Real world pain hits business hard, as insolvencies and welfare numbers surge

Almost 26,000 businesses have plunged into insolvency since the 2022 election due to rising cost pressures, as more than 930,000 Australians rely on jobless welfare payments.

Almost 26,000 businesses have plunged into insolvency since the 2022 election – including a record number last month – amid crippling cost pressures and surging JobSeeker levels that show more than 930,000 Australians relying on jobless welfare payments.

Australian Securities & Investments Commission data reveals the country has notched a record number of insolvencies in a calendar year, with 12,405 businesses collapsing between January and November.

Revealing the deep pain felt by employers, ASIC statistics show 6925 construction firms, 4012 hospitality businesses, 1706 retailers and 1329 manufacturers have become insolvent since June 2022. A record 1442 businesses hit the wall last month, an increase of 62 per cent compared with November last year and 158 per cent compared with May 2022 levels.

As businesses struggle under the pressure of energy, insurance, rent, loans and other costs, the number of Australians on welfare payments continues to spike.

Despite a tight labour market, Department of Social Services figures reveal growing JobSeeker and Youth Allowance (Other) recipient levels, with 930,240 relying on welfare payments at the end of November, which is almost 83,000 higher than the same period last year.

The welfare cohort is at similar levels to October 2022 and would be pushing closer to one million if the government had not moved about 65,000 people to the parenting payment single category in September last year. Youth Allowance (Other) recipients are at their highest since February 2022.

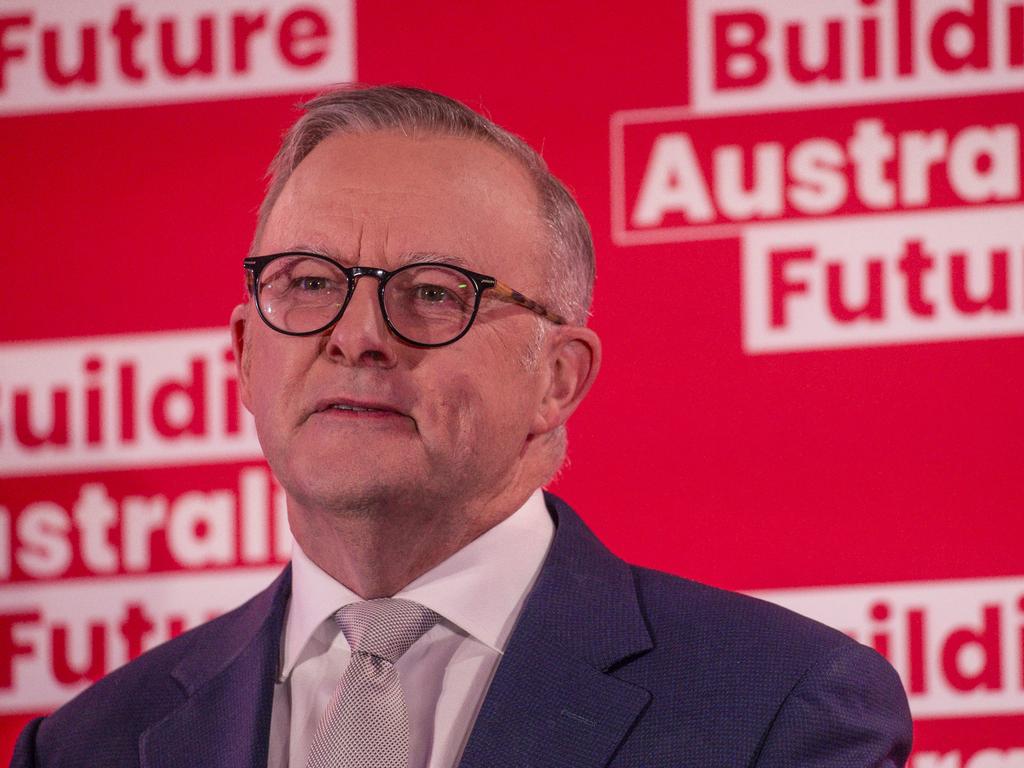

The record spike in insolvencies comes amid a persistent cost-of-living crisis and rising pressure on the Albanese government, which has been criticised for spending too much and not doing enough to drive down inflation.

As more businesses fail and others teeter on the edge, the Coalition has attacked the Albanese government for hiring 26,000 new permanent public servants since 2022.

Building industry figures on Tuesday warned that the high volume of failing construction businesses, ranging from mum-and-dad outfits to larger building firms, undermined Anthony Albanese’s ambitious pledge to build 1.2 million new, well-located homes across Australia by mid-2029. Many in the building industry are deciding to transition out of construction given rising costs, a slowdown in activity and tradie shortages.

Small Business Minister Julie Collins said the government understood that “some businesses and people are doing it tough”.

She said the government was providing more than $640m to support 2.6 million small businesses, including extending the $20,000 instant asset write-off and providing energy bill relief for one million eligible businesses.

Deputy Opposition Leader Sussan Ley said: “For each of the 26,000 new permanent public servants the Albanese government has added … an Australian business has gone to the wall.”

The opposition small business spokeswoman added that Australians “cannot afford another three years of this economic incompetence”, with electricity and gas prices for small business owners rising by up to 52 and 32 per cent.

“The official data now confirms November was the worst month for business failures on record, up 62 per cent on last year and up 158 per cent on May 2022,” Ms Ley said. “This is Albonomics, skyrocketing public spending and collapsing business conditions,” Ms Ley said. “Australians need to understand the ‘Albonomics Ratio’ – one public servant in, one business out. For every new permanent public servant Anthony Albanese has added, we have lost an Australian business.”

The Australian understands the Albanese government is confident its targeted measures are adequate, given that corporate insolvencies as a proportion of all companies are lower than the long-term average. The slightly lower percentage is linked to the fact there are more businesses in the economy. Some companies entering external administration are also using a small-business restructuring process to restructure debt and continue operations.

Australian Bureau of Statistics figures on Tuesday revealed there were 2.66 million actively trading businesses as at June 30. Across 2023-24, there was a 2.8 per cent increase in the number of businesses based on a 16.8 per cent entry rate and 14 per cent exit rate, encompassing 436,018 entries and 362,893 exits.

Master Builders Australia deputy chief executive Shaun Schmitke said the government must create a more business-friendly environment that reduced risk and uncertainty for employers. “While insolvency levels have increased right across the economy, construction still represents the lion’s share, demonstrating that builders – from small, family-run businesses right through to the big construction companies – continue to feel the pressure of decreasing productivity, lack of labour supply and increases to the cost of doing business,” Mr Schmitke said.

“If we are to have any chance of reaching the 1.2 million new home targets, we need to get the settings right to increase investment in housing and keep builders on the job, delivering the homes Australians desperately need.”

Council of Small Business Australia chief executive Luke Achterstraat said the insolvency data confirmed “our greatest fears – that things would continue to get worse for small business before they get better”. He said rising energy, rent and insurance costs had made the “operating environment unbearable for thousands of mum-and-dad firms”.

“Behind each insolvency statistic is a family, their livelihood, their staff and sometimes even a life’s work. The insolvency crisis must be a wake-up to government that the time for rhetoric and self-congratulation is over,” Mr Achterstraat said. “It’s time for proper small business support – tax relief, genuine energy relief and a laser-like focus on removing red tape and barriers to doing business. Failure to act will lead to reduced competition, higher margins and lower living standards at a time the nation can least afford it.”

Mr Schmitke said the government must simplify industrial relations laws, remove inefficient regulation, lower inflation and drive higher productivity.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout