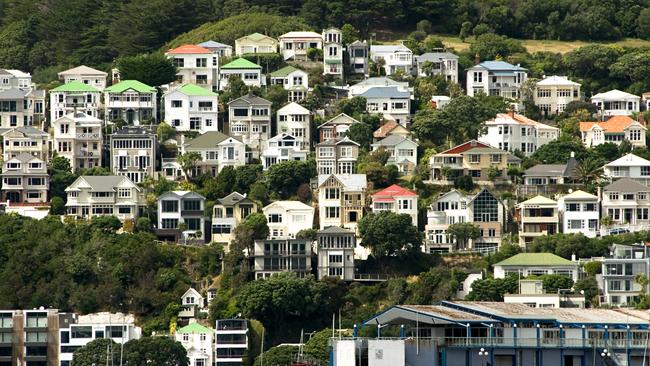

Reserve Bank of New Zealand looks to debt-to-income curbs to cool housing markets

Like the RBA, NZ’s central bank can’t directly target house prices. But its new debt-to-income curbs may help tame the market.

The central bank of New Zealand believes debt-to-income restrictions on mortgages could be a key to slowing the nation’s rapid increase in housing prices, by reducing investor activity without undermining first-home buyers.

It’s a move that is likely to be watched closely by Australian policymakers.

The Reserve Bank of New Zealand (RBNZ) said on Wednesday that after examining the potential impacts of debt-to-income lending limits on the housing market, it was determined that such a policy would help cool a housing market that is even hotter than Australia’s.

“Our analysis detailed that debt serviceability restrictions, such as a debt-to-income (DTI) limit are likely to be the most effective additional tool that could be deployed by the Reserve Bank to support financial stability and house price sustainability,” it said in a statement.

“The analysis also demonstrated that any such restrictions would impact investors most powerfully while having limited impact on first-home buyers.”

House prices in New Zealand, like Australia, have been boosted by similar factors: returning economic growth post-Covid, record low interest rates and expansionary economic policy.

But the pace of house price growth in New Zealand has surpassed that of Australia, with the country’s Real Estate Institute saying median house prices lifted 32.3 per cent in the year to May 2021 to $NZ820,000 ($760,246).

According to CoreLogic figures, the median price of a property in Australia lifted 10.6 per cent over that same period.

Like its Australian counterpart, the RBNZ does not have a remit to target house prices directly.

But in February New Zealand’s Minister of Finance Grant Robertson issued a formal direction to the RBNZ stating it must have regard to house price sustainability when making decisions about the financial stability of the economy.

Mr Robertson has agreed to add DTI limits to the RBNZ’s macroeconomic toolkit “on the condition that any implementation is designed to avoid impact, as much as possible, to first home buyers”.

Debt-to-income limits on mortgages would see loans restricted by a certain multiple of the income of the borrower.

They differs from loan-to-value ratio (LVR) limits, which measure how much a bank can lend for property against the value of that property.

The RBNZ has imposed LVR restrictions by only allowing one-fifth of the mortgage lending to go to borrowers with deposits of less than 20 per cent.

The NZRB said the two policy tools could work in a complimentary way to protect the financial stability of the housing market, while its governor Adrian Orr said it would also ensure “prices do not deviate too far from sustainable levels.”

“We believe that a ‘sustainable house price’ is the level that the price would be expected to move towards over several years, reflecting the underlying drivers of supply and demand for housing, including population growth, building costs, land supply, and interest rates,” Mr Orr said.

Reserve Bank of Australia Governor Philip Lowe has said the Australian central bank’s remit only extends to ensuring lending standards are maintained when the property market turns bullish.

In April he said the RBA was “monitoring trends in housing borrowing carefully.” Australia’s prudential regulator has also stated its remit extends only to lending standards.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout