Facebook faces inquiry on Libra currency

Australia’s financial regulators are expected to force Facebook to divulge details about plans for a global cryptocurrency called Libra.

Australia’s financial regulators are expected to force Facebook to divulge details about plans for a global cryptocurrency called Libra, after the social media giant failed to reassure officials over the threat it posed to national security, banking, consumers and investors.

Eight Australian regulators have struck a secret deal to use their respective “formal powers” to probe Facebook on Libra after a meeting between senior watchdog officials and the company’s US executives late last month failed to satisfy the concerns of government agencies.

READ MORE: Bold play was sure to cause jitters | Little faith in Facebook currency | Facebook Libra a critical test for regulators

The action has been prompted by concerns the new currency could fuel a wave of scams through phone-based apps, increase privacy concerns and make anti-money-laundering and anti-terror enforcement more difficult.

The regulators included the Australian Securities & Investments Commission, the Office of the Australian Information Commissioner, anti-money-laundering regulator Austrac and the Australian Competition & Consumer Commission.

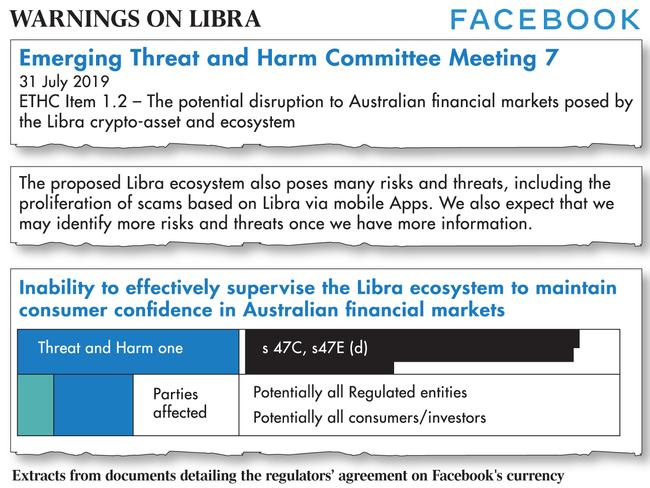

Heavily redacted documents obtained by The Australian reveal ASIC’s “emerging threat and harm committee” met on July 31 to discuss “the potential disruption to Australian financial markets posed by the Libra crypto-asset and ecosystem”.

Commissioners at the meeting were warned that an “inability to effectively supervise the Libra ecosystem”, in order to maintain consumer confidence in financial markets, could affect “all regulated entities” and “all consumers (and) investors”.

An internal briefing note in documents obtained under Freedom of Information laws shows the corporate watchdog discussed consumer vulnerability to Libra due to the “high penetration of Facebook-owned apps”.

“The proposed Libra ecosystem also poses many risks and threats, including the proliferation of scams based on Libra via mobile apps,” notes an ASIC paper created for the meeting. “We also expect that we may identify more risks and threats once we have more information.”

Facebook on June 18 unveiled plans to launch Libra next year with the aim of controlling the global flow of money, backed by a loose alliance of companies such as Visa, Mastercard and PayPal. The project has slipped into disarray under the weight of intense scrutiny from politicians worried about how the $US550bn company handles the data of 2.4 billion Facebook users. Last month, PayPal sparked an exodus from the Libra alliance, followed by Visa, Mastercard and eBay.

Facebook has 15 million active users in Australia and further penetration through subsidiaries. This includes eight million active Instagram users and five million active WhatsApp users.

Australian authorities are drawing up plans to investigate the new currency because of a string of unresolved concerns, including: how a jurisdiction would exercise control over the currency; and whether it could threaten the financial system and undermine the efforts of central banks and other key institutions to manage the economy.

There are also unanswered questions around the structure of the cryptocurrency, the timeframe for it to be launched, privacy and consumer protections, its compliance with money-laundering and terrorism-financing laws and competition issues.

Regulators were originally scheduled to meet Facebook’s US technical team in August after the company’s Australian executives were unable to answer technical, detailed questions the watchdogs put to the Silicon Valley-based company in July.

Regulators had planned to put a sweeping list of concerns to the tech giant at the August meeting. That meeting failed to take place. Regulators and Facebook executives from the US finally met mid-last month.

The documents obtained by The Australian show the financial watchdogs agreed to share any information, where possible, that was gained from subsequent meetings with Facebook and the rest of the regulatory community.

In an email to the group of Australian agencies and regulators, OAIC deputy commissioner Elizabeth Hampton said: “If we don’t get answers to these questions from the US-based team we will then need to consider whether formal powers are exercised where available, which may need to be done independently rather than in concert.”

Libra, which would be managed by an independent Libra association made up of almost 30 tech companies, had been hailed by Facebook as an innovation that could revolutionise the global payments system, making it easier to send money around the world and helping the 1.7 billion people without proper banking systems to access financial services.

Facebook, which has one of five seats on the Libra board, said each unit of the digital currency would be backed by a mix of financial assets such as stable national currencies and stored by consumers in a digital wallet accessible through Facebook’s Messenger app, WhatsApp and the Calibra app.

A spokesman for the OAIC said the agency was continuing to work with regulators and international data-protection authorities to monitor the development of Libra. “We remain concerned that Facebook and Calibra have only made broad public statements about privacy, and they have not addressed the information handling practices that will be in place to secure and protect personal information,” he said.

Facebook Australia declined to answer a list of detailed questions about the meetings and the concerns regulators put to the company. “From the beginning, we’ve said we’re committed to taking the time to get this right,” a Facebook spokesman said. “As a member of the Libra association, we will continue to be a part of dialogue to ensure that this global financial infrastructure is governed in a way that is reflective of the people it serves.”

Senior ASIC commissioner Cathie Armour was among four commissioners who met representatives from Facebook’s Australian operations on July 9, alongside other regulators. ASIC senior lawyer Hema Raman recorded that there “was little new information offered about the Libra and Calibra products and the potential launch date”.

Two days after that meeting, ASIC chairman James Shipton alerted Ms Armour and the rest of the watchdog’s seven-member group of commissioners to news that US Federal Reserve chairman Jerome Powell had said Facebook’s plan to build a digital currency called Libra could not proceed until the company addressed serious concerns.

“Interestingly the Fed came out strongly overnight with concerns about, and a request to slow down, the Libra initiative,” Mr Shipton told his senior staff in an email.

An ASIC spokesman declined to say whether it was using its compulsory information gathering powers on Facebook.

“ASIC co-operates widely, closely and often with other regulators, both here and in other jurisdictions,” it said. “Discussions on these issues are still at a relatively early stage, and we are therefore not in a position to comment on them at present.”

The OAIC in early August castigated Facebook after it “failed to specifically address the information handling practices that will be in place to secure and protect personal information” tied to Libra.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout