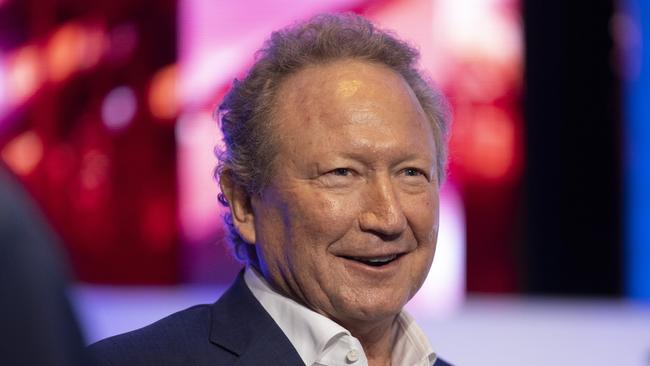

Analysts at Shaw and Partners are following Mincor’s lead and advising shareholders to accept the $752m buyout proposal on the table from the interests of billionaire and Fortescue Metals chairman Andrew Forrest.

Mincor, which released its target statement on Tuesday, said shareholders should accept the $1.40 per share offer that landed on March 21 from Dr Forrest’s Wyloo in the absence of a superior proposal.

This was after the revelation that Mincor was delivering ore in to its offtake with BHP which was not in specification to the agreed offtake terms due to higher arsenic levels.

Shaw had a $1.80 a share price target on the stock, and said it continued to see the bid as undervaluing Mincor’s long-term potential.

But the analysts said they followed suit and advised shareholders to sell into the offer.

The offer was a 35 per cent premium to the previously traded share price and has been declared Wyloo’s best and final offer, should no rival bid emerge.

Wyloo currently holds 23.24 per cent of the shares.

Mincor’s share price has halved over the past year on a lower nickel price and as the speed of ramp-up in re-establishing production in the Kambalda region of Western Australia has fallen behind expectations.

The company has highlighted risks in not accepting the offer, such as the speed of operational ramp-up, BHP’s refusal to guarantee future receipt of off-spec material and uncertainty regarding future exploration results.

Mincor was leveraged to future production and exploration success, said Shaw.

“Nevertheless, we see little alternative for shareholders other than accepting the offer following board acceptance.”

The offer closes on May 8.

New information in Mincor’s target statement on Tuesday included more than 40,000 tonnes of ore were mined by Mincor in March, a substantial uplift on the prior quarter’s production rate, and that Mincor had cash $59.2m at the end of March, down from $85.1m at the end of December.

Also, the offtake agreement between BHP and Mincor for its nickel mined in the Kambalda district in Western Australia contains a change of control clause that would be triggered if a third party such as Wyloo got to 50 per cent or more of Mincor, but only if Mincor is not listed on an official stock exchange at the time.

Shaw analysts said the price of nickel, a key component used in the manufacturer of lithium batteries to make electric cars, was volatile and was often driven by arbitrary policy changes such as the Indonesian export ban.

As such, the price of nickel was relatively difficult to forecast.

Mincor’s nickel production in Kambalda is strategically important to BHP, as it needs Mincor’s concentrate to blend with its own product, Shaw said.

BHP has signed a processing and offtake agreement for all of Mincor’s output to December 2025 which significantly de-risks the project.

Elsewhere, Macquarie analysts say that the amount of gold St Barbara produced in the third quarter of the financial year from its Leonora operation was 18 per cent below its estimate.

The company is in a trading halt to recut its merger deal with Genesis Minerals as a result and redraft its fiscal 2023 forecast production guidance.

It comes amid a flurry of merger and acquisition activity in the base metals sector, with Teck Resources rejecting a $US23bn buyout by Glencore, despite it being a 20 per cent premium, and Sibanye-Stillwater buying New Century Resources.