Cost-of-living crunch pushing more Australians into financial stress: Equifax survey

An onslaught of higher housing payments coupled with more expensive essentials is driving more Australians to find ways to pay down debt and make their money go further.

An onslaught of higher housing payments coupled with more expensive essentials is driving more Australians to find ways to pay down debt and make their money go further as financial stress levels increase.

Credit rating agency, Equifax, reports a substantial uplift in financial stress for households, with 39 per cent of Australians surveyed now a victim. This stress is more common among women (41 per cent) and younger Australians, with 42 per cent of millennials and 52 per cent of gen Z reporting increased anxiety about their finances.

Cost-of-living pressures are also having a profound impact on personal insolvency figures, with the Australian Financial Security Authority reporting that volumes increased by 6.4 per cent to 3307 in the September quarter, compared to 2023.

Equifax Australia and New Zealand chief executive Melanie Cochrane said consumers were looking for budgeting techniques and rethinking their discretionary spending as they prepared to face economic headwinds.

“With the prolonged cost of living and inflationary pressures, many Aussies are still fighting to stay afloat,” Ms Cochrane said.

“While it’s encouraging to see consumers keeping their eyes on the prize in terms of financial ambitions, it’s concerning that a third are struggling with the cost of living to the point where they have no spare money to invest in their financial goals.”

The 2024 Australian Credit Scorecard released by Equifax shows half of all Australians have cut back on discretionary purchases now compared to 12 months ago – a significant increase from 2022, when only 37 per cent said this. Increased living expenses meant 56 per cent of Australians cook more at home to save on takeaway or restaurant spending.

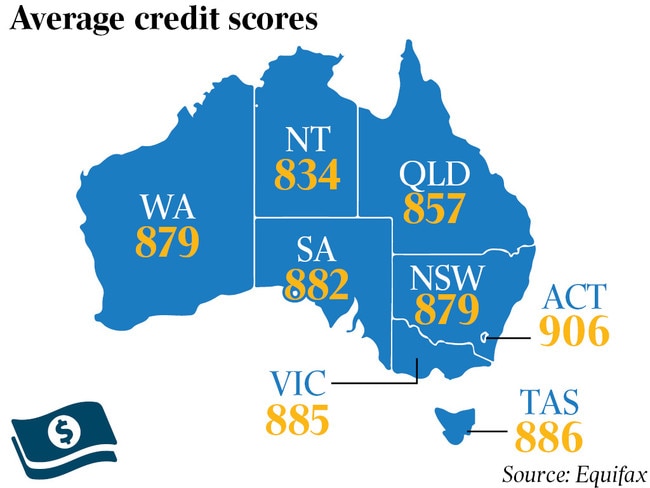

Equifax said the national average credit score remained “excellent” at 861 out of a possible 1200, lifting by six points from last year’s average result of 855.

It comes after data from the Australian Bureau of Statistics showed that household spending rose 2.8 per cent in the year to October, down from 4 per cent a year prior.

Deloitte Access Economics on Thursday forecast a retail recession to end in 2025, with Australians to return to making discretionary purchases in greater volumes amid an uplift in consumer sentiment and the impact from tax cuts. A predicted interest rate cut from the Reserve Bank could be the green ‘go’ light consumers needed to feel comfortable spending again, Deloitte said.

Equifax identified a 9-percentage point decrease to 60 per cent in the level of Australians that remained financially ambitious, while half say paying down debt or moving beyond living pay cycle to pay cycle is their biggest financial priority for the coming year.

“We’re not out of the woods, and in these moments, the greatest pressure is inevitably felt by the most financially vulnerable among us – like young people, new migrants, those who have been through major life changes, and small business owners,” Ms Cochrane said.

“It’s important to ensure that these groups aren’t financially excluded as the economy begins to improve.”

Emerald-based hairdresser and owner of Ashe Australia, Melanie Tambling, said a strong uplift in living expenses had forced her family of four to readjust the way they operated. Her children were catching the bus to school instead of being driven to save on petrol, while takeaway/eating out was cut back to once a month.

“Interest rate hikes and an over-budget renovation made us realise we were spending more than we earned, so I’ve taken on more hours to help,” Ms Tambling said.

“The family’s adjustments have helped lower expenses, but managing month-to-month finances is still challenging.”

She said the biggest challenge she’d faced was explaining to her children why they couldn’t have certain things their friends had, or why they must wait for essential purchases.

“It’s not easy, but knowing we’re not wasting a single dollar gives me peace of mind; I think a lot of families are going through the same thing right now,” she said.

Demand for personal loans and credit cards observed over the past two years had begun to wind down as arrears across all product types started to decrease, Equifax reported, and head of insights Carrie Cheung said it suggested households were cautious.

“This tells us that people are maintaining payments, and many households are becoming increasingly cautious with their spending, prioritising essentials and looking for ways to save wherever they can,” Ms Cheung said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout