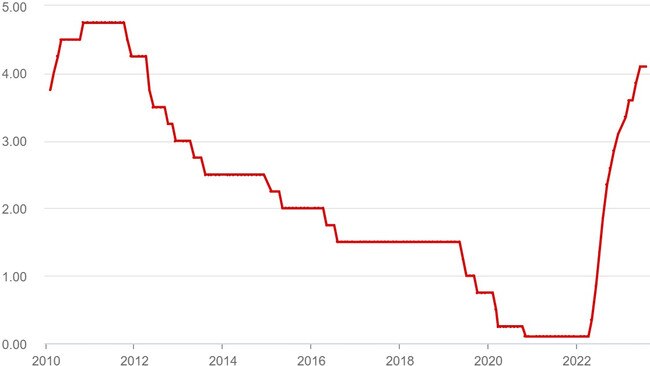

It follows the line ball call on Tuesday to hold the cash rate at 4.1 per cent and indeed if inflation continues to cool, there’s a good chance the RBA is done hiking.

Tuesday’s hold decision is significant on a number of fronts. Importantly it allows households and businesses to catch up with the new reality that money is much more expensive than it has been for a decade and to adjust for the need to sustainably reduce spending. Its only little more than a year ago that the cash rate was sitting at next to zero.

Tuesday’s decision marks the second consecutive month of a pause, and while from a modest base, this has provided the most stability in the cash rate since the central bank started its brutal hiking cycle in May last year. The pause could very well indicate the economy has entered a new phase: The high hold.

This stability will be so important for restoring consumer confidence that is lagging at critically low levels and this will help improve the strength of the eventual economic recovery.

The hold call also has the unintended effect of giving Prime Minister Anthony Albanese and his treasurer Jim Chalmers some room on the political battle over the economy. Businesses too can plan for investment decisions through the economic cycle.

Close to end

One way or another Australia has arrived at the end of its cash rate hiking cycle and avoided the recession-inducing 5 per cent cash rate pricing seen elsewhere around the world.

To be clear, we are not out of the woods yet.

Markets are tipping there will be one more cash rate hike to come to 4.35 per cent – either towards the end of this year or early next year, before cuts start to begin from late calendar 2024. But that move will only happen if there is an inflation breakout and very likely be under new governor Michele Bullock who starts in mid-September.

The decision to hold in August follows official figures showing inflation is falling slightly faster than the RBA is forecasting. This has given the central bank headroom to continue to assess the landscape.

And the inflation fight remains ever so critical. Lowe noted in the RBA statement on Tuesday that while goods inflation has eased, services inflation remains sticky. And for the first time he is getting more concerned about rent inflation. Lowe is also worried about the lag effect of higher wages could push inflation up again while the jobs market remains extremely tight.

Even so households are responding by pulling back spending and he came as close as he has come to declaring victory by declaring in the cash rate statement the RBA is tipping inflation to move back into it 2-3 per cent target range by late 2025.

The central bank still expects Australia to avoid a recession and the upcoming corporate reporting season should confirm resilience among businesses. The ASX staged a late rally following the decision.

Tuesday’s hold will see a flurry in the property market which is already gently bubbling back to life. Figures released this week by property tracker CoreLogic show national prices lifting 0.8 per cent in July, led by Brisbane and Perth.

On a national level, property prices are down 5.3 per cent from the April 2022 peak before interest rates started rising. Even with the rapid run up on the cash rate, prices over the past 12 months are down 2.1 per cent in Sydney and 4 per cent in Melbourne, CoreLogic numbers show. However, rises are partly being put down to tight supply, with the coming spring selling season likely to put a lid on any further price gains.

There’s one more board meeting for RBA’s Lowe to oversee. It’s becoming increasingly likely the central bank boss may go out on a hold.

Fast fibre

TPG Telecom chief executive Inaki Berroeta faces a choice of cashing in more of his prized fibre network than he was banking on, although that would give him leverage to step up the battle in the mobile market.

Berroeta has long made it known that he wanted to sell off his capital city residential fibre network Vision and last year appointed Bank of America to secure a deal. But Macquarie-backed Vocus – the natural buyer for Vision – has come back wanting more. Vocus also wants parts of TPG’s intercity backhaul network and connections to lucrative businesses customers across Australia.

As my colleague Bridget Carter reports the talks for a potential $4bn-plus sale have a long way to go and Vocus needed to nudge after being stalled since April.

Vocus is maximum bullish on the outlook for demand for data by business and the prospect of AI being used by every corporate within the next few years has added to that. The choice Berroeta faces is the foregone revenue in the future with his enterprise and government businesses that underpins the fibre network, targeting $1bn by 2025.

Where rival Telstra had been playing with old copper wires for decades, TPG is sitting on a modern fibre network across capital cities and major corridors between east coast states.

The network up for grabs also represents the biggest non-NBN operator providing high speed date to residential properties. This was fibre network built around TPG founder David Teoh’s early decision to keep one step ahead of NBN by wiring-up city apartment buildings for maximum return for his outlay. It also includes assets Teoh picked up through the $1.5bn iiNet buyout and Bevan Slattery’s old Brisbane-based Pipe Networks.

With a long-proposed mobile tower tie-up between TPG and Telstra facing the uncertainty of a legal challenge to overturn regulatory hurdles Berroeta still faces an elevated capex spend over the medium term to hit his goal of a national 5G coverage by 2025.

Berroeta has shown his preparedness to run TPG asset light to drive his mobile business harder including last year’s $950m sale of the towers business Canadian pension fund OMERS and the stalled Telstra deal was at least a creative attempt to try and secure an immediate win for mobile coverage.

Even the big telco’s including Telstra are showing they are prepared to offload heavy infrastructure to investors with longer term horizons so the battle in mobiles can take place today.

Any sale - if a deal proceeds - will see funds pay down TPG’s $3.6bn debt helping keep pressure off gearing and interest costs, while investors would be in line for a capital return.

johnstone@theaustralian.com.au

Philip Lowe warned he hasn’t quite done raising interest rates, but the outgoing Reserve Bank boss increasingly looks to have finished the job and in doing so, engineered a soft landing for the economy.