China chastens BHP, Rio over ‘failed pricing’ on iron ore

Australia’s two biggest iron ore producers have been called in for a dressing down by China’s peak steel industry body.

Australia’s two biggest iron ore producers have been called in for a dressing down by China’s peak steel industry body amid rising concerns China’s action against Australian metallurgical coal producers is combining with high iron ore prices to damage Chinese industry.

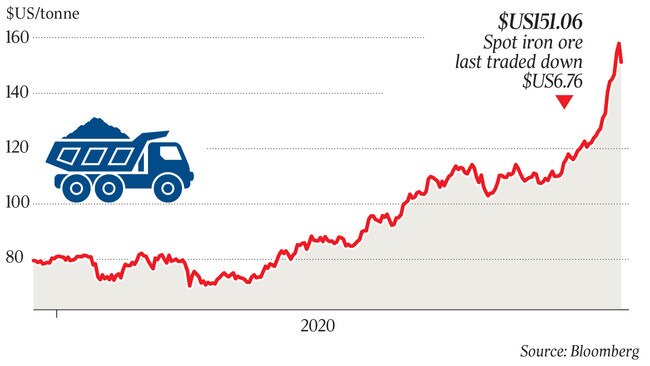

Marketing executives from BHP were last week questioned in a video call by China Iron and Steel Association representatives about this month’s iron ore spike that has sent prices above $US160 a tonne, after the Pilbara Ports Authority released data showing exports through Port Hedland had softened 13 per cent in November.

CISA issued a statement after a meeting of its own members the same day, saying the “iron ore pricing mechanism had failed” and its members were calling on Chinese regulators at the State Administration of Market Supervision and the China Securities Regulatory Commission to investigate recent iron ore prices and “severely crack down on possible violations of laws and regulations”.

On Monday BHP confirmed it had met with CISA representatives to discuss the iron ore price, but would not disclose details, saying only it was “in constant contact with our iron ore customers and doing all it can in this challenging year to maximise iron ore production”. It is understood Rio Tinto marketing executives have also been called into a meeting with CISA this week, with the price of iron ore at the top of the agenda.

One industry source familiar with the situation, who asked not to be identified because of the political sensitivities involved, told The Australian all iron ore producers were likely to face similar meetings, but it is understood Fortescue Metals Group has so far been exempt from questioning by China’s peak steel industry body.

Fortescue chief executive Elizabeth Gaines said the company had a “strong and positive relationship with the China Iron and Steel Association (CISA) which includes regular meetings and ongoing communication on matters of mutual interest”.

While the meetings are believed to have been called in the wake of the dip in Pilbara output in November, the cause of this month’s iron ore spike is the latest output downgrade from Brazilian major Vale, which cut 2020 output guidance in early December, and flagged a slower-than-expected ramp-up of its operations in 2021.

Vale’s latest downgrade forced benchmark prices for iron ore upwards again, and coincided with November’s slowdown in Pilbara output — the result of regularly scheduled routine maintenance ahead of Australia’s cyclone season, which kicked off in earnest on the weekend as severe weather forced a brief shutdown of iron ore ports in the Pilbara.

Benchmark iron ore prices briefly topped $US160 a tonne late last week, but iron ore futures dropped sharply on Monday in response to CISA’s public threats to involve Chinese regulators.

Iron ore contracts traded on the Singapore exchange touched $US159 a tonne in early trading but dropped sharply on news of CISA’s threat to call in regulators, tumbling as low as $US150.71 through the day.

But while it had an immediate impact on speculative trading, the jawboning from China’s peak steel industry body is a regular occurrence at times of rising iron ore prices over recent years and has not so far had any impact on fundamental market dynamics.

CISA’s latest threats come as Chinese steelmakers face cost pressures as China’s ban on Australian metallurgical coal bites into their margins.

While Australian metallurgical coal producers are being hit hard as prices in other markets tumble, Chinese mills are believed to be paying more than $US180 a tonne for premium grade coking coal from other sources, more than $US80 a tonne more than Australian coal is fetching.

CISA’s public appeal to China’s regulators may also be the result of concerns among policymakers that higher steel prices may start to impact the nation’s construction sector, as well as making Chinese mills uncompetitive against international rivals.

CISA made similar accusations that Australian miners and market traders active on the Dalian exchange were manipulating the price of iron ore in July 2019, when iron ore prices crept above $US125 a tonne in the wake of Vale’s tailings dam collapses that curtailed Brazilian supply earlier that year.

China’s peak steel body cast similar aspersions in 2011, when it called for the establishment of strategic government reserves of the commodity as prices hit $US180 a tonne, and in early 2013 when prices recovered strongly to top $US120 a tonne after a savage fall to near $US80 a tonne the previous September.

It warned of speculative trading in the commodity in August 2017 as prices again rose from multi-year lows, calling for regulatory intervention to curtail speculation on iron ore futures exchanges in China.

CISA’s intervention immediately forced changes to key futures markets in China aimed at curbing speculative trading in futures contracts.

On Monday China’s Dalian Commodity Exchange scrapped a 50 per cent transaction fee reduction for iron ore futures contracts, effective from the night session.

The Zhengzhou Commodity Exchange said it would significantly increase transaction fees for some thermal coal futures contracts, as well as increasing the trading margin required. It is also set to lift its daily price limit from 4 per cent to 5 per cent. Amid the adjustments, Zhengzhou‘s thermal future contract fell over 4 per cent before triggering a trading halt on Monday.

Industry sources say that, while CISA’s latest intervention may force a small drop in the prices of futures contracts in the near term, and possibly even a short-term fall in benchmark prices, the slow pace of recovery of Vale’s production in Brazil, and the looming cyclone season in the Pilbara, are likely to continue to support the price of the steelmaking commodity.

CBA resources analyst Vivek Dhar said the demand for iron ore had grown as China powered its economy out of the coronavirus crisis.

“Obviously when you have such a sharp increase you want to know why — but there’s actually a rationale behind it. It’s because the market is caught short,” he said.

“Demand has been rising post-COVID. China has put in that policy where they want to backstop growth but they were concerned COVID was going to weigh on the economy.

“So they put in an infrastructure package which was very notable.”

additional reporting: Perry Williams

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout