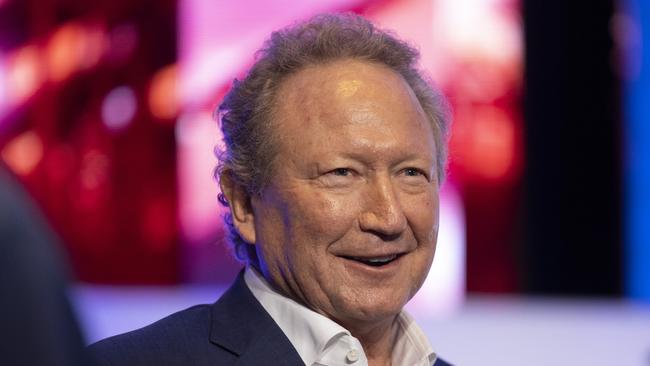

Andrew Forrest poised to win Mincor control after its board tells shareholders to accept Wyloo Metals offer.

Mincor’s board has recommended shareholders fold in to Andrew Forrest’s $760m play for the nickel producer.

Mincor Resources’ board has recommended shareholders fold in to Andrew Forrest’s $760m play for the nickel producer, conceding the company’s struggles to bring its mine online make shareholders vulnerable to “significant risk” if they do not accept the $1.40 a share cash bid.

Mincor confirmed last week it was in dispute with BHP, which buys ore from the WA miner for its Kambalda concentrator, over the quality of the product it was delivering to the mining major’s Nickel West division.

With BHP threatening to reject deliveries that do not meet its specifications – particularly in regard to nickel and arsenic content in the ore – Mincor chairman Brett Lambert told shareholders on Tuesday the company was at risk of having its debts called in if shipments were rejected.

“We have confidence in the ability of the Mincor team to successfully address challenges over the long term. However, the offer has been presented, and needs to be considered, at a point in time when there is a lack of certainty,” he said.

“During the ramp up period, Mincor has delivered and BHP has accepted off-specification product. BHP recently advised that it is unable to amend the agreed specifications to guarantee the future acceptance of 100 per cent of mined ore. This places Mincor’s cash flow and its ability to repay debts as they fall due at risk as they are dependent on its ability to sell all of its ore.”

Dr Forrest’s Wyloo Metals extended its Mincor holding to 23.2 per cent on Tuesday, after on-market buying at the $1.40 offer price, and said on Monday – in the wake of Mincor’s revelations about its BHP dispute – the price was its “best and final” offer.

Mincor’s board unanimously recommended shareholders accept the offer on Tuesday saying that, although they had discussions with a number of other companies “regarding potential interest in submitting an alternative proposal”, no superior bids had been put on the table.

“Furthermore, while a superior proposal cannot be ruled out, Wyloo has a disclosed Voting Power of 23.24 per cent in Mincor as at the last practicable date, meaning Wyloo has the ability to block compulsory acquisition under any competing takeover bid and its shareholding will likely be determinative of any vote on a competing scheme of arrangement,” Mincor told shareholders.

“The Mincor board believes this reduces the likelihood of a superior proposal emerging.”

Mincor booked a $54.7m loss for the fist half of the year, and said it finished March with a consolidated cash balance of $59.2m and debt of $27.5m in secured debt to BNP Paribas.

Mincor shares closed at $1.40 on Tuesday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout