CBA’s Matt Comyn: Economy faces ‘difficult period’ with low rates

Financial institutions face ‘real pressure’ in an unprecedented economic environment, according to CBA chief Matt Comyn.

Financial institutions face “real pressure” in an unprecedented economic environment where interest rates will stay at rock bottom for an extended period, according to Commonwealth Bank chief Matt Comyn.

“The Australian economy will go through a difficult period,” Mr Comyn told The Australian.

“But the range of actions taken by the Reserve Bank, and the steps of the government, are going to settle markets over a period of time.”

RBA governor Philip Lowe said on Thursday the central bank would do “whatever is necessary” to help the nation navigate a deeply challenging period. Among the measures announced by the central bank, apart from a 25-basis-point cut in the cash rate to 0.25 per cent, was a $90bn, three-year funding facility for the nation’s banks at a fixed rate of 0.25 per cent — significantly below their current cost of funds.

Lenders will be able to obtain initial funding of up to 3 per cent of their loan portfolios, with provision for more if they increase lending to the business sector, particularly small to medium-sized enterprises.

The prudential regulator also came to the party with relief from strict, “unquestionably strong” capital rules, and the Morrison government developed a complementary funding program for the non-bank sector, small lenders and the securitisation market, to be implemented by the Australian Office of Financial Management.

Australian Prudential Regulation Authority chairman Wayne Byres said the banks might need to use some of the $235bn in common-equity tier-one capital buffers to facilitate more lending, particularly if they wanted to use the new RBA facility.

If banks were able to demonstrate that they could continue to meet their various capital requirements, Mr Byres said APRA would not be concerned if additional benchmarks announced in 2016 were not met in the period of disruption caused by the coronavirus.

“APRA has been pursuing a program to build up the financial strength of the system for many years, when banks had the capacity to do so,” he said.

“As a result, the Australian banking system is well-capitalised by both historical and international standards.

“Even if the banking system utilises some of its current large buffers, it will still be operating comfortably above minimum regulatory requirements.”

Senior bankers, including Mr Comyn, welcomed the package of measures.

However, an extended period of low interest rates will devour bank profits.

Jefferies analyst Brian Johnson predicted in a note that profitability would be “savaged”.

Declining yields on hedging portfolios would be a major hit to earnings, and more deposits would become insensitive to rate reductions.

Major-bank share prices slumped further on Thursday, shedding 5-10 per cent of their value.

Commonwealth Bank lost 4.7 per cent to $60.95 while Westpac fell 8.6 per cent to $14.53. NAB shed 9 per cent to $14.57 and ANZ tumbled 9.8 per cent to $15.

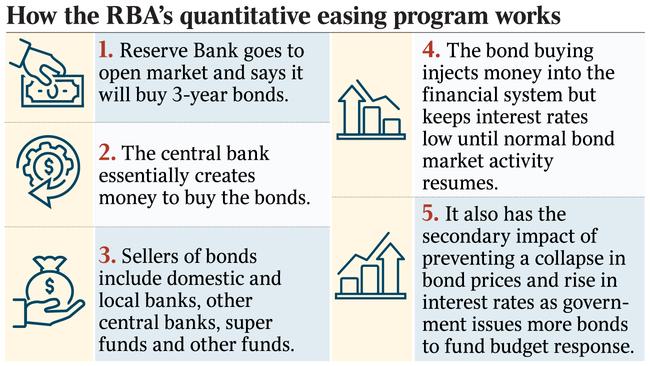

While bond yields have slumped to a historic low, Dr Lowe said on Thursday the functioning of major government bond markets was now impaired.

This had disrupted other markets because of the role of government bonds as important financial benchmarks, with funding markets only open for the highest quality borrowers. The RBA will kick off a program of quantitative easing, or the purchase of government securities in the secondary market, on Friday, targeting a 0.25 per cent yield on three-year government paper.

Dr Lowe said the RBA’s funding facility would complement the yield target by slashing funding costs for the entire banking system, cutting the cost of credit to households and businesses.

The second objective was to establish an incentive for lenders to offer credit to the SME sector.

“This is a priority area for us,” Dr Lowe said. “Many small businesses are going to find the coming months very difficult as their sales dry up and they support their staff.

“Assisting small businesses through this period will help us make that bridge to the other side when the recovery takes place.

“If Australia has lost lots of otherwise viable businesses through this period, making that recovery will be harder and we will all pay the price for that.”

Under the scheme, banks will be able to draw on the facility until the end of September.

For every extra dollar lent to large businesses, lenders will have access to an additional dollar of funding from the Reserve Bank, or $5 in the case of SMEs, until the end of March next year. These funds can be drawn upon up until the end of March next year, but institutions accessing the scheme will have to provide the usual collateral to the RBA, with haircuts applying. The first drawdowns will be possible within a month.

Mr Comyn said CBA was “extremely focused” on SMEs, which were experiencing difficult trading conditions.

The bank, he said, strongly supported the RBA’s term funding facility, and would participate in the scheme to “the fullest extent possible” so it could access long-term funding at cheap rates.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout