The only lingering doubt about the budget is that the government has fallen victim to the old adage: “Never waste a crisis”.

The good news is budgets are not the only forum for structural reform and indeed an economic statement could, if the government so desired, come anytime soon, to make good on all that work from the COVID commission, BCA and others.

Changes urged include a complete revamp of the aged-care industry to force scale on the duds and increase accountability, which doesn’t need to wait for any royal commission findings.

Instead of increasing the money going directly to JobSeeker participants, why not revamp the system to pay unemployed people a living wage while they undertake microcredential courses to give them new work-ready skills?

A third item on the list of the Productivity Commission’s inspired changes would be to hold back GST payments to states that don’t open the door to massive changes to their planning rules, thereby opening the local economies to more rational land uses.

These are but three actual structural reforms that provide social benefits and long-term economic gain at a time when the economy is bouncing back.

If turning off the goodies is an issue, here are long-term social adjustments to boost the economy term.

The concern expressed at a KPMG webinar on Wednesday by HSBC economist Paul Bloxham was that, while the budget was right for the times, the reality is that economic cycles are now firmly in the hands of the politicians, with the RBA effectively sidelined.

Those wanting structural reform may have had hopes for the May budget next year, but if the pundits are right and there is an election pending later next year then the chance of a Liberal government producing hard-hitting structural reform a few months out from an election are not great.

The good news is the breadth of the stimulus provided — for companies with turnover below $5bn, which as a point of reference means roughly 60 per cent of BCA members could participate.

The threshold covers all but the top 40 listed companies and the likes of AustralianSuper, offshore-controlled Optus and Toll, Pratt Holdings and Gina Rinehart’s Hancock. Based on KPMG analysis, the R&D changes, while not removing the flagged intensity measures most Australian manufacturers wanted out the policy, is significantly better for big R&D spenders.

Local manufacturers had fought against the intensity measure because it is measured against total costs, including selling costs, which meant foreign companies with offshore facilities had fewer costs and hence increased intensity.

Under the budget changes, the tax benefit for companies with revenue bigger than $20m a year in turnover is 8.5 per cent, but if your capital intensity is over 2 per cent, any amount over that amount is increased to 16.5 per cent.

This is a step forward on any account, and known winners include CSL, ResMed and Cochlear.

The cap on the amount to be claimed is also increased from $100m to $150m.

Deloitte analysis says the combination of the immediate expensing of assets and the loss carryback is wider and more extensive than expected, including its application for companies earning up to $5bn in turnover.

When the Gillard government implemented the policy in 2012, it was only for 12 months and only for small companies.

The policy allows you to get refunds on taxes paid if you report a loss this year and the next due to the COVID-19 restrictions.

The benefits are real but the window of opportunity is relatively small at just two years, which may make it beneficial more in boosting confidence than actual dollars in your wallet.

The test here is, as NAB boss Ross McEwan said on Wednesday, the onus lies on corporate Australia taking up the challenge left by the Treasurer.

Low interest bill

The aforementioned Paul Bloxham has noted that low interest rates meant the size of the government debt is not so crucial when you consider that per capita debt in the 2019 financial year was $12,905 and the interest bill $523.

On present projections, in the 2024 financial year the debt per head will be $30,126 but the annual interest bill just $426.

Funds under fire

Below the headline changes to superannuation in Tuesday’s budget was another shot at the industry funds, with the government planning to change the best interest rule to the “best financial interest” rule.

The rule requires fund trustees to act in the best financial interests of their members, which is something the not-for-profit industry funds would argue is easily met.

The naysayers would argue the $185bn AustralianSuper’s investment in the New Daily publication would not meet the test, nor would funding television advertisements featuring Greg Combet spruiking industry super and association memberships.

These payments would all have to be listed in the annual report.

The biggest kick to the link between union awards and default funds was the lifetime fund change where your first default can stay with you for life. That means your first union award is the only one that matters and in time the links will be broken.

The rationale offered was that there were six million multiple accounts held by 4.4 million people and this would help reduce them.

Some 3 million accounts have $100bn invested in underperforming funds, which will now be subjected to an annual test based on an eight-year rolling average with the idea that trustees would wake to the underperformance and join better-performing funds.

All of the above have on the surface some merit but three of the four come with a political clip around the ears for industry funds.

Bids for Lion assets

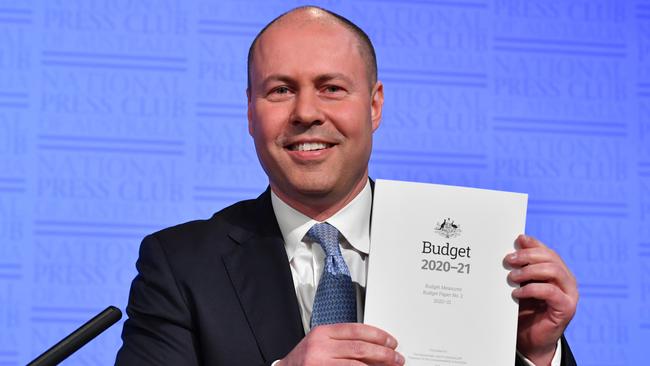

While all eyes are focused on the budget, the folk at Deutsche are slowly but surely working through the bids for the Lion dairy assets after last year’s sale to the Chinese was blocked by Josh Frydenberg.

Canadian dairy giant Saputo has popped its head into the bidding ring, but is being treated with caution because of perceived ACCC issues when Lion is anxious for a clean, quick sale by year end.

Deutsche approached Andrew Forrest’s Tattarang but his level of interest is unclear.

Known bidders include John Wylie’s Tanarra Capital and Bega but the deal is yet to move through to stage two, which is to narrow down serious bids.

The Chinese offered $600m, which is where bidding will start working backwards but anything north of $500m will require a capital raise from Bega. Lucky for its boss Barry Irvin at Wednesday’s $5.29 the stock is priced at something like 26 times Morgan’s earnings per share forecast for this year of 20.4c up from 14.9c last year.

Legislation before federal parliament paints an even better view for business, with the government door wide open for business, wanting to spend money today.