Jobless rate at pre-Covid level

Unemployment has unexpectedly sunk to pre-pandemic levels after the number of employed Australians surged by 115,000.

Unemployment has unexpectedly sunk to pre-pandemic levels after the number of employed Australians surged by 115,000.

Financial watchdogs warn banks not to go easy on home loans, as they watch the risks of borrowing outpacing income growth.

RBA chief says a ‘laser-like focus on costs’ by business is stopping the powerful jobs recovery from flowing through to pay rises.

US bond investors have learned that central bank forecasts can be misleading. Australia must learn the same lesson.

Fed officials signal a rise in interest rates by late 2023, sooner than earlier forecast, as the US economy recovers and inflation heats up.

Prices have dropped from record highs, spurred by the economic reopening and potentially pointing to an eventual return to normalcy.

Lina Khan’s appointment as head of the US Federal Trade Commission signals a radical campaign against the big tech platforms from the US government.

Bold reforms will help Australia’s hospitality industry recover from Covid-19.

It’s a talkfest for sure, but the prime minister’s invitation to this particular one is a big deal.

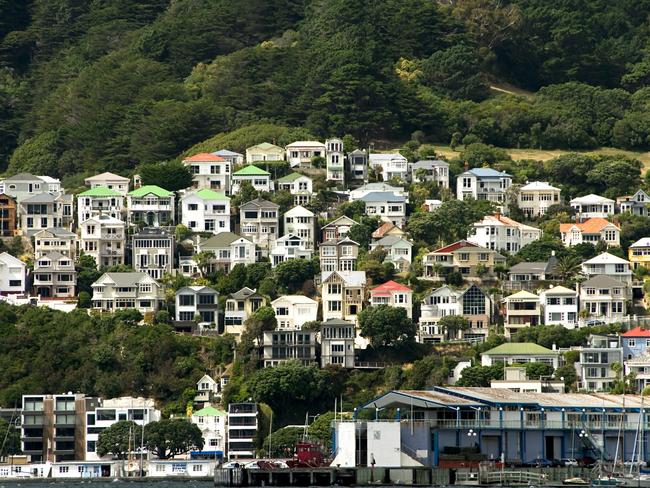

Like the RBA, NZ’s central bank can’t directly target house prices. But its new debt-to-income curbs may help tame the market.

Australians still overwhelmingly support investment and tourism from China despite increasingly frosty relations between the two countries.

Skill shortages and supply chain bottlenecks have been slowing work and blowing out costs across the economy.

Victoria’s state budget settings stand apart from the rest – for the wrong reasons.

The RBA has effectively ruled out ending its bond purchasing program as scheduled in September, despite an expanding economy.

Their ABC’s Alan Kohler really should know better – but he’s so misty-eyed about the fantasy of useless renewable energy, he actually might not.

Australia’s response to Covid-19 is to be hailed, not feared.

Aviation ranks as one of the hardest sectors to transition to a net-zero-emissions world.

The 10-year bond market is telling us there is now clear doubt that inflation in the longer term will move up sharply.

Climate change will surely get an airing in every panel discussion, something not conceivable just a year ago even by the most enthusiastic ESG activists.

The chief executives of many big American companies are wary of discussing inflation in public.

Original URL: https://www.theaustralian.com.au/business/economics/page/199