Pandemic brakes come off and economy surges

The phase-out of Covid-19 restrictions has boosted the budget bottomline by $8.5bn.

The phase-out of Covid-19 restrictions and lockdowns has boosted the budget bottomline by $8.5bn, as Australia’s jobs recovery and surging tax revenue slashed the nation’s record deficit bill.

Booming business activity in the lead-up to Christmas and jobs coming back online as east coast states reopened their borders helped move thousands of Australians off welfare and lowered social security payments by $1.9bn last month.

Monthly financial statements released by Finance Minister Simon Birmingham showed tax receipts over the first half of the financial year were $3.4bn higher than anticipated in last month’s mid-year budget update.

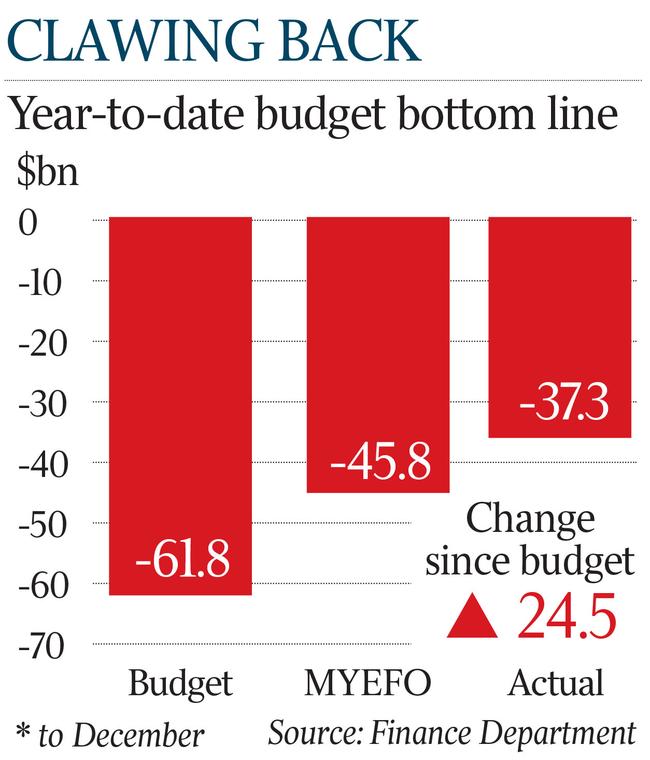

The first-half budget outcome was $24.5bn better than predicted in May last year, with the deficit in the same period falling to $37.3bn.

Ahead of Josh Frydenberg handing down an early pre-election budget on March 29, S&P Global Ratings on Thursday reaffirmed Australia’s AAA credit rating in a new report spruiking an “improving” fiscal outlook.

The international agency said there was evidence the federal deficit was “narrowing substantially as stimulus measures finish”, further buoyed by a continuing post-lockdown economic recovery that had pushed unemployment down to 4.2 per cent.

A key driver of Australia’s economic recovery was the creation of more than 400,000 jobs in November and December, with 13.2 million people in employment last month.

Senator Birmingham said the improved economic position, which showed the Omicron wave had failed to stall the recovery, indicated a “stronger economy and creating more jobs is key to a better budget bottom line”.

“The current jobs boom means fewer welfare payments are going out the door and there are more taxpayers across the economy,” Senator Birmingham said.

“Covid-19 continues to see additional costs associated with healthcare, business and income support, resulting in budget deficits that we would rather not see.

“However, Australia is one of only nine countries to retain our AAA credit rating, which can only be protected by continued economic strength.

“Given the tax cuts we’ve delivered for households and businesses, the strength of total tax receipts is further evidence of the resurgence of our economy.”

S&P credit analyst Anthony Walker said “we do not expect to see a large increase in spending initiatives that would substantially weaken fiscal accounts in the next budget or in the lead-up to the commonwealth election”.

“Nor do we expect further lockdowns to derail our expected fiscal recovery at the general government level, either by weighing on projected revenue growth or resulting in material fiscal stimulus,” Mr Walker said.

In response to S&P’s optimistic outlook for Australia, Mr Frydenberg said “sustainable public finances is key to retaining our AAA credit rating and only the Coalition has a strong track record of fiscal discipline and repairing the budget”.

“Australia cannot afford the threat of a high taxing and big spending Labor Government who at the last election proposed $387bn of higher taxes and sought to divide Australians with their class war rhetoric,” Mr Frydenberg said.

S&P estimated that the general government deficit – including the commonwealth and state and territory governments – would average about 3.3 per cent of GDP between fiscal years 2022-23 and 2024-25, down from a peak of 9.2 per cent of GDP in 2020-21.

Australia’s net debt would continue to climb over the coming few years, reaching a “modest” 36 per cent of GDP by the middle of the decade – more than triple the 11 per cent recorded in 2019 before the pandemic, the report noted.

The global ratings agency noted that Australia’s heavy reliance on commodity exports remained a key vulnerability, but that global demand for our natural resources had remained strong through the pandemic.

Opposition Treasury spokesman Jim Chalmers on Thursday attacked the government over flat wage growth and cost-of-living pressures for families.

“When it comes to interest rates we saw in the inflation data earlier in the week, that the costs of living are skyrocketing and real wages are going backwards under Scott Morrison. Nobody is pretending under either government that interest rates will stay at zero forever. Clearly, at some stage, the bank will be contemplating rate rises,” Dr Chalmers said.

“What we’re seeing right around the country right now is people are finding it hard to get groceries, hard to find rapid antigen tests, hard to meet the rising cost of living, whether it’s rent or petrol.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout