Spending and property prices on the rise

Consumers and homebuyers are defying Omicron and speculation about higher interest rates, with spending rebounding to pre-outbreak levels and housing tipped to rise by 6pc.

Consumers and homebuyers are defying Omicron and speculation about higher interest rates, with credit and debit card spending rebounding to pre-outbreak levels and the housing market tipped to rise about 6 per cent this year.

CBA senior economist Kristina Clifton said an analysis of credit and debit card data suggested there was a “little bit of a slowdown in early January, mainly on the services side”, but the latest figures over the week to January 21 had seen spending lift again and “broadly back to where we were pre-Omicron”.

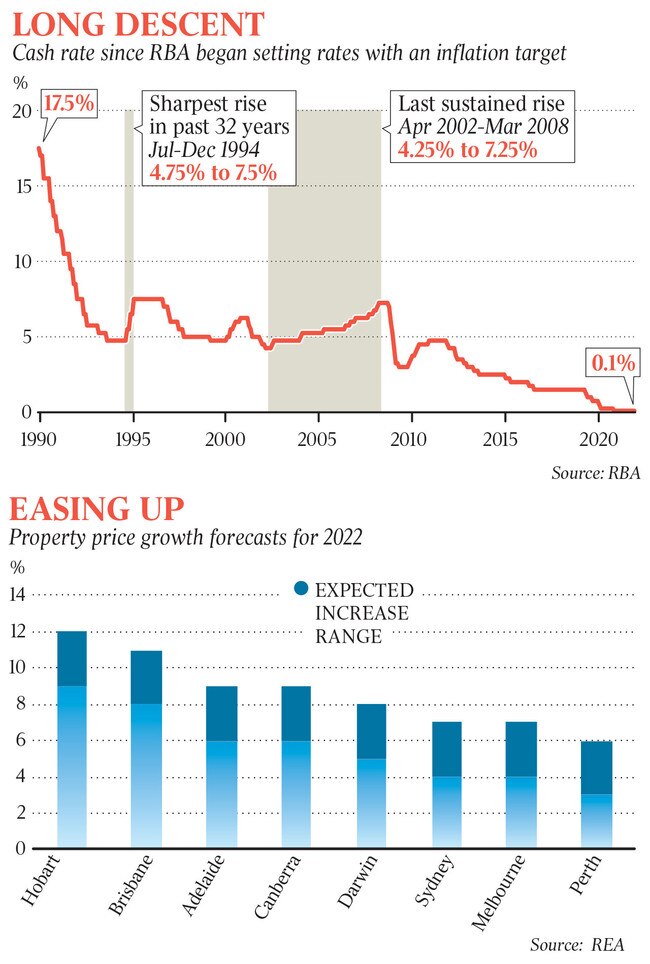

The positive card data came as REA Group’s new housing market outlook said values in Sydney, Melbourne and Perth would grow by between 3 per cent and 7 per cent this year. The Brisbane and Hobart housing markets would prove the most resilient in 2022, with prices to rise by between 8 per cent and 12 per cent, according to the REA Group forecasts. The national growth forecast of about 6 per cent comes after property prices rose 25 per cent last year.

REA Group director of economic research Cameron Kusher said the slowdown in the Sydney and Melbourne property markets had been happening since the middle of last year.

He said an increase in listings and the shift away from spending on housing to other goods and services would have moderated price growth this year, regardless of an earlier than anticipated lift in borrowing costs.

The Reserve Bank is expected to hold rates steady at 0.1 per cent at its first board meeting of the year. But it is widely expected to open the door to a rate hike before the end of 2022 after data this week revealed inflation jumped to 3.5 per cent over the year to December. It’s also anticipated that RBA governor Philip Lowe will announce the end of the bank’s $4bn-a-week bond buying program – the next step towards an eventual removal of emergency monetary policy settings put in place to support the economy through the pandemic.

Ms Clifton said the softness in credit and debit card spending was “nowhere near the extent when there is an actual lockdown in place”.

Weekly spending by CBA customers slumped to 10 per cent below pre-pandemic levels during last year’s lockdowns, before recovering to be 15 per cent higher ahead of the Omicron wave. The surge in cases flattened consumption to be about 10 per cent higher than the same weeks during 2019.

Creditorwatch chief economist Harley Dale, whose firm provides credit scores for tens of thousands of Australian firms of all sizes, said the Omicron outbreak meant “we haven’t got off to the start in 2022 that most businesses had anticipated”.

“Businesses are proving pretty resilient,” Mr Dale said. “There are some who have had to close over the Christmas, new year period, and some who it doesn’t make commercial sense to reopen.” Mr Dale said a lack of real-time data made it difficult to assess how many firms would fail as a result of Omicron, but said “I think we’ve already learnt the latest form of the virus has sadly been very destructive”.

While the pandemic has created winners and losers, Ms Clifton said the nation’s economic fundamentals remained strong. “We have very high levels of household savings, consumer sentiment is still in reasonable shape, and we have a very, very tight labour market,” she said.

“All the underlying conditions are in place for as strong economy once this outbreak has passed.”

SQM Research property analyst Louis Christopher said 2022 was set to a “very interesting year”. He said his base case was that the national average property price would grow by 0-5 per cent this year, and that there was the potential for falls in Sydney (-2 per cent to 4 per cent growth) and Melbourne (-3 per cent to 2 per cent).

Once again, Brisbane looked the outstanding prospect, Mr Christopher said, where he predicted growth of between 8 per cent and 14 per cent in 2022.

ANZ head of Australian economics David Plank said his bank’s card spending data was yet to reveal any meaningful pick-up in consumption, although “the economy’s in good shape”.

“There will be sticker shock with the first rate – it will be the first one people have seen for a long time,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout