out an unchanged, $2-a-share interim dividend.

ANZ Bank deferred its half-year dividend in late April, saying the board was likely to determine its final position on August 19 when the bank unveils its third quarter trading update and Pillar 3 report on capital and risk.

Westpac, for its part, deferred its interim distribution in May.

Its Pillar 3 report is due on August 18, when the bank is likely to update shareholders on the dividend.

National Australia Bank, also following APRA’s original guidance, slashed its interim dividend by 64 per cent, from 83c to 30c, in April.

Mr Byres said in his speech that, in addition to the reduction in overall uncertainty, capital markets were now functioning in an orderly manner, with access to capital available to those seeking it.

APRA also understood the scale of support packages offered by the financial sector to its customers, and it had been able to conduct stress tests on banks and insurers to understand “how and when pressure will emerge under severely adverse scenarios.

This included the extent to which the impact of COVID-19 “will play out differently for banks and insurers”.

Mr Byres said all this was helpful.

However, there was still a strong case for prudence, “at least for the time being”.

Mr Byres also acknowledged the uncertainty in relation to how promptly entities would have to rebuild their capital buffers if they were eroded to levels below the industry’s “unquestionably strong” benchmarks.

“It is difficult to be precise on this point, but I want to be clear we have no intention of creating a capital cliff-face that banks or insurers need to rapidly climb,” he said.

“As we have done in the past, our approach will be to allow banks and insurers to rebuild (to the extent any rebuild is required) in an orderly manner, and in a way that doesn’t unnecessarily constrain activity or economic growth.”

More broadly, Mr Byres said the nation’s financial system remained “fundamentally sound and stable”, with banks and insurers soundly capitalised and highly liquid.

“APRA’s stress testing of the banking sector indicates the industry is well-placed to withstand any major economic headwinds ahead: even when faced with severely adverse scenarios, our analysis indicates the banking industry would remain well above minimum capital requirements,” he said.

“The insurance sector remains willing and able to support customers in times of need.

“Both sectors have also proven operationally resilient in the face of severe disruption to many aspects of their business activities.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout