But its move is a sign the banking system — so roundly criticised by politicians over the past few years who have taken its strength for granted — will be prioritising customers over shareholders in a bid to help cushion the potential impact on business of the coming economic crisis.

CBA’s moves that chief executive Matt Comyn announced on Thursday were, as he said, “unprecedented” in “unprecedented times”. They also include a 70-basis-point cut in one, two and three-year fixed income loan rates for owner-occupiers paying principle and interest (aimed at relieving the pressure on homebuyers) and a 60-basis-point increase in the 12-month term deposit rate to 1.7 per cent (aimed at providing some support for battered savers).

The changes to home loan repayments, Comyn said, would release up to $3.6bn in cash for households. In the short term, CBA’s move will mean shareholders’ interests will potentially take a back seat as part of an emergency rescue package that is being mobilised. But in the longer term the bank’s announcements are also in its shareholders’ interests as they reduce potential bad debts from its customers by giving them breathing space.

Effective emergency measures to rescue the economy — or cushion the potential recession — are now, rightly, the name of the game. Saving the economy is more important than short-term bank profits and dividends.

Friday will see how much the other big banks are prepared to follow suit, but CBA’s bold move has put them all under pressure to move in a similar direction, no matter what short-term pain it may cause for their profits.

Thursday was a day of extraordinary measures from the federal government and Reserve Bank — measures needed to cope with extraordinary times.

The message from Thursday’s developments is that the Reserve Bank is prepared to do whatever it takes to keep businesses afloat or, perhaps more accurately, reduce the number going to the wall, by working closely with the banks to help keep credit lines open.

Yes, the bank cut its cash rate to another record low of 25 basis points, and signalled that the rate would continue for the foreseeable future.

But as the RBA has realised for some time, just lowering the cash rate has a limited positive impact on the broader economy — “pushing on a string” is the official term — other than to continue to stimulate already high house prices.

The real importance of what was announced by the RBA was less about the price of credit and more about opening the funding spigot to the banks to keep lending to businesses — big and small. The RBA announced plans for at least $90bn in funding for the banks to lend to business customers, with an emphasis on small and medium-sized companies.

Banks will be able to borrow an amount equal to 3 per cent of their existing outstanding credit to Australian businesses and households from the RBA, with access available until the end of September.

Lenders will also be able to borrow additional funds from the bank if they increase their lending to businesses — with the RBA giving them a dollar of funding for every extra dollar lent and an extraordinary $5 for every extra dollar of lending to small and medium-sized companies.

The move was backed up by the announcement from the Australian Prudential Regulation Authority that they would be allowed to dip into some of their capital to make it easier for them to take advantage of the RBA’s new funding.

The sophisticated range of measures announced by the RBA is a testament to the bank under governor Philip Lowe. It has been clear for months the RBA has been bracing itself for a potential downturn in the economy and how best to respond with new forms of monetary policy in an era of already record low interest rates.

While no one saw this coronavirus crisis coming, Lowe has been preparing the central bank over the past few months for a suite of measures to stimulate the economy beyond cutting the cash rate.

He outlined some of his thinking in a speech on unconventional monetary policy in November at a time when the Morrison government was still insisting on delivering a budget surplus.

There was widespread relief yesterday that the government and Reserve Bank are finally on the same page, facing the crisis together, with their similar messaging of government providing a “bridge” to get the economy over the economic chasm of the next few months.

The months of apparent behind-the-scenes tension between the government and RBA has been replaced by much-needed team work.

Lowe was at pains to explain why the RBA had taken a different and potentially more accommodating stance than the Bank of England.

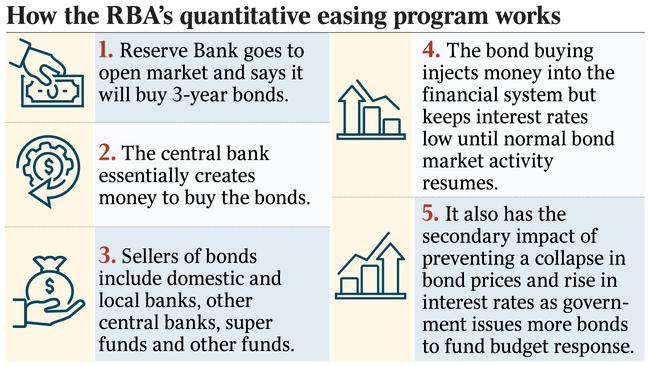

He was also at pains to distinguish what the RBA was announcing from “quantitative easing”.

Lowe argued there was no quantitative aspect to what the bank was doing. “Our emphasis is not on the quantities,” he said.

“We are not setting objectives for the quantity and timing of the bonds that we will buy.”

Commonwealth Bank’s move to slash its lending rate to small businesses by 100 basis points — four times the cut in the Reserve Bank’s cash rate — took other banks by surprise on Thursday.