Billions of dollars’ worth of telecommunications towers will be the focus of dealmakers in the year ahead, with Telstra hiring Macquarie Capital for the selldown of its tower portfolio.

The appointment was anticipated, with DataRoom flagging in November last year that Macquarie was well placed to win the role.

DataRoom understands the sales process will launch into action in August, with a conclusion likely by the end of the year. This will be after Singtel’s Optus is scheduled to begin the sales process of a stake in its Australian telco tower portfolio, thought to be worth about $2bn.

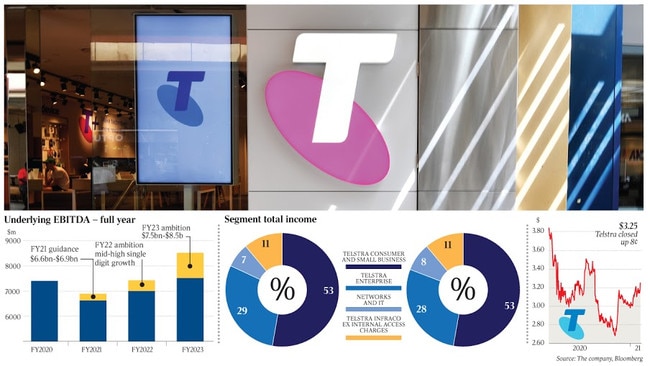

Telstra announced last November it would split the company into three divisions by this year: InfraCo, InfraCo Towers, which included its mobile tower assets, and ServeCo, comprising products and services.

Telstra used Macquarie Capital and JPMorgan in 2017 when it explored a possible securitisation and demerger of its long-term NBN contract.

Macquarie has strong expertise in infrastructure and access to several global investors.

Telstra InfraCo was established in 2018 as a stand-alone business unit, which offered the flexibility to monetise different asset groups.

Telstra said it would look to monetise its mobile tower assets, which generated $163m of operating profit for the six months to December, over time given the strong demand and compelling valuations for what was high-quality infrastructure. A potential sale of the mobile towers was flagged by DataRoom in 2019 as likely to be on the cards to raise more capital. This was as Telstra looked to raise up to $2bn through divestments to strengthen its balance sheet.

Telstra prides itself on having the country’s largest and fastest network based on national average combined mobile speeds, and the value of its towers largely depends on the structure of any deal, but it is thought it would be worth well over $1bn.

In November Telstra chief executive Andrew Penn signalled that a potential sale of the towers would capitalise on a strong level of interest from infrastructure investors eager to secure opportunities in a low-interest rate environment where few exist.

A delay to the start of the Optus tower process, initially scheduled to begin last year, has some prospective buyers jittery that the company’s Singaporean parent may not proceed. Those close to the situation maintain it is on track. Optus chief executive Kelly Bayer Rosmarin is likely to be thinking hard about strategic initiatives for the business, and no doubt one of the considerations of selling a stake in the company’s Australian towers is timing.

Some say a concern may be that buyers could be keen to pass on the Optus sale, run by Bank of America, and instead focus on the Telstra process. However, DataRoom revealed last year that a long list of candidates would be lining up for the auction.

Should a sale proceed, there is still a lot of unanswered questions about the structure. Despite reaping an initial windfall, a sale and leaseback of assets mean an additional future cost for the company.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout