The sales process for the $2bn Optus communications towers is about to get under way, with promotional material for the sale set to hit the desks of prospective suitors shortly.

It is understood that flyer documents will be sent out next month before the process starts in earnest in August, with Bank of America working on the transaction.

It is likely to be a strongly fought option, with many players said to be keen to acquire the assets.

However, the question is whether parties will be prepared to pay a price that would be hoped for before the onset of COVID-19, with Optus no doubt unwilling to lower its expectations based on the current economic environment.

Another is if Macquarie Group’s Axicom will be excluded from a competition standpoint from the auction. If it can compete for the asset, it is considered a clear frontrunner.

Axicom was purchased from Crown Castle in 2015 for $2bn.

In recent years, it purchased 56 communications towers from Southern Cross Media, expanding its reach across regional Australia.

Other underbidders from that Crown Castle auction are expected to be in the mix for the Optus offering.

During the Crown Castle sales process, the suitors included AMP Capital, Morrison & Co and infrastructure funds such as Palisade Investment Partners, Canadian private equity giant Brookfield with Digital Bridge Holdings and Providence Equity.

It will be interesting to see if other telcos such as TPG Telecom throw their hat in the ring, although they could be hamstrung by the Australian Competition & Consumer Commission. Canadian pension funds will also surface.

DataRoom revealed in January that a sale of the towers by Optus was up for consideration to fund the rollout of its 5G network.

Now Singaporean parent Singtel appears to be pushing the button on a plan for divestment.

The selloff comes after Optus boss Kelly Bayer Rosmarin described its last financial year as a challenging one.

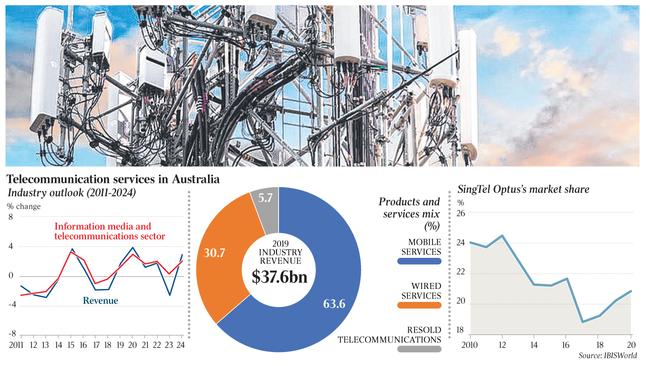

In May, Optus delivered a $402m full-year net profit, down 39 per cent from the previous corresponding period, as more customers opted for SIM-only phone plans and data price competition intensified.

A challenge for the company, among others in the telco space, is that its home internet margins are eroding as it gains more NBN customers, which have low resale margins.

Australian telecoms providers remain under pressure to find ways to fund the rollout of 5G infrastructure.

Late last year, some had earlier wondered whether Telstra would explore options for its mobile phone towers. Optus earlier said it had no plans to sell its satellites, but others have believed for some time that a sale of those was on the cards.

Singtel launched a strategic review of its Optus Satellite business in 2013, and an initial public offering was among the considerations for what then was seen as a $2bn operation.

Intelsat SA and a consortium made up of Blackstone, TPG Capital and Malaysia-based MEASAT Global bid for the assets, and Kohlberg Kravis Roberts and Apollo were also reportedly looking, but walked away due to the high price.

The sale plan was then abandoned.