Federal budget 2020: Instant asset write-offs spur business investment

Companies are already drawing up plans to bring forward investment after the Morrison government expanded its instant asset write-off scheme.

Companies are drawing up plans to bring forward investment and upgrade equipment after Treasurer Josh Frydenberg extended the instant asset write-off scheme in an effort to catapult the country from one of its deepest recessions.

From Tuesday night, companies with turnover of up to $5bn can write off the full value of an asset in a single year rather than wait years and claim depreciation – a move that truckies and car dealers to caravan and cardboard box makers have warmly welcomed.

The Morrison government expects the incentive will provide about $26.7bn in tax relief over the next four years, with companies able to tap into the scheme – which has no limit to the value of assets claimed – until June 2022.

Business will also be able to offset losses from past profits, accessing another $4.9bn in tax relief, with the two incentives aimed at creating 50,000 jobs in the next 18 months.

Jake Dingle, chief executive of carbon wheel manufacturer Carbon Revolution, which is expanding its operations on the outskirts of Geelong, said while it was yet to turn a profit and enter a tax-paying position, the company would take advantage of the initiative.

“Because we are an advanced manufacturing business, we are investing in capital equipment, so clearly that it is something that is certainly helpful from that perspective,” Mr Dingle said. “We are driving towards profitability over this coming year, so pre-profit those sort of things are from a cash point of view are less beneficial, but as you break into profit they become very beneficial.”

Carbon Revolution chief financial officer Gerard Buckle said the asset write-off scheme would help accelerate investment increasing losses this year, which they will later offset against future profits.

“We will take advantage of it in a way that when we are completing our tax returns, this will add to our tax deductions for this year and our carry forward tax losses will be greater, so when we get into that position of tax paying, this will be sitting there for us.”

A spokeswoman for Treasurer Josh Frydenberg said businesses would be able to write-off multiple assets, with no limit to the value of the asset they can claim.

“Businesses with turnover up to $5bn will be able to deduct the full cost of eligible depreciable assets of any value in the year they are first used or installed ready for use. The cost of improvements made during this period to existing eligible depreciable assets can also be fully deducted.”

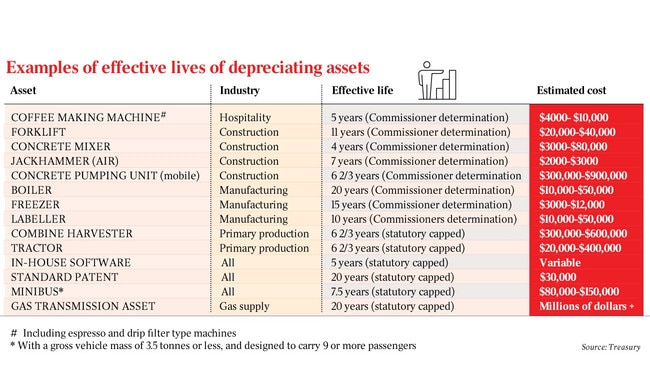

Examples include a forklift, valued between $20,000-$40,000, a minibus, worth between $80,000-$150,000, and a combine harvester, which can be worth up to $600,000.

Victorian Transport Association chief executive Peter Anderson said that the tax incentive would help renew Australia’s ageing fleet of trucks.

He also praised the ability to offset future losses against previously paid taxes.

The measures are designed to help support the recovery of the economy, which the Treasurer expects will begin to rebound next year, forecasting 4.25 per cent growth after a 3.75 per cent fall this year. Meanwhile, the unemployment rate is expected to peak at 8 per cent by December, before falling to 6.5 per cent by June next year, according to the budget papers.

“Extending the instant asset write-off program will stimulate spending on new trucks, trailers, technology and other equipment to renew our ageing transport fleet which will have enormous benefits for safety and productivity,” Mr Anderson said.

“And for those transport businesses that have been unable to work because of forced closures, the ability to carry-back losses and receive a tax credit could be just what they need to recover as our economy starts to reopen.”

James Voortman, Australian Automotive Dealer Association chief executive hoped the expansion of the instant asset write-off scheme will lift car sales.

“The temporary full expensing initiative will boost investment and with vehicles being a key asset for so many Australian businesses, we hope that it results in increased sales and a recovery in the automotive retail sector,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout