Big spenders key to Covid-19 economic comeback

Consumers and housing will drive the nation’s economic recovery in 2021 according to the nation’s leading economists.

Consumers and housing will drive the nation’s economic recovery in 2021, even as JobKeeper comes to an end and international borders remain firmly shut, according to the nation’s leading economists.

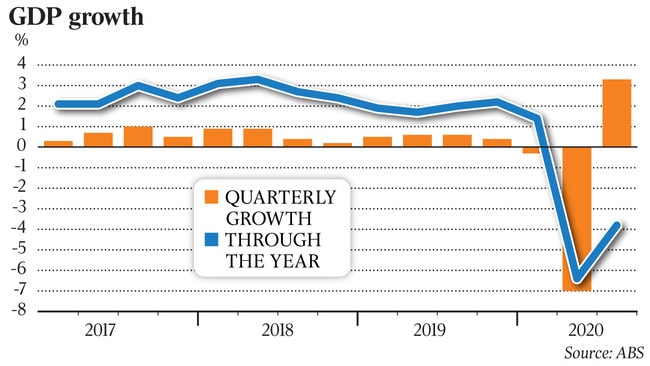

Australia could return to pre-pandemic levels of economic activity by mid-year, if not earlier, top-ranked economist Saul Eslake has predicted, with the chance of a GDP print of 3 per cent on Wednesday “not at all unreasonable”.

“I think we will see a continued, more rapid than previously expected, return to pre-pandemic levels of economic activity.

“And by the middle of the year, if not earlier, we will have returned to pre-pandemic levels of GDP and employment,” Mr Eslake told The Australian.

The unemployment rate will take longer to recover, he cautioned.

“We may not have returned to pre-pandemic levels of unemployment (by mid-year), because the workforce has grown over the past year; we’ve had an increase in the participation rate.

The unemployment rate, at 6.4 per cent, is still well above the 5.1 per cent recorded in February 2020 before the pandemic hit.

Still, Mr Eslake expects Australia could see unemployment drop below 5 per cent ahead of the Reserve Bank’s target date of 2024. As the economic recovery gets under way, the composition of economic activity will be different from the pre-COVID-19 days, he said.

“There’ll be less spending by foreigners, but there already is more spending by Australians happening than before the pandemic. While GDP hasn’t yet recovered to pre-pandemic levels, retail sales certainly has, new motor vehicle sales certainly have and housing commencements have.”

The federal government’s decision early in the pandemic to ban Australians from leaving the country has been an underappreciated source of stimulus to the economy, he said.

“There’s a lot of attention being given to the loss of income arising from foreign tourists and students not coming here, but what’s been underappreciated is that, ordinarily, Australians would have spent $45bn overseas. And they’ve actually only spent $2bn (between March and December).

“The rest has either been spent by Australians on things like electronic equipment, communications equipment, household furnishings, clothing, new cars, renovations and the like. Or it’s contributed to the significant $112bn increase in household savings since the pandemic started.”

That increase in household savings is “a very important cushion” that will help the economy navigate the tapering of government support programs, he said.

HSBC chief economist Paul Bloxham, meanwhile, believes Australia is in an upswing to a “new normal” but expects the momentum to slow from the swift recovery in 2020.

“It’s pretty positive in the sense that the economy’s improving, it’s being led by the consumer and we’re seeing an upswing in the housing market, which is helpful as well.

“But there are still a few challenges yet to come, (including) the end of the large fiscal programs, such as JobKeeper, at the end of next month,” he said.

The end of JobKeeper may slow the momentum in the jobs market, Mr Bloxham warned.

“Another aspect is that the international border is still closed, and so that’s a significant drag on growth, in the sense that it constrains inward migration, international tourism, and the arrival of foreign students.

“These are all important aspects of Australia’s growth story and it looks as though those constraints will be in place for quite some time yet.”

HSBC is forecasting a 2 per cent economic expansion for the December quarter before the pace of growth slows.

“There’s still quite a lot of adjustment that has to happen, so we think that we’re going to lose some momentum; the rate of growth is going to slow, we think, in the first half of this year.

Westpac also sees the economic recovery being driven by consumers and housing, as well as public demand after a round of expansionary state budgets.

“Confident consumers are spending up, boosted by earlier government support, and home building is rebounding, up in response to cheap credit and incentives,” Westpac senior economist Andrew Hanlan said.

The household saving ratio jumped to 22 per cent in the second quarter of last year, up from 5.3 per cent at the end of 2019, boosted by income transfers from the government.

The saving rate moderated to 18.9 per cent in the third quarter and will decline further in the fourth quarter and through 2021 as confident consumers draw down on this savings buffer to fund a lift in spending, Mr Hanlan predicted.

“The easing of COVID-19 restrictions and the vaccine rollout have contributed to the confident mood among consumers and businesses,” he said.

Westpac expects real GDP to have expanded 2.5 per cent in the December quarter, to be down 1.8 per cent year-on-year. Westpac’s estimate is a fraction higher than consensus estimates for a 2.4 per cent expansion.

The brighter economic outlook comes as corporate earnings exceeded expectations in the February reporting season.

Ahead of Wednesday’s closely watched GDP data, the RBA holds its monthly board meeting on Tuesday.

Nomura senior economist Andrew Ticehurst expects the central bank could sound more upbeat on global and local growth developments but said near-term uncertainties would see it keep the cash rate steady. Its guidance on keeping rates at the current level until 2024 will also be repeated, he predicted.

“However, we flag that it could seek to introduce flexibility around its QE program.

“Rather than buying a fixed $5bn per week of (commonwealth and state government bonds), the RBA could announce that it will tailor the size of these purchases to better reflect underlying market conditions, while keeping the size of this program unchanged,” Mr Ticehurst said.