Consumer prices up as annual inflation rate hits 3 per cent

Inflationary pressures in hot pockets of the economy could see the Reserve Bank bring forward interest rate rises, economists say.

Inflationary pressures in hot pockets of the economy could see the Reserve Bank bring forward interest rate rises, economists say, following stronger than expected underlying prices growth in the September quarter.

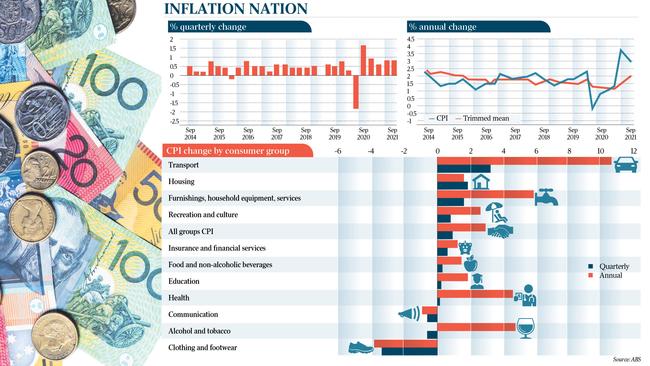

The consumer price index rose by 0.8 per cent in the three months to September, pushed along by soaring home building and fuel costs, taking the headline annual inflation rate to 3 per cent.

But core inflation, which strips out one-off factors, rose by 0.7 per cent to an annualised 2.1 per cent, its highest level since 2015, and ahead of market expectations. The RBA focuses on this “trimmed mean” inflation measure when setting official interest rates and the CPI news saw bond yields surge and the dollar rise to US75.3c from US75c.

The central bank’s current guidance is it will not raise the cash rate from 0.1 per cent until actual inflation is sustainably within its 2-3 per cent target band and it does not expect the economy to meet these conditions before 2024.

With rising global inflation and monetary policy tightening by other central banks, financial markets have been in a trading war with the RBA on yields, pricing the next move in official rates in Australia to now be as early as April, with a 1 per cent cash rate by the end of next year.

The RBA’s 0.1 per cent target rate for the yield on the April 2024 bond rose to 0.225 per cent on Wednesday and participants expect the central bank to be active in the market in coming days to reduce yields.

AMP Capital chief economist Shane Oliver said interest rate rises were now getting closer but the RBA would seek more evidence that the inflation pick up was due to factors beyond Covid-19 distortions.

Dr Oliver said the RBA would want to see a tighter labour market with full employment and wages growth around 3 per cent or more before lifting rates.

The wage price index rose by 1.7 per cent in the year to June.

“With the economy recovering again, we believe the conditions for the start of rate hikes will now be in place by late 2022,” he said.

Dr Oliver expects a 15 basis-point increase in the cash rate to 0.25 per cent in November next year, and a 0.25 per cent rise the following month, taking the cash rate to 0.5 per cent by the end of next year.

“While this will mean an increase in consumer and housing interest rates, the overall level of the cash rate will still be incredibly low and will be far from ‘tight’ monetary conditions,” he said.

Westpac market strategists noted the quick reaction by currency markets. “To be sure, core CPI will have to do more than simply ‘trip over’ the 2 per cent lower bound for the RBA to be concerned and react,” they said, adding that Tuesday’s RBA board meeting and statement on monetary policy on November 5 “will be super important”.

ANZ Bank economists said the “surprise” lift in core inflation was driven by stronger than expected strength in a range of services such as insurance and restaurant meals.

That “will put some pressure on the RBA to rethink its forward guidance for the cash rate,” ANZ’s Hayden Dimes and David Plank said, adding the central bank was likely to dig in on its view that wages growth was unlikely to see a material change. “This sets things up for an ongoing battle between the RBA’s outlook and market pricing,” the ANZ economists said.

Commonwealth Bank economists said the CPI outcome “is a significant miss” on the RBA’s forecast profile for underlying inflation, and it would need to make upward revisions to that outlook in next week’s statement on monetary policy.

According to the Australian Bureau of Statistics, the most significant price rises in the September quarter were for new homes bought by owner-occupiers, which rose 3.3 per cent, and automotive fuel, which lifted 7.1 per cent.

Head of prices statistics at the ABS Michelle Marquardt said construction costs such as timber increased because of supply disruptions and shortages. “Combined with high levels of building activity, this saw price increases passed through to consumers,” she said, adding the CPI’s automotive fuel series reached its highest level in its half-century history. Fuel prices have jumped by 36 per cent from their lows in mid-2020.

The ABS reported global supply disruptions led to price rises for furniture (up 3.8 per cent), motor vehicles (up 1.4 per cent) and audiovisual equipment (up 1.8 per cent). The most significant price fall was for fruit, down 8.3 per cent from favourable growing conditions and reduced demand from the food service industry. Clothing prices fell 5.5 per cent as retailers looked to move excess stock as sales fell due to lockdowns.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout