Home borrowing binge hits new high in January: ABS

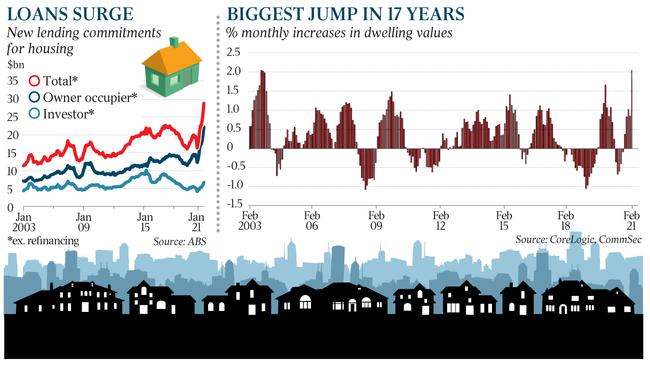

Australians are taking on new housing debt at an unprecedented rate, committing to nearly $29bn in loans in January – 44 per cent more than a year before.

Australians are taking on housing debt at an “astonishing” rate, committing to $28.8bn in loans in January — 11 per cent more than in December and 44 per cent more than a year ago.

The borrowing binge has accompanied a surge in home prices, which jumped by 2.1 per cent in February, the sharpest monthly increase in 17 years, according to CoreLogic.

The cheapest loans in history and growing confidence the economy will continue its V-shaped recovery from the worst downturn in nearly 100 years has sparked Australians’ renewed appetite for debt. CBA economists described the surge in new lending as “astonishing”.

Borrowing by owner-occupiers lifted nearly 11 per cent in the month to $22.1bn — up 52 per cent from January 2020, seasonally adjusted figures from the Australian Bureau of Statistics revealed.

AMP Capital chief economist Shane Oliver said the record run in borrowing pointed to “solid house price gains in the months ahead, although January’s 2 per cent capital city rise may be hard to beat”.

The rapid recovery in home values over recent months has put to bed predictions the COVID-19 recession would trigger a property market collapse, and replaced those fears with forecasts of an emerging residential real estate bubble as Australians rush to take advantage of cheap home loans. Three-year fixed mortgage rates have dropped by 0.9 percentage points over the past 12 months to about 2 per cent, according to RateCity.

Despite the role of cheap money in fuelling demand for loans and property, Reserve Bank of Australia governor Philip Lowe will use the central bank’s monthly board meeting on Tuesday to reiterate his commitment to keeping rates low for years to come.

Dr Lowe remains unconcerned about the prospect of an overheated housing market, having noted that prices have only reached their peaks of four years ago. The CoreLogic data showed prices in Sydney are still 1.1 per cent below their July 2017 peak, while Melbourne home prices are 1.7 per cent below the March 2020 high.

EY chief economist Jo Masters said the RBA would rely on lending controls — known as macroprudential policy — rather than rate rises to contain the housing market, should it eventually deem it necessary. “Interest rates are expected to remain incredibly low for several years,” Ms Masters said.

In a further sign of a hot property market, the ABS report showed investors jumping back into bricks and mortar after largely fleeing the market before the pandemic.

New lending to landlords lifted 9.4 per cent in January to $6.6bn, or 22 per cent higher than a year ago. Investor lending has rebounded 62 per cent since May 2020, when it reached its lowest level since December 2002.

The number of first-home buyers committing to new loans jumped 10 per cent to 16,664 — 70 per cent higher than in January 2020, and the highest level since May 2009.

The Morrison government’s HomeBuilder program — which offers $15,000 in cash subsidies for eligible new builds and substantial renovations — has also sparked a record surge in lending for constructing new homes: up 20 per cent in January to $9.9bn, and 162 per cent more than a year ago.

The value of owner-occupier home loan commitments rose across all states and territories, besides Western Australia, to reach record highs, the ABS said.

The surge in lending and house prices came as the RBA ploughed a further $4bn into the bond market on Monday, double its usual daily intervention, as it sought to tame a sharp uplift in 10-year yields, which briefly pushed above 1.9 per cent last week.

The jump in global yields has sparked fears that the central bank may not be able to control a lift in borrowing costs which could, if left unchecked, threaten the sustainability of a federal government debt burden that is expected to reach $1 trillion in the next financial year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout