Canberra needs to tell Beijing that more trade hits will force its hand on iron ore

And according to reports in the South China Morning Post, wool is being considered as the next target. What Chinese in Beijing don’t realise is that anti-China anger in Australia is now reaching fever point. We don’t like being taken for patsies. If the Chinese attack wool then the community pressure on the Australian Government to respond, and respond hard, will be immense.

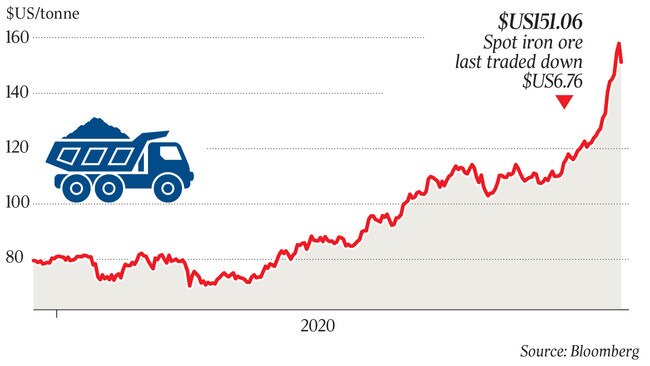

The community will demand that we explain to the Chinese government that if they attack wool then the days of having iron ore prices below $US200 a tonne will be well and truly over.

I want to emphasise that I would hope that such a step is not made necessary. But we need to prepare for it.

Regional context

Before looking at how such a preparation might unfold I want to put our trade war with China in the context of what’s happening in our region and around the world.

A new world order is emerging and Australia finds itself deeply involved in the repercussions. The most obvious manifestation of this new world order is the rise in Asian currencies, led by China, Taiwan and South Korea. And despite our China trade war, the Australian currency has joined the ranks of those rising Asian currencies. At the same time, the euro has also been firming.

America is still the financial capital of the world and in that position is able to attract vast amounts of money to fund its deficit and government spending. That will not stop in the short to medium term.

But the political instability in the US and the possibility of massive additional spending by the Biden regime is causing global money to seek non-American homes.

China’s yuan market is nowhere near being able it to replace the US dollar. But it’s clearly moving in that direction and major capital raisings are taking pace in China, including in Hong Kong. The lower American currency will boost the American economy until it starts to boost interest rates. Watch the 10 year US bond rate as a signal that this is emerging as a threat.

Last week trades took place in short-term Australian bonds giving them a negative interest rates as global traders were prepared to accept a loss on bonds in exchange for exposure to the Australian dollar.

The Australian dollar was in part depressed because the world believed that it would take China along time to recover from COVID -19 and that would affect our exports, particularly iron ore.

Instead, China has performed brilliantly and is developing large trade surpluses which are being reflected in the iron ore price. As I pointed out last week, iron ore revenue is swamping the impact of the Chinese attack on our agricultural exports.

Former Resources Minister and current Deputy Leader of the Nationals in the Senate, Matt Canavan, has his ear to the ground, at least in Queensland. He has broken ranks with the government and demanded that Beijing should “pay a price” and for its trade bans. Canavan says Australia should impose a levy on iron ore exports to China. Canavan’s replacement Resources Minister Keith Pitt (another Queenslander) quickly scotched the idea.

Pressure on prices

But it is now time to quietly tell China that it if it keeps this up then we will have no choice but to succumb to public pressure and retaliate. And the only retaliation we have is to put the iron ore price above $US200 a tonne either via and export levy or some other measure.

Part of our problem is that there’s no real contact between Canberra and Beijing and, for all his brilliant work in China, Andrew Forrest of iron ore miner Fortescue is not really the best person to convey that message. Terrible as it might seem in Canberra, if we have no way of telling Beijing what’s happening Down Under, then we may need to ask the Victorian government, which has better connections with China, to pass on the message that if China attacks wool then that will set alight anti-Chinese feeling in Australia that no government can afford to ignore. Maybe we could wave the carrot of lower iron ore prices as a peace offering. But given iron ore prices are set by the market that’s not easy. If the trade war public outrage forces us to respond we of course will see our bottom line hit.

But Chinese foreign ministry spokesman Zhao Lijian has become the living image of anti-Chinese feeling in Australia. We have a wonderful population of Chinese people in Australia and we welcome their students and tourists. We made errors that contributed to this situation but the issue has gone far beyond that now, sadly. Regaining respect may require a response that makes the Chinese take notice. But first we must warn them.

China is having a ball by hitting out hard at what it regards as an incompetent government in Canberra. There is no respect for Australia and, as a result, Beijing is now looking around for other areas where it can have some fun.