In what is clearly a crisis-era trade-off, Commonwealth Bank did not put through the 0.25 per cent official reduction in rates on its standard variable home loans, rather it announced a reduction in one-, two- and three-year fixed rates to the same number of 2.29 per cent. (The rates had been close to 3 per cent).

In a move that will offer a real surprise to older Australians, the bank also threw in a completely unexpected lift of 60 basis points in one-year term deposits to 1.7 per cent.

The upward move on cash deposits is likely to be copied by other banks with some variations in the next few days.

Behind the scenes, banks will want to bring in as much in deposits as they can in the months ahead to balance strong demand for urgent credit from business at all levels.

Leading the pack in deposit collection is a smart move by CBA and even smarter if by the end of the one-year term commercial rates have moved higher.

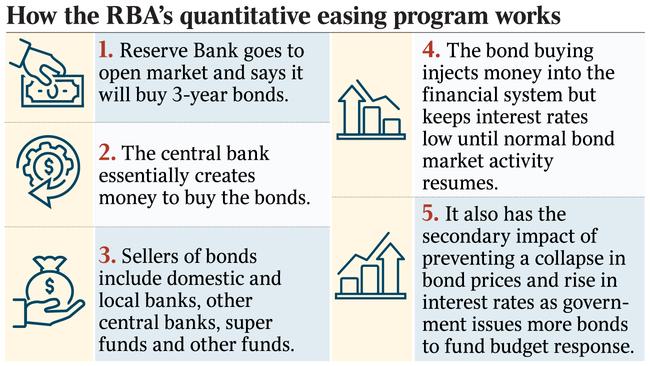

For consumers, the crisis puts highly attractive fixed rates into the market which are low by historic standards, but not unknown in market’s more familiar with so called quantitative easing (QE) strategies such as in mainland Europe, where fixed rates are under 2 per cent.

Should home loan borrowers fix? Financial advisers invariably suggest that investors should not fix in an effort to “beat the bank”, hoping variable rates will be higher than the fixed rate over the course of the fixed term loan.

Instead advisers suggest you should fix if you want the security of knowing how much repayments will be each year.

Many advisers also suggest a consistent fixed mortgage approach, as rolling over into fixed arrangements continually over the life of a home loan smooths out financing costs in the long term.

One alternative approach is to split the mortgage repayment requirement - making one portion of the borrowings fixed and one portion variable. This allows borrowers who unexpectedly find themselves able to pay more back than they had anticipated to do so without incurring the break fee costs of fixed-term loans. However, the arrangement also means you have two loans on a single property.

Paradoxically, fixing is less popular when rates are low.

Investors and home buyers know the deals are attractive, but they don’t have the confidence to make a long-term commitment.

Steve Mickenbecker at the Canstar research group said: “When you see fixed rates close to 2 per cent it is probably a good deal, but that does not mean it will be flooded with offers.”

As the economy softened and official rates dropped lower in recent years, the flows into fixed dropped off from around 15 per cent of all loans in the banking system, to closer to 12 per cent.

Among the big four banks the portion in fixed is invariably higher.

Melanie Kirk of Commonwealth Bank investor relations says: “Just now, inside the bank, we have about 81 per cent variable and 19 per cent fixed and I expect those flows will change with the new pricing.”

The immediate outcome of the Reserve Bank’s historic market intervention is that big bank mortgage rates - fixed only - are going down and cash deposit rates are going up.