Economic boom before election: RBA forecasts unemployment could fall to 3.25pc

The backdrop to the federal election will be a booming economy, the Reserve Bank says.

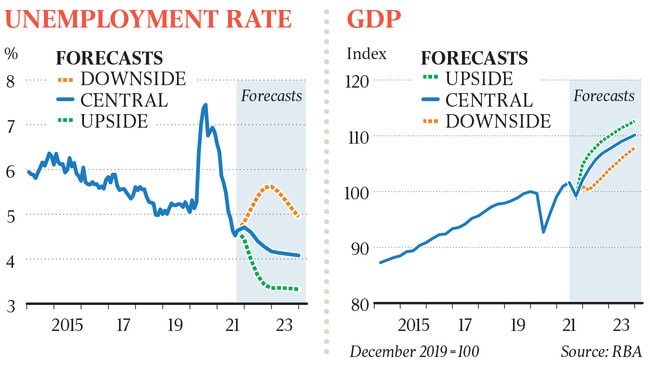

The Reserve Bank has flagged unemployment could be as low as 3.25 per cent this time next year if household spending surges, Australia maintains its success in suppressing Covid-19, and the global recovery is sustained, taking the nation to a full employment nirvana not seen in generations.

In a “plausible upside scenario” in the central bank’s quarterly statement on monetary policy, published on Friday, a consumer-led revival off the back of booming home and share prices and world-leading vaccination rates would see the economy grow by about 12 per cent from now until the end of 2023. If that were to occur, and wages and inflation became elevated, “an increase in the cash rate in 2023 could be warranted”, the RBA conceded.

Even the RBA’s central scenario has the economy roaring out of the Delta disruption, as borders reopen to tourists, workers and students, leading to 5.5 per cent growth next year and a decline in the jobless rate to about 4 per cent by mid-2023, with a steady pick-up in wages and inflation.

“In the past half century or so, this rate of unemployment has been experienced in Australia only briefly,” the bank said of its central labour market view.

This presages modest pay increases because of “spare capacity and the inertia in the wage-setting process”.

The RBA’s upgraded economic forecasts in the wake of extended lockdowns will set an upbeat tone in the lead up to a federal election, expected to be in either March or May.

“Now that vaccination rates are rising quickly to very high levels, and restrictions on activity have been eased significantly, the economy is recovering rapidly,” the RBA said.

Almost 80 per cent of Australians aged over 16 are now fully vaccinated.

Finance Minister Simon Birmingham said economic strength was driving skill shortages in the economy but “it was a good problem to have”. He said borders were opening faster than anticipated, with a flow of international visitors to NSW and Victoria, and that foreign students and workers would soon follow.

“Then we can get into seeing those skilled migrants coming back in, helping to meet some of those challenges,” Senator Birmingham told Sky News.

The RBA said that, with the economy now opening up, the “solid momentum” evident before the Delta outbreak was expected to resume. “Consumer spending is already picking up, and will be supported by rising incomes as employment recovers, even as fiscal support for income is wound back,” it said. “Strong growth in household wealth this year should add impetus to consumption. The household saving ratio has been high during lockdown periods, but is expected to return to around pre-pandemic levels over the next couple of years.”

Along with the evolving health situation, the RBA said another key uncertainty was how much consumption responds to higher household wealth. “A stronger response than has been the case on average historically would support stronger economic growth and the unemployment rate falling well below 4 per cent by the end of 2023,” it said.

It added that core inflation would rise to above 3 per cent, outside the RBA’s target range.

The RBA said the downside scenario considered the effects of another bad health outcome, such as a new strain of the virus or a decline in vaccine effectiveness, and lingering uncertainty about the economy. “These factors could combine to reduce activity and spending,” it said.

“In that scenario, unemployment would be above 5 per cent for most of the next few years and inflation would fall below the 2 to 3 per cent target range”.

Echoing governor Philip Lowe’s remarks after Tuesday’s RBA board meeting, the statement said overseas wage and price pressures due to labour shortages and rising energy costs were not likely to spread here. “The pre-pandemic starting points for both wages growth and inflation were lower in Australia than they were in many other advanced economies,” the statement said.

The bank again pushed back against financial markets, which are factoring in several rises next year in the cash rate from its floor of 0.1 per cent, declaring “in the board’s view, the latest data and forecasts do not warrant an increase in the cash rate in 2022”.

The RBA again vowed to be patient, stating it would not raise rates until there was a return to full employment and wages growth was materially higher than the present 1.7 per cent annual rate.

Even if wages grew by 3 per cent, and underlying inflation reached – for the first time in seven years – 2.5 per cent by the end of 2023, such an outcome “could be consistent with the first increase in the cash rate being in 2024”.

Market economists, however, are expecting a tightening of policy well before then, due to stronger wages and core inflation, which hit 2.1 per cent in September.

CBA senior economist Kristina Clifton said: “Supply constraints and strong demand for goods globally is putting upward pressure on inflation. Alongside a rebound in demand domestically we see inflation lifting from here.”

CBA is tipping the first rate rise next November, with the cash rate peaking at 1.25 per cent in the September quarter 2023.

ANZ believes stronger inflation and wage outcomes will combine to trigger an RBA rate hike in the first half of 2023.

The RBA said the Delta outbreak, which saw half the population in lockdowns, caused a 2.5 per cent fall in GDP in the September quarter, a more benign view than Treasury’s 3 per cent forecast decline.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout