IMF, Treasurer warn Australia to feel effects of Trump, uncertainty in China

Australia should expect to face a more divergent global economy as the International Monetary Fund warns of a sharp increase in economic uncertainty.

Australia should expect to face a more divergent global economy as the International Monetary Fund warns of a sharp increase in economic uncertainty ahead of Donald Trump’s return to the White House, and sluggish growth prospects in China.

The IMF’s latest World Economic Outlook on Friday said while global inflation was easing, and therefore allowing central banks to press ahead with interest rate cuts, growth among the world’s largest economies was heading in different directions.

“Though the global growth outlook is broadly unchanged from October, divergences across countries are widening,” IMF chief economist Pierre-Olivier Gourinchas said.

The Washington-based fund’s new report reaffirmed its economic growth projections for Australia, forecasting GDP to expand by 2.1 per cent this year, edging higher to 2.2 per cent in 2026.

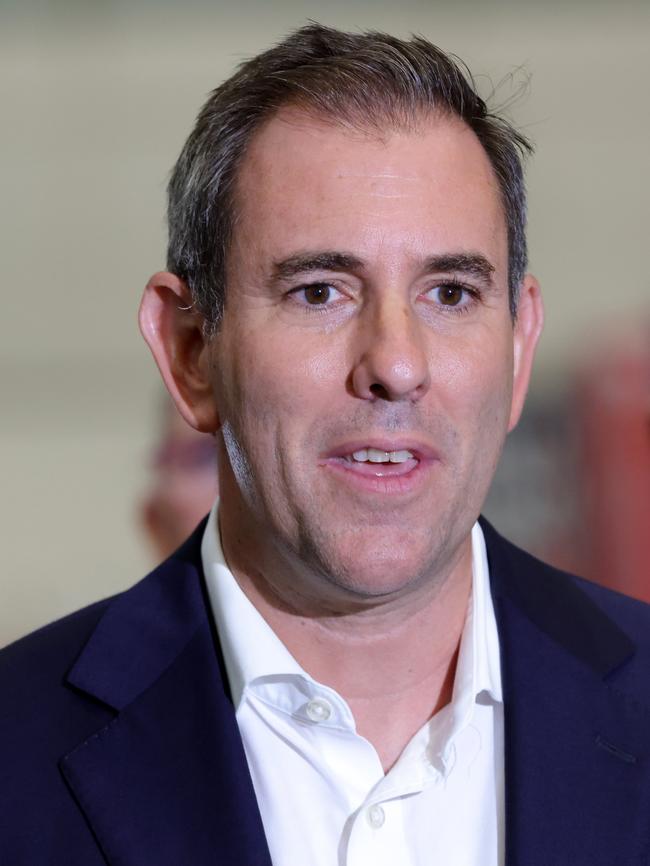

Those projections are a slightly more downbeat assessment than those released by Jim Chalmers in December’s mid-year budget update, which tipped GDP growth of 2¼ per cent for both 2025 and 2026.

However, the IMF still expects Australia to exceed the average GDP growth among advanced economies, with forecasts showing weaker output in Japan, the Euro Area and the UK.

The Treasurer on Friday said the IMF highlighted “big risks” for Australians and we will not be immune to slowing global growth.

“Conflict, trade tensions and weakness in the Chinese economy are likely to dampen growth around the world in 2025,” Dr Chalmers said.

“Australia is not immune from these challenges but we’ve made huge progress together in the past two years, with inflation down, wages up, unemployment low and more than 1.1 million new jobs created since we came to office.

“There’s always a premium on the type of responsible economic management that has been a hallmark of the Albanese government from the start, but even more so amidst this global uncertainty.”

Opposition Treasury spokesman Angus Taylor said the IMF projections showed the economy would remain weak if Labor wins the next election, due by May.

“The IMF has once again called on governments to rein in their spending but Labor continues to ignore these warnings. Without spending discipline, our financial future remains uncertain,” he said.

In a concerning development for Australia, Professor Gourinchas flagged that China was at risk of falling into a ”debt-deflation stagnation trap” – where falling prices and high debt drive up unemployment and lower growth – in the event that government stimulus proves insufficient.

China has struggled to rebuild economic momentum following the Covid pandemic, with burgeoning local government debt, a prolonged downturn in the property market and sagging consumption hampering growth.

Economic confidence has similarly soured, largely owing to Chinese President Xi Jinping’s resistance to unleashing the kind of government stimulus Beijing poured into the economy in late 2009 in response to the global financial crisis.

The IMF projects China’s GDP, which in 2024 grew to a ¥139 trillion ($28.6 trillion), will expand by a further 4.6 per cent this year, likely falling short of Beijing’s expected 5 per cent growth target, and well short of its average annual rate of almost 7 per cent in the decade to 2023.

For Australia, the sluggish activity has weighed on demand for key commodity exports, including coal and iron ore, as China’s steel mills moved to slash output.

At the same time, the IMF projected the US economy would expand by a robust 2.7 per cent in 2025, half a percentage point higher than its previous October forecast and outpacing its pre-pandemic trend, with growth propelled by strong jobs gains and accelerating business investment.

However, US president-elect Donald Trump’s plan to curb immigration and sharply increase tariffs on imported goods were “likely to push inflation higher in the near term”, Professor Gourinchas warned.

“Higher inflation would prevent the Federal Reserve from cutting interest rates and could even require rate hikes that would in turn strengthen the dollar,” he said.

Since November’s presidential election, the greenback has gained 6.1 per cent on the Australian dollar, which on Friday was buying US62.1c, a near five-year low. The greenback’s strength has bolster the commonwealth company tax take, as Australia’s key commodity exports, such as iron ore, are priced in US dollars.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout