IPCC report puts shareholder pressure on companies to accelerate climate change plan

Australian corporations face escalating pressure from investors to accelerate their climate change ambitions.

Australian corporations face escalating pressure from investors to accelerate their climate change ambitions, with companies needing to fast-track their net zero emissions policies to avoid a major climate tipping point.

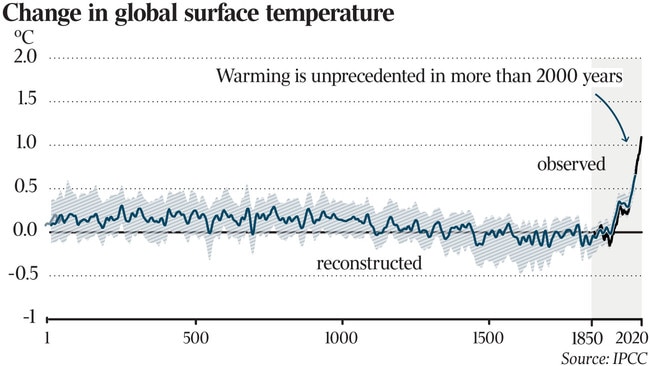

The world’s leading climate scientists warned on Monday that the prospect of limiting global warming to 1.5C will be out of reach within 12 years at current rates of greenhouse gas emissions, in a report that finds it is now “unequivocal’’ that human activity is heating the planet.

While major Australian businesses have been flocking to sign up to net zero emissions goals by 2050, the climate report meant those goals would need to be ripped up and brought forward by 10-15 years, according to climate consultant and investment firm Pollination Group which has advised the NSW and Victorian governments on policy.

“While everybody is talking about net zero by 2050, the focus is now going to be on net zero by 2040, if not 2035, and I think it’s going to be 2035,” Pollination Group founding partner Martijn Wilder said. “That means if you’re a company director or an investor, and you’re looking at investing in assets, you have to look at the risk from the perspective of having to phase out those assets by 2035.”

UN Secretary-General Antonio Guterres said the report was a “code red’’ for humanity and the Paris Climate Change accord’s global warming limit of 1.5C was “perilously close’’.

Company directors would need to re-examine their exposure to the updated climate warning, Pollination said, while the report cast doubt over sanctioning new high-carbon fossil fuel projects. “If you’re a director of a company, and you’re failing to take heed of this, you’re really exposing yourself and your company. And if you’re investing in assets that are high greenhouse-emitting, you’ve really got to question whether they have any future at all.”

Investors would demand much more from big business, HSBC said.

“We think this report provides investors with an even stronger case to demand more action from businesses and governments,” HSBC said on Tuesday. “For high-carbon activities to rethink business models and strategies; for industries to be more innovative in lower-carbon solutions; for all segments of the economy to prepare for the impacts of climate change.”

Australian corporations already face a crackdown on disclosing climate risks after major investor groups held briefings with Treasury and the nation’s financial watchdogs in June to introduce a mandatory reporting system by 2024.

Pressure on companies would now grow as investors sought out those that could adapt to a 1.5C scenario, the $US54 trillion ($70 trillion) Climate Action 100+ group said.

“Investors are increasingly shifting their portfolios to align with the goal of keeping average global warming to 1.5°C,” Climate Action 100+ Australia director Laura Hillis said. “The latest IPCC report further reinforces the imperative for the economy to rapidly decarbonise. Investors will continue to put pressure on companies to disclose their plans to incorporate climate risks, including at a physical and asset risk level.”

Companies will have to return to the drawing board to recalibrate their targets, the Australian Council of Superannuation Investors said.

“The findings of the IPCC report underline the climate-related risks faced by investors and companies across the globe. The report will be a catalyst for companies to reassess and realign their targets in light of these findings,” ACSI chief executive Louise Davidson said.

Property developer Mirvac has acknowledged it expects climate challenges to increase in their frequency and intensity.

“The report is a sobering reminder of the urgency for action to protect our planet. The business community isn’t waiting. The time for effective planning around a transition to a zero carbon economy and adaptation to a changing climate is now,” Mirvac chief executive Susan Lloyd-Hurwitz said.

IAG, the country’s largest general insurer for home and contents, said immediate action was needed.

“The IPCC report is another reminder of the immediate, urgent need for climate action,” IAG executive manager for natural perils Mark Leplastrier said. “We believe climate change requires broad-scale collaboration and co-ordination across all sectors of the community – it’s too big for one organisation to solve. There is limited time to make a difference, but it is still possible, so we hope that this latest confirmation of the science will drive more urgent engagement and conversation, so the necessary change can happen as soon as possible.”

Australia’s bank regulator warned in April of the unprecedented, far-reaching impact of climate change on all parts of the financial system, putting lenders and insurers on notice they need to be on top of the risks to their businesses.

Construction giant Lendlease said setting targets was no longer enough without action.

“Industry collaboration is critical in order for our sector to meaningfully reduce its carbon footprint,” Lendlease global CEO Tony Lombardo said. “This means working closely and co-operatively with our partners up and down the supply chain to reduce the embodied carbon in the materials our sector relies on – namely steel, cement and aluminium. Given what’s at stake, it’s no longer enough to make ambitious commitments without translating them into real and tangible outcomes.”

The Reserve Bank said in June that Australian businesses would face increasing international pressure to come clean on plans to lower carbon emissions.

Governor Philip Lowe said the question he was mostly asked from international forums was “what is Australian business doing to decarbonise?”