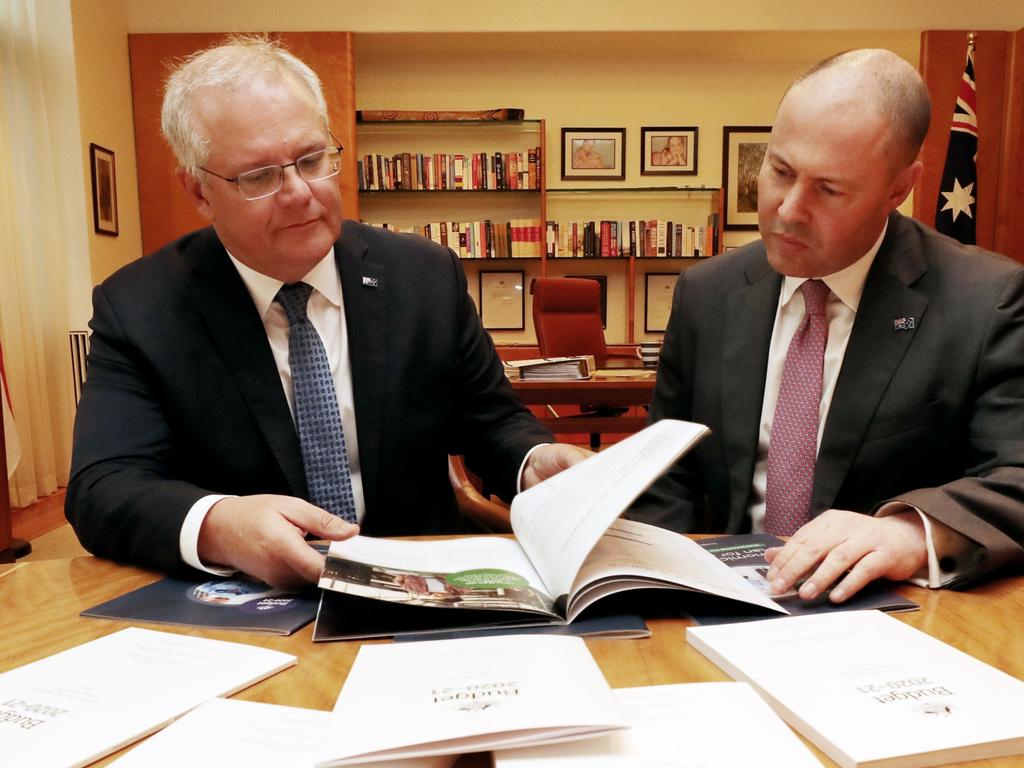

Federal budget 2020: Turbocharged write-offs in 50,000 job business investment push

Businesses will be able to write off the full value of new assets in a single year under a $26.7bn budget tax relief package.

Businesses will be able to write off the full value of new assets in a single year under a $26.7bn tax relief package the Morrison government hopes will turbocharge business investment and create about 50,000 jobs by mid-2022.

Under the plan, firms with turnover up to $5bn — more than 99 per cent of Australian businesses — will be able to deduct the full cost of assets until June 2022.

Josh Frydenberg said the initiative would provide $26.7bn worth of tax relief over the next four years, branding it a “game changer” that would “get Australians back to work”.

Business will also be able offset losses from past profits, accessing a further $4.9bn in tax relief. The measures are designed to help support the recovery of the economy, which the Treasurer expects will begin to rebound next year, forecasting 4.25 per cent growth after a 3.75 per cent fall this year.

Meanwhile, the unemployment rate is expected to peak at 8 per cent by December before falling to 6.5 per cent by June next year, according to the budget papers. Mr Frydenberg said the two tax incentives would “dramatically expand the productive capacity of the nation and create tens of thousands of jobs”.

“Building on the successful expansion of the Instant Asset Write Off during the COVID crisis, tonight we go further, announcing the largest set of investment incentives any Australian government has ever provided,” Mr Frydenberg said on Tuesday night.

“This will be available for small, medium and larger businesses. It is a game changer. It will unlock investment.

“A trucking company will be able to upgrade its fleet, a farmer will be able to purchase a new harvester and a food manufacturing business will be able to expand its production line. This will boost the order books of the nation.”

For example, Mr Frydenberg said, a company that turns over $200m a year and buys $400,000 worth of software would normally claim a tax deduction of $80,000 for that investment, with the remaining cost depreciated over future years.

But under the new scheme, it would be able to claim the full cost and pay $96,000 less in tax.

He said the expanded instant asset write-off scheme would apply to about $200bn worth of investment, including 80 per cent of investment in depreciable assets by non-mining business.

The Business Council of Australia had called for greater tax incentives to encourage businesses to invest again, and any measure would be “maximised if it applies to companies small and large”.

However, the BCA argued for a 20 per cent investment allowance to help catapult the country out of recession, estimating that the initiative would have cost $10bn a year and created 500,000 jobs over a decade. “We are seeing many capital budgets being scaled back in 2020,” the BCA said in its pre-budget submission.

“Supporting larger projects has a big impact in terms of job creation and creates significant opportunities for small businesses that form part of the supply chain for major projects.”

To spur growth further, Mr Frydenberg said businesses would be able to offset losses against previously paid taxes.

The BCA has supported such a move, saying it would bolster “cash-constrained business, as well as investment by reducing the bias against riskier projects”. Losses incurred to June 2022 can be offset against prior profits made in or after the 2018-19 financial year.

Mr Frydenberg said that normally a business would have to return to profit before it could use these losses.

“But these are not normal times,” the Treasurer said.

“Through no fault of their own, millions of small and medium sized businesses have faced lockdowns and restrictions that have severely impacted their ability to trade. COVID-19 has turned fundamentally sound businesses into loss-making businesses.

“In order to keep their workers, these businesses need our help now. They cannot wait years for the tax system to catch up. So … companies that have been doing it tough throughout this crisis will be able to use their losses earlier.

“Together with our reforms to insolvency and the provision of credit, we are giving Australian businesses their best chance to succeed and keep more people in work,” Mr Frydenberg said.

The government will also expand its tax treaty network to eliminate double taxation and attract more foreign investment and skilled workers.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout