Inflation edges into RBA target band despite high fuel, house prices

Chief executives have warned that consumers will continue to feel the pinch of rising prices.

Chief executives have warned that consumers will continue to feel the pinch of rising prices with inflation remaining elevated as the economy battles supply bottlenecks as well as rising fuel and construction material costs.

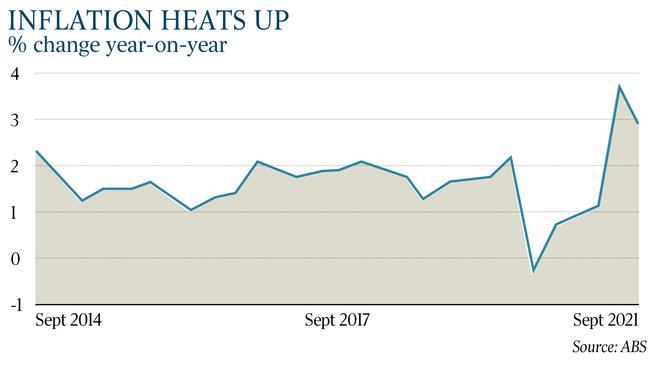

The nation’s underlying inflation rate came in much higher than economists’ expectations in the year to September, causing the Aussie dollar to jump over expectations the Reserve Bank’s could bring forward rises in official interest rates.

Woolworths chief executive Brad Banducci said inflationary pressure had been creeping into supermarket shelves as more of his grocery suppliers were pushing for “material” price increases to recoup steeper shipping, freight and other supply chain costs.

Mr Banducci said he expected the grocery sector over the next six months to switch from a “very deflationary” atmosphere to “slightly inflationary”, evident in expected price rises across fresh food categories such as meat, as well packaged groceries and products like tinned food and pasta.

“The question is not whether we are going to be deflationary but to what extent there is material inflation in the market,” Mr Banducci said.

The Bureau of Statistics’ Consumer Price Index (CPI) released on Wednesday showed the trimmed mean inflation rate – which strips out more volatile price fluctuations – increased from 1.6 per cent to 2.1 per cent, its highest since 2015. Economists were forecasting only a 1.8 per cent rise in underlying inflation.

Covid-related bottlenecks in materials and labour – coupled with government subsidies – has been boosting housing construction costs.

The headline inflation rate retreated to 3 per cent over the year to September, falling off last quarter’s 3.8 per cent, but remains elevated as the economy battles rising fuel and Covid-related bottlenecks in construction materials and labour costs.

It came just under economist predictions of 3.1 per cent, but the quarterly increase of 0.8 per cent was in line with consensus.

The surprising growth in underlying inflation sets it within Reserve Bank’s inflation target of between 2 and 3 per cent, putting the bank’s record-low interest rates in focus.

The sentiment was visible in bond markets, with Australia’s 3-year bond yield jumping as much as 14 basis points to 0.91 per cent – its highest level since January last year – while the Australian dollar lifted around 0.25 per cent to US75.30c.

However, the RBA has previously indicated it will not move on interest rates until inflation remains within its target band for a sustained period of time.

Flight Centre managing director Graham Turner, who is also a major shareholder in national retailer 99 Bikes, said there were signs of inflation in bike sales as well as in tourism sectors.

“If you look at the bikes industry there is a serious supply problem because of that lack of supply, it’s a bit like the building industry. Bike retailers have not increased overall prices but they are not discounting heavily.”

On the luxury resort front Mr Turner said his Spicers Retreats, which dominate the luxury accommodation end of the eastern seaboard, had experienced some inflation.

“That is due to the fact that demand has increased,” he said.

Wagners chairman Denis Wagner said concrete supply was stretched in the Brisbane and Toowoomba markets, although this was yet to flow through to prices.

He added the lead up to the 2032 Olympic Games in Brisbane meant “10 years of prosperity” for construction materials as new infrastructure was built.

David Harrison, chief executive of commercial property major Charter Hall, argued that inflation was more likely to be transitory rather than a structural cycle of rising inflation.

He cited both rising technology use as reducing costs and the reluctance of central banks to lift interest rates.

“Over the last 20 years the rate of growth of technology has driven productivity improvements, and has been effectively deflationary. That’s not going away,” Mr Harrison said

Mr Banducci said there were lots of conversations with supermarket suppliers around the increase cost of shipping.

“We are seeing material price increases from suppliers … there are more this year and some of the logic to it is relatively compelling with freight costs

“We agree to about 50c in every dollar that is asked for, that’s probably slightly higher this year and the overall quantity is higher so we continue to work through those”.

Capital Economics Australia and New Zealand economist Ben Udy said although the increase in underlying inflation would keep pressure on the RBA to taper asset purchases, a lift in interest rates would require a continual increase in the price of goods and services.

“Trimmed mean inflation has now risen above the lower end of the bank’s 2-3 per cent target band two years earlier than the bank was forecasting,” he said.

“The RBA will still need wage growth to rise above 3 per cent in order to be convinced that the rise in underlying inflation is lasting and that interest rates can be lifted. But the strength in prices supports our view that the bank will continue tapering its asset purchases from February next year.”

Russel Chesler, head of investments and capital markets at VanEck, said the data indicated inflation would be an ongoing problem and require multiple interest rate hikes to contain.

Michelle Marquardt, head of prices statistics at the ABS, said the most significant price increases in the quarter were new dwellings, up 3.3 per cent, and petrol, up 7.1 per cent.

“Construction input costs such as timber increased due to supply disruptions and shortages,” Ms Marquardt said. “Combined with high levels of building activity, this saw price increases passed through to consumers.”

She added that petrol’s recent gain meant fuel prices had risen 36 per cent since their pandemic low in mid-2020.

Disruptions to supply chains continued to increase prices, with furniture up 3.8 per cent and cars lifting 1.4 per cent.

But there was a noticeable drop in clothing prices, which fell 5.5 per cent as retailers slashed prices to move excess winter stock that couldn’t be sold amid lockdowns in Australia’s east.

Additional reporting: Lisa Allen and Glen Norris

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout