Port delays crippling economy: ACCC

The competition regulator has warned that economic recovery could be derailed and inflation driven higher by a supply chain squeeze hitting the nation’s ports.

The competition regulator has warned Australia’s economic recovery from the Covid-19 pandemic could be derailed and inflation driven higher by a supply chain squeeze hitting the nation’s ports that is creating a nightmare for business.

The Australian Competition and Consumer Commission’s latest container stevedoring monitoring report released Thursday lifted the lid on stretched supply chains that touch almost every part of the national economy, and especially retailers, importers and exporters.

While global transport lines remain fragile, when ships finally arrive at major ports such as Sydney, Brisbane or Melbourne they are met with some of the most inefficient and slowest stevedoring operators in the world that imposes further costs to business and the wider Australian economy, the report found.

Indeed, congestion at Port Botany has become so bad – with idle times for ships almost doubling in the last year – that some shipping lines are skipping the port entirely.

At the same time, Australia’s largest container ports, Melbourne and Sydney, are ranked in the bottom 15 per cent and 10 per cent respectively, of 351 global ports, the ACCC said.

ACCC chairman Rod Sims pointed to a delay on the Fremantle docks that saw the delivery of 44 combine harvesters delayed just as farmers were heading into harvesting.

“So, if you are one of the people in WA that needed the combine harvesters … that just means you can’t harvest your crops and it’s difficult for the entire economy and in some cases disastrous for elements of the economy.”

Such is the havoc across the supply chain flowing from Covid-19 and industrial disputes, characterised by delays, higher shipping costs, a shortage of shipping containers and strikes, that a number of Australian businesses are now struggling to meet their contractual obligations.

Anthony Scali, the chief executive of ASX-listed furniture retailer Nick Scali, has testified to choke points across the supply chain with his orders facing considerable delays for customers. Mr Scali also labelled the prices being charged by shipping and freight providers as “extortionate” but that there was nothing business could do to remedy the dire situation.

“You have a freight contract at a certain rate and they aren’t being honoured and they don’t even want to engage to talk about rates it is just week by week, and delays is the other problem with extensive delays,” Mr Scali told The Australian.

“Delays depends on strikes and apparently there are more (waterfront) strikes planned for November which will make it worse. There are delays from the ports, getting goods off the wharf but the biggest problem is the extortion of freight rates and that is the real threat to the economy because you are going from $1000 to $7000 to $10,000 for a shipping container.”

The ACCC has discovered that some of the nation’s largest retailers have become so desperate to grab hold of shipping containers that remain in short supply they have resorted to buying their own containers and chartering their own vessels to transport cargo.

With margins squeezed and freight rates rocketing as much as four fold through the pandemic, the ACCC warned a number of retailers had informed it that they have begun to pass on the higher charges to consumers and that this price hike cycle had not yet peaked – feeding inflationary pressures through the Australian economy.

“The margins of Australian importers and exporters are being squeezed, as they are all around the world, and the current situation is very challenging for businesses that rely on container freight,” Mr Sims said.

“International shipping line movements normally run lean and just-in-time, but a surge in demand and Covid-19 outbreaks that have forced numerous port operations to temporarily shut down have caused congestion and delays with a cascading effect across the globe,” said Mr Sims.

“We are really now at ‘peak worse’. Just as we are recovering and opening up, Victoria and New South Wales, and you get this big problem of a surge in demand for goods and then a cascading effect and because the system is so finely tuned the cascading just continues and gets worse and worse.”

The ACCC stevedoring report showed that freight rates on key global trade routes are currently about seven times higher than they were just over a year ago. However, even at these rates, shipping lines cannot guarantee on-time delivery.

Mr Sims took the extraordinary step of advising people order their Christmas gifts early to ensure they arrive on time due to ongoing shipping, supply chain and port delays.

“If you want to do one thing to improve the efficiency of the economy then have an efficient freight system … the vast bulk of what Australians consume in terms of goods is imported, it will cost you more to buy the things you are buying and you may not be able to get what you want when you are used to getting it, you may find your Christmas present doesn’t turn up when you want.

“Frankly it is a good idea to buy early.”

Mr Sims said shipping line schedules that worked like clockwork are now out of sync.

Shipping lines have deployed all their fleet but are unable to fully utilise their capacity as vessels are either trapped for long periods of time in port waiting queues or choose to skip ports altogether.

There is an abundance of empty containers, but they are stuck in the wrong places, the ACCC report found.

The ACCC discovered that shipping lines are finding it easier to build new containers rather than to evacuate the existing ones while a number of exporters are struggling to meet their contractual obligations, and some smaller exporters are being squeezed out altogether.

“Many exporters are unable to pass on their increasing costs in full due to their participation in competitive global markets. Some domestic retailers have begun to pass on the higher charges to Australian consumers.” the report said.

Such is the concern within the supermarkets industry that a task force involving the leading supermarket chains such as Woolworths, Coles, Aldi and Metcash as well as the Australian Food and Grocery Council representing suppliers and pallet owners Brambles and Loscam has been formed to address the issue.

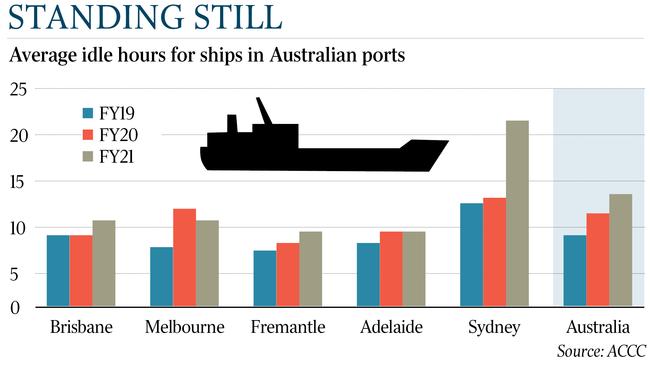

The ACCC stevedoring report also looked at how systemic industrial relations issues and restrictive work practices had further disrupted the supply chain and exacerbated congestion and delays. Data obtained by the ACCC shows average idle hours, which is the length of time a ship spends in berth, at Port Botany increased from 11.9 hours pre-pandemic to 21.2 hours in 2020-21.

“Industrial action on top of pre-existing congestion has unfortunately put enormous strain on our international container ports at a time when they can least cope with it, and in the case of Port Botany, some shipping lines have decided the delays make using the port commercially unviable,” Mr Sims said.

“The long-running labour issues in the container stevedoring industry have resulted in lower productivity and higher costs for Australian cargo owners,” Mr Sims said.

To help alleviate rising costs and improve productivity as well as competition the ACCC is now calling for the government to repeal Part X of the Competition and Consumer Act 2010. Part X permits shipping lines to collaborate on prices, capacity and schedules, among other things, which would otherwise be considered as anti-competitive conduct.

Mr Sims said most other nations in the world had repealed this permit for shipping lines to collaborate with Australia one of the last jurisdictions to still allow the practice.

“There does not appear to be evidence of shipping lines charging excessive freight rates before the pandemic. However, the shipping industry has become more concentrated over the past decade, so there is a growing risk that shipping lines could use Part X to artificially elevate freight rates in the future.

“The ACCC is proposing to develop a class exemption, in place of Part X, which would allow for a more limited form of collaboration that would likely be in the public interest.”