NPP road map to boost business adoption for payments

The group steering the New Payments Platform is hoping that two key upgrades will a game changer for business-to-business payments.

After about a year of management input, the board of NPP Australia signed off last week on a three-year road map designed to take the $1bn-plus real-time payments network to its next stage of market penetration.

Since launching in February 2018, the New Payments Platform has devoted most of its energy to developing single or person-to-person payments, which account for less than 20 per cent of the overall market.

The road map signals a switch in emphasis, with NPPA now targeting business-to-business applications for participating financial institutions, payment providers and users of the wider payments system.

Two new features are expected to exponentially increase the volume of transactions on the platform.

Read more: Bank details exposed in second NPP breach Banks slow to act on fast payments service, says RBA

The first is deeper use of the NPP’s message format, which is built for much richer data than the 18 characters currently available for direct entry payments.

With more than 1400 data fields to choose from, additional information can be provided with the payment or through a reference to externally-hosted documents.

NPPA has developed message guidelines for payroll, tax, superannuation and e-invoicing payments, effectively standardising how these payments will pass across the platform.

Payroll providers, cloud accounting software providers such as Xero, and employers will be able to incorporate the NPP standards into their products and services so they can send payroll, tax, super and e-invoicing payments via the NPP by December next year.

Additional messaging standards will be developed for other payments according to market demand.

The second feature is the one that the NPPA is most often asked about: a mandated payments service, or the ability to initiate payments from a customer’s account, such as a direct debit.

Potential uses from the December 2021 implementation date include subscription-type payments, e-commerce and “on behalf of” services like a corporate using a cloud accounting software provider to do its payroll run.

The point to note about both features is that the implementation dates are mandatory, which means participating institutions can be fined if they don’t meet the deadline.

The introduction of penalties was the NPPA’s response to criticism from the Reserve Bank earlier this year about a slower-than-expected rollout of NPP services by banks.

The RBA blamed complexity of bank IT systems and an “underestimation” of the scale of investment needed to meet delivery time frames.

While the road map requires further investment in the platform, it will be internally funded by the NPPA, without an extra call on the 13 shareholders.

Use of the network generated $43 million in operating revenue in 2019.

Since launch, 85 banks, credit unions, building societies and fintechs have connected to the NPP, including the neobanks 86 400 and Bendigo and Adelaide Bank-owned Up.

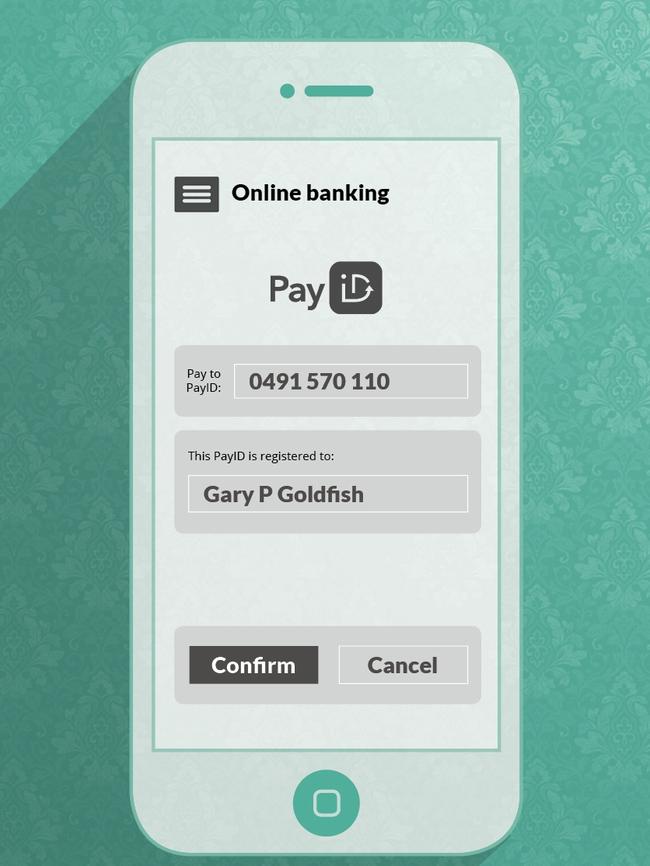

More than 66m account holders can now make and receive payments through the NPP – equivalent to about 90 per cent of reachable accounts – and about 3.6m PayIDs have been registered by customers wanting to receive real-time payments to their bank account via their PayID.

According to the RBA, NPP adoption has been as fast – if not quicker – as similar platforms offshore.

As at mid-October, it was processing an average of 750,000 payments worth an average of $750m a day.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout