Renters most at risk of personal insolvencies as households buckle under debt: AFSA

The Australian Financial Security Authority expects a significant surge in the number of personal insolvencies lodged during the next 18 months.

The Australian Financial Security Authority says personal insolvencies will surge by 25 per cent in the next 18 months as households dig into their savings to pay debts thanks to cost-of-living pressures.

A report released by AFSA showed debtors with small savings buffers are most vulnerable to insolvency through challenging economic conditions.

The government agency, which is responsible for administering personal insolvency and personal property securities systems, is most concerned about renters with unsecured debt who have had to deal with above-inflation price rises in the past few years amid supply constraints and a surging population.

AFSA chief executive Tim Beresford told The Australian it was a tale of two stories, with renters suffering much worse than any other demographic on the back of a lack of supply in the market that had pushed rents up significantly.

“Households and businesses are now under the highest level of mortgage stress and cash flow constraints since the GFC,” Mr Beresford said.

He said renters, who often had few assets, were vulnerable: “If they find themselves losing a job or having their hours cut, it is really difficult for them to hang on.”

Renters make up 93 per cent of personal insolvencies, despite accounting for about 25 per cent of households. According to AFSA, 50 per cent of households have a mortgage and 25 per cent are mortgage free.

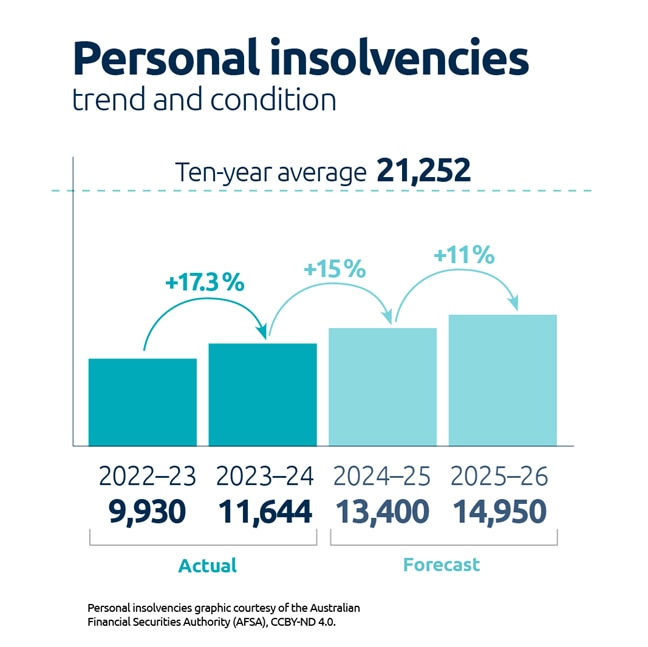

AFSA forecast a 15 per cent increase in personal insolvencies in the 2025 fiscal year to 13,400, compared to 11,644 in the previous 12 months. It expected a further 12 per cent lift in 2026 to 14,950.

The proportion of debtors with less than $50,000 in liabilities continued to represent a large part of the personal insolvency system, with 49 per cent of debtors having less than $50,000 in liabilities and just over a quarter of debtors having more than $100,000 in liabilities.

Mr Beresford said while interest rates, enforcement by the tax office over unpaid debt, and cost-of-living pressures were adding pressure on personal insolvencies, there were signs of resilience.

“The fact that unemployment remains remarkably low means people are hanging in there and not going into insolvency,” he said.

However, the insolvencies surge comes off a low base, with personal insolvencies declining to just under 10,000 annually during the pandemic, well below the 10-year average of 21,252. But as pandemic relief measures faded and savings dwindled, insolvency rates began a steady climb. NSW, Queensland and Victoria make up the lion’s share of personal insolvencies, at 3447, 2926, and 2254 respectively.

The State of Personal Insolvency System Report found that in 2023-24 most personal insolvencies were incurred by men, at 55.4 per cent, while 42.3 per cent were incurred by women.

Large metropolitan areas had higher rates of personal insolvency than regional areas. Sydney had the most personal insolvencies, at 17.3 per cent of the total, followed by Melbourne with 13.6 per cent.

A quarter of all personal insolvencies were a direct result of a business becoming insolvent, but they accounted for 75 per cent of the personal insolvencies’ total debt ($17.3bn), with a total value of $13.2bn in liabilities.

The ATO is looking to claw back almost $50bn in unpaid tax, which has resulted in an increase in small business restructuring filings as more director penalty notices (DPNs) are issued.

Mr Beresford said households would remain at risk of personal insolvency until inflation came down, while an increasing housing supply would help renters.

The AFSA said households needed to remain vigilant and seek advice from financial counsellors or other trusted individuals if they suffered financial strife.

“Reach out and ask for advice,” Mr Beresford said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout