Reserve Bank delivers first rate cut since 2020, handing potential election trigger to Anthony Albanese

Anthony Albanese has a trigger for cancelling next month’s budget and calling an April election after the Reserve Bank delivered its first interest rate cut in nearly five years.

Anthony Albanese has a trigger for cancelling next month’s budget and calling an April election after the Reserve Bank delivered its first “very small” interest rate cut in nearly five years, but household borrowers are being warned against expecting further relief in the short term amid uncertainty about the global economy.

After the central bank cut the cash rate by 25 basis points to 4.1 per cent, RBA governor Michele Bullock said she was not convinced about market expectations of a further three interest rate cuts by the middle of next year.

Her comments poured cold water on the prospect of a second pre-election rate cut at the RBA’s April 1 meeting and signalled that the central bank predicted the cash rate would be above market expectations of 3.4 per cent by June next year.

Ms Bullock also warned there was significant uncertainty about the global economic outlook given the trade wars flagged by US President Donald Trump.

She said the board would need more evidence inflation was falling to the middle of the 2-3 per cent target range before any other rate cuts were considered, with underlying inflation not predicted to fall below 2.7 per cent in the next two years, according to the RBA’s forecasts.

“Today’s decision does not imply that further rate cuts, along the lines suggested by the market, are coming,” Ms Bullock said.

“It’s a very small rate cut, that’s true. It reverses the one we did in November (2023). But … removing a little bit of restrictiveness has an impact at the margin for people who have mortgages.”

While the headline inflation rate dropped to 2.4 per cent in the year to December, trimmed mean inflation, the RBA’s preferred measure, was still above target at 3.2 per cent.

Ms Bullock said the decision to cut rates was not a “lay-down misere” but had the consensus of board members.

The major banks immediately announced they would pass on the savings from the cut to the cash rate, with borrowers with a mortgage of $500,000 to save $80 a month. Australians with a mortgage of $750,000 and $1m will see monthly repayments lowered by $120 and $159 respectively, according to the federal government.

Bond traders on Tuesday slashed their interest rate bets, with the market predicting the cash rate would only be cut one more time by the end of the year.

Money markets are predicting just a 20 per chance of a move lower at the RBA’s next meeting, while economists are tipping a shallow easing cycle with just one or two rate reductions by the end of the year.

The Prime Minister moved to downplay speculation on election timing by declaring the “plan” remained for a budget to be delivered as scheduled on March 25, which would have to be cancelled to accommodate an election before May. The election needs to be held by May 17 at the latest.

“We’ve been working on the budget, and the ERC (expenditure review committee) met for many, many hours yesterday and again this morning,” Mr Albanese told ABC radio. “We’ll continue to work, and we’ll continue to look at ways in which we can provide support for Australians.”

Mr Albanese said the RBA’s decision would not have an impact on the timing of the election, but Labor MPs are expecting an election in April while believing there was a small possibility it could be held on March 29.

Labor MPs who spoke to The Australian on Tuesday were unanimously against a March budget, given the deficits it would forecast.

“There will be a lot of polling on (the rate cut) but April 5 and 12 are still my best guess,” one Labor MP said.

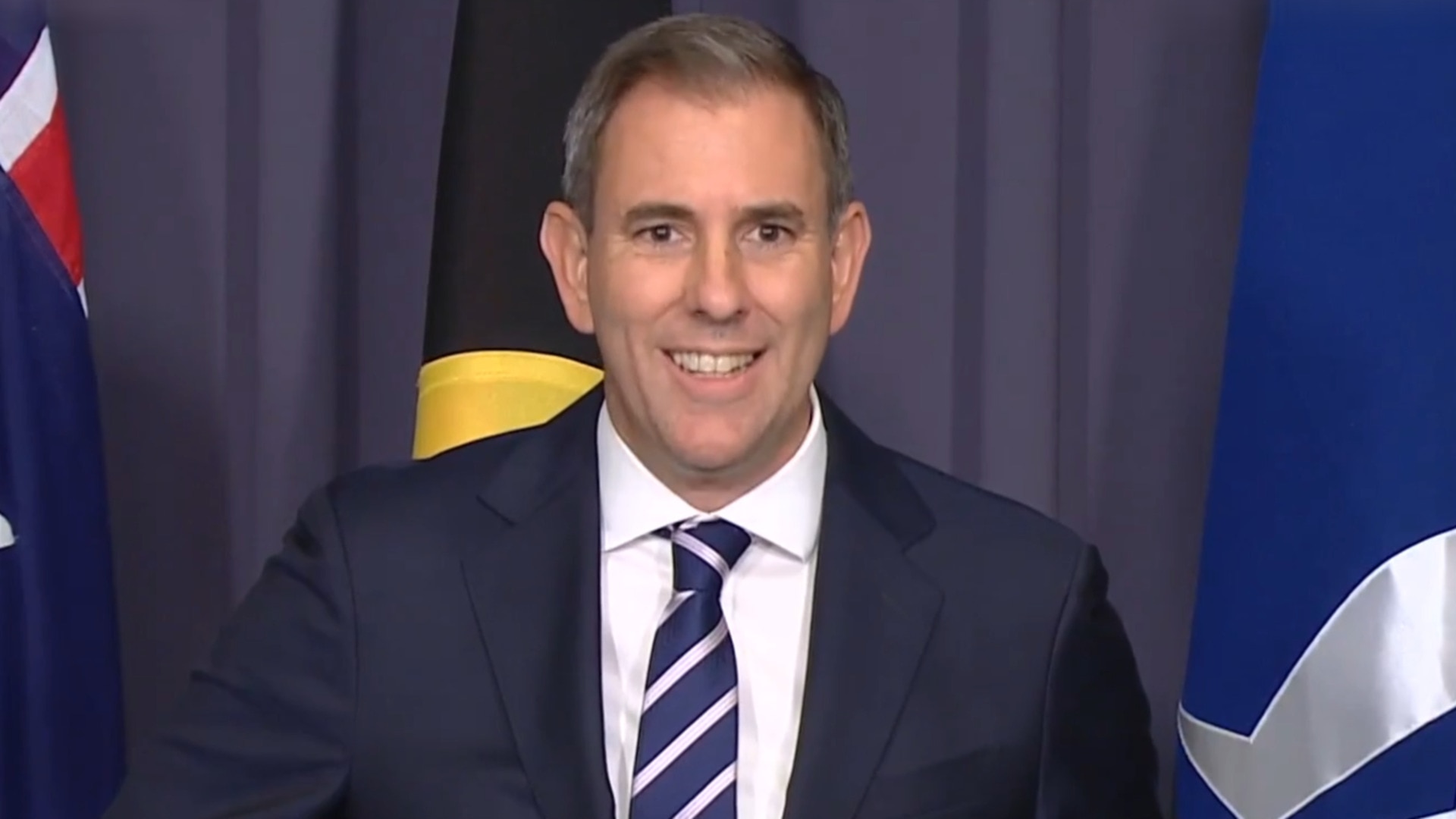

Jim Chalmers said “we are more or less full term now” as he denied the uncertainty over the election date was deterring business investment. “We’re not talking about an election in six or nine or 12 months’ time, regardless of the decision the Prime Minister takes,” Dr Chalmers said. “An election is more or less imminent.”

He said the rate cut was “relief that Australians need and deserve” but admitted it was “not mission accomplished”.

“We know that it won’t fix every challenge we have in our economy or in household budgets, but it will help,” the Treasurer said.

“This is the soft landing that we have been planning for and preparing for, but we can’t be complacent about the months and years ahead. We know that there is more work to do. We know that this is not the solution to every challenge that people are confronting in their household budgets, but it will help. It’s not mission accomplished, because we know that people are still under pressure.”

Setting up a cost-of-living fight with the Coalition, Dr Chalmers said extending the $300 electricity bill rebate for households and businesses past its June 30 expiry was “under review”. The Coalition has flagged it may not support an extension of the rebate, which cost $3.5bn in the last budget.

“When it comes to additional cost-of-living help, whether it’s energy bill rebates or others … we keep that under constant review,” Dr Chalmers said. “If we can, if there’s a case for affordable, responsible cost-of-living help, then we will do it.”

Opposition Treasury spokesman Angus Taylor said the rate cut had been a “long time coming”.

“We’ve seen interest rate cuts in peer countries around the world between one and 2 per cent,” Mr Taylor said.

“It’s a long journey back to the standard of living Australians had when these interest rate increases began. The living-standard collapse in Australia has been bigger than peer countries around the world, and indeed, in the forecast today from the Reserve Bank, there is a downgrade in living-standard forecasts, despite the interest rate cut.”

Separate forecasts released by the RBA on Tuesday projected underlying inflation would ease to 2.7 per cent in June, down from the previous forecast of 3 per cent. The decline to within the RBA’s 2-3 per cent inflation target band comes despite unemployment being expected to rise no higher than 4.2 per cent by 2027, well down on the previous forecast of rising to 4.5 per cent by December.

The central bank also substantially downgraded its forecasts for real household disposable income to 3.1 per cent this financial year, down from 3.9 per cent in November, a reduction that fuelled Coalition claims that living standards would not return to their levels recorded in the aftermath of the pandemic until 2031.

Projected growth in public demand – a proxy for federal and state spending – would be 5.3 per cent in the current financial year. That figure was sharply higher than its previous projection of 4.4 per cent released in November.

Ms Bullock said the board had been surprised inflation was coming down with the employment market so strong.

“We are continuing to test how low we can keep unemployment without adding to inflationary pressures and so far, in good news, we’re achieving it,” she said.

RBC Capital Markets macro rates strategist Robert Thompson said the “noticeably cautious” comments from Ms Bullock and other RBA communications suggested the chance of a follow-up move in April was “very unlikely”.

“The underlying message from this prudent and cautious approach is that the onus is on the data to weaken and support further easing,” Mr Thompson said, instead tipping a cut in May after the cut-off for the federal election.

However, Commonwealth Bank’s head of Australian economics, Gareth Aird, said another quarter-point cut in April “cannot be ruled out”, particularly if Australia’s tight job market began to display signs of deteriorating. “At this stage we think that it would require two labour force surveys of clear labour-market loosening for the board to deliver back-to-back rate cuts,” he said.

ADDITIONAL REPORTING: Simon Benson, Rhiannon Down

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout