Banks await new APRA guidance on dividends

Regulator Wayne Byres will have investors’ full attention on Wednesday when he reveals the latest thinking on dividends.

Financial services watchdog chief Wayne Byres will have the full attention of directors and investors on Wednesday when he reveals the regulator’s latest thinking on the critical issue of dividends.

More than three months has passed since Mr Byres, chairman of the Australian Prudential Regulation Authority, hijacked board dividend policies on April 7, warning directors that any payments should be “materially reduced” or deferred during the COVID-19 crisis.

Later that month, National Australia Bank slashed its interim dividend by 64 per cent, from 83c to 30c, when new chief executive Ross McEwan kicked off the half-year profit reporting season.

ANZ deferred its dividend in April, with Westpac’s deferral announced in May.

Commonwealth Bank had already maintained and paid out its $2 a share dividend owing to its earlier balance-date.

It is understood that Mr Byres will set down some broad markers for the regulator’s approach to dividends when he addresses the Trans-Tasman Business Circle.

Any formal guidance will come later, and is more likely to be in a matter of weeks rather than months.

While the APRA’s public intervention on board dividend policies was rare, it fell short of the stricter approaches taken by regulators in Britain and New Zealand, which explicitly told entities to freeze distributions so they could support their domestic economies.

The US Federal Reserve followed suit in late June, ordering the country’s biggest banks to cap dividends and suspend share buybacks so they could conserve funds for lending.

Announcing the results of its annual stress tests, the Fed said a prolonged economic downturn could saddle the biggest banks with up to $US700bn ($995bn) in loan losses.

The stress tests were expanded this year to examine the effects of the downturn brought on by the pandemic.

Until recently, the focus of Mr Byres’ presentation tomorrow was intended to be APRA’s approach to the looming expiry of loan deferrals at the end of September.

On July 8, however, the regulator announced an extension of mortgage and business lending deferrals, first announced in March, for a further four months until the end of March 2021.

Any extension is conditional on an appropriate credit assessment by lenders.

The APRA chairman said in his letter to all banks and insurers in April that dividends should be limited in the months ahead to ensure spare capacity could be used to lend and underwrite insurance.

Capital management decisions, he said, looked to the future, and the current environment was plagued with uncertainty.

The industry was therefore advised to use robust stress testing to inform its view on appropriate capital levels, with heavy consideration to be given to “plausible downside scenarios” and the deferral of dividends.

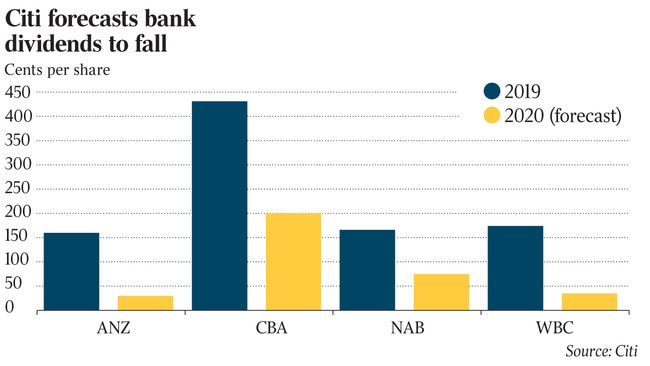

In a report on Monday, Citi analyst Brendan Sproules warned that the recovery in bank dividends would take longer due to the likelihood of rolling lockdowns after a second spike in COVID-19 infections in Victoria.

Regulators would also seek even higher capital buffers, with the industry to carry a persistent portfolio of loan deferrals.

Solvency challenges were also likely to emerge for small lenders.

Mr Sproules forecast that ANZ and Westpac would not pay any interim dividend after announcing deferrals at their half-year results, and that CBA would follow suit for its final dividend.

A senior banker said on Monday that no one in the industry had a “clear handle” on the outlook, or the major banks’ capacity to reward their shareholders.

“There’s still too much uncertainty, which is why any guidance from APRA on dividends will be treated like papal smoke coming from the Vatican,” he said.

ANZ said at its half-year result that the board was likely to determine its final position on the interim dividend on August 19, when it unveils its third quarter trading update and Pillar 3 report on capital and risk.

Westpac’s Pillar 3 report is due the day before, with the board also likely to complete its deliberations on the half-year payout.

ANZ chair David Gonski said at the interim result that the decision to defer the dividend had nothing to do with the bank’s financial position, and APRA had not communicated any concern about its capital levels.

“The board agrees with the regulator’s guidance that deferring a decision on the 2020 interim dividend is prudent given the present economic uncertainty and that making a decision at this time would not have been appropriate,” Mr Gonski said.

“This was a very difficult decision and the board considered all options available as we understand the impact this decision will have on those shareholders who rely on dividends.”

While CBA was the only one of the four majors to avoid the impact of the dividend pronouncement in April, it will be caught in the regulatory net for its full-year result. The bank will announce its 2020 result on August 12. CBA faces the same challenges as the other banks, with Mr Sproules forecasting no final dividend.