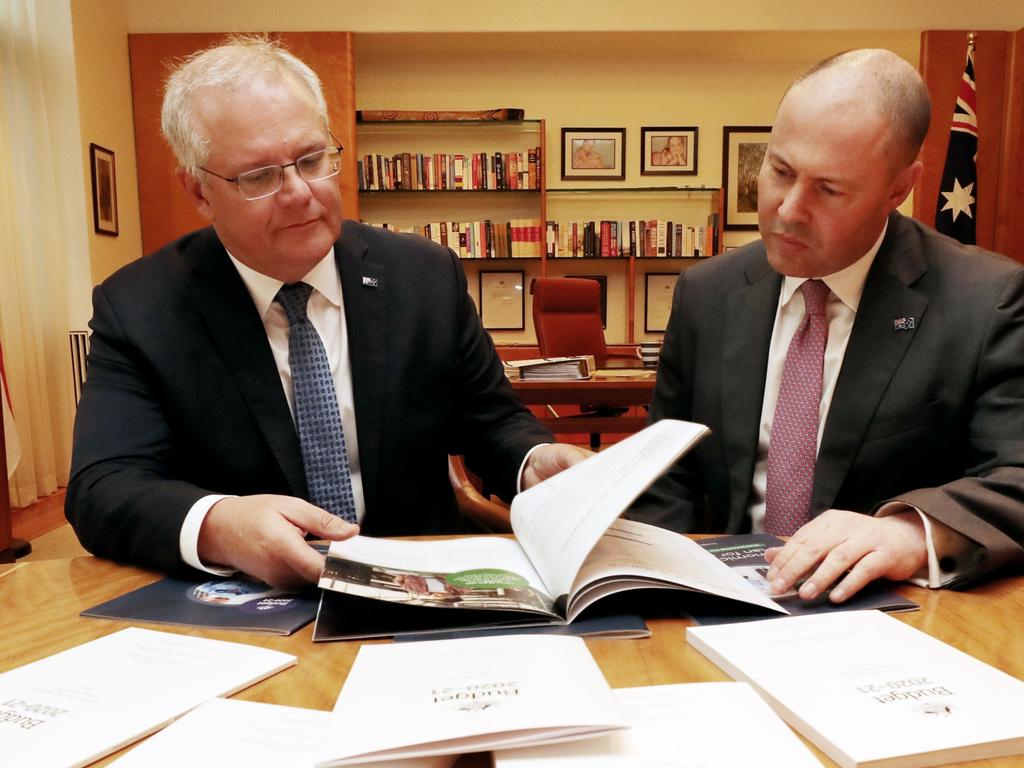

Federal budget 2020: Small businesses to get $100m tax breaks and insolvency lifeline

Small businesses have been handed major tax breaks worth more than $100m and an insolvency lifeline in Tuesday’s federal budget.

Small businesses have been handed tax breaks worth more than $100m and an insolvency lifeline.

More than 200,000 businesses will be exempt from fringe benefits tax, be able to deduct start-up expenses and will be able to access simplified trading stock rules by 2021.

The $105m set of 10 small business tax concessions will benefit companies employing more than 1.7 million Australians.

“From July 1, 2020, eligible businesses will be able to immediately deduct certain start-up expenses and certain prepaid expenditure,” the budget papers say.

“From April 1, 2021, eligible businesses will be exempt from the 47 per cent fringe benefits tax on carparking and multiple work-related portable electronic devices (such as phones or laptops) provided to employees.

“From July 1, 2021, eligible businesses will be able to access the simplified trading stock rules, remit pay as you go (PAYG) instalments based on GDP adjusted notional tax, and settle excise duty and excise-equivalent customs duty monthly on eligible goods under the small business entity concession.” Small businesses will also have two years to amend income tax assessments for financial years starting from July 1, 2021, unless they have significant international tax dealings.

Companies with turnover under $10m can also deduct the balance of their simplified depreciation pool at the end of the income year. Thousands of enterprises facing closure due to the COVID-19 pandemic will now be helped by US-style bankruptcy laws which allow them to trade their way out of insolvency.

“By reducing complexity, time and costs, a simplified restructuring process will encourage more Australian small businesses to restructure when in financial distress to improve their chances of survival,” the budget papers say. “Where that is not possible, a simplified liquidation process will ensure greater returns to creditors and employees and allow assets to be quickly reallocated elsewhere in the economy, supporting productivity and growth.”

The budget also include $7bn worth of initiatives to help small businesses deal with mental health issues, including “$4.3m to provide free, accessible and tailored support for small business owners by expanding Beyond Blue’s NewAccess program in partnership with the Australian Small Business and Family Enterprise Ombudsman”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout