RBA looking at potential Aussie cryptocurrency for faster payments

The Reserve Bank is mulling the potential for a so-called central bank digital currency based on blockchain technology.

The Reserve Bank is considering whether there is a role for a digital version of the Australian dollar, based on the technology underpinning bitcoin, that banks, fund managers and other corporates could use to make major payments.

The RBA said its in-house “Innovation Lab” was mulling the potential for a so-called central bank digital currency (CBDC) based on blockchain technology that could be used to speed up major transactions.

“The Innovation Lab is being used to explore whether there is a role for a digital Australian dollar (that is, an Australian CBDC) in the context of the Bank’s responsibilities for issuing the currency and overseeing the payments system,” the RBA said in its submission to a Senate inquiry into financial technology, or fintechs.

However, the bank stopped short of saying a ‘digital dollar’ would be rolled out to households, given they already have good access to digital money in the form of commercial bank deposits that provide payment service.

A CBCD for households could also undermine the broader banking system, given it could divert deposits away from commercial banks, which could crimp their ability to lend.

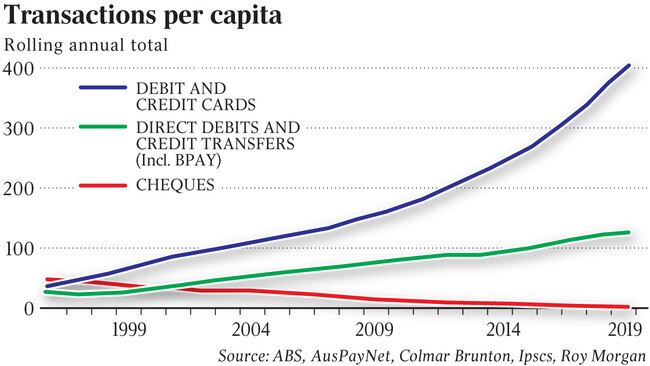

Elsewhere, the RBA was broadly supportive of fintechs saying the “various changes and innovations occurring in the payments system can help boost productivity in the broader economy and support Australia’s transition towards a digital economy”.

While it did not directly oversee the regulation of fintechs, where they had an impact on financial stability or smooth running of the payments system it was prepared to step in.

More recently, the Bank has flagged it was examining surcharging and buy now, pay later platforms such as the model used by ASX-listed Afterpay as to whether this was an area the RBA needed to step in and regulate. It expects to finalise a review into this by the end of the year.

While the RBA does not see payments technology such as bitcoin taking off in Australia as a means of payment given its extreme volatility, it said newer asset-backed cryptocurrencies such as so-called stablecoins are emerging or have been proposed, and could become more widely used in the future.

It was also working with regulators both here and offshore to monitor stablecoins with the highest profile one being proposed by global tech giant Facebook through its Libra platform.

“(Libra) has the potential to become widely used given the involvement of various companies such as Facebook that may be able to leverage their large existing user bases and technological capabilities,” the RBA said.

“The Bank is working closely with relevant agencies domestically and internationally to understand recent proposals to ensure they will be adequately regulated and supervised,” it said.

The RBA itself has played a part in financial technology as being a key player in the development of the new payments platform (NPP) which is used by banks to facilitate real time payments among banks.

It said the NPP would be able to drive the shift to “data-rich payments” where documents such as invoices or real time tax reporting can be sent along with payments.

“These capabilities should all be feasible over the next few years, and the industry is working on some of these innovations already,” the RBA said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout