Fresh from striking a deal to sell a stake in its telephone exchange buildings for $700m, some are wondering whether Telstra will now turn its attention to its mobile phone towers to raise even more capital.

The move to date has been off limits for the country’s largest telco, but it now finds itself needing cash to finance investment, with a goal of raising up to $2bn through divestments to strengthen its balance sheet.

Chief executive Andy Penn has flagged a move to sell off non-core assets as part of a turnaround strategy, and while towers would not be the first choice, there may be few other options for it to raise funds.

Pacnet, the Asian telecoms service provider purchased by Telstra in 2014 for $US697m and now integrated into the business, is one business some believe the group is eager to offload, but buyer interest at a strong price is thought to be limited.

Telstra sold a 49per cent interest in its portfolio of telephone exchange buildings to Charter Hall funds in July and it has also divested data centres to Hutchison Global Communications owner I-Squared Capital, but that only netted the telco $160m.

Investment bank UBS worked on the sale and leaseback of Telstra’s properties, and one wonders whether the Swiss bank is working on the same plan for the towers.

Telstra prides itself on having the country’s largest and fastest network based on national average combined mobile speeds, and the value of its towers largely depends on the structure of any deal, but it is thought it would be worth well over $1bn.

They would likely command a strong level of interest from infrastructure investors eager to secure opportunities in a low-interest rate environment where few exist.

Other asset sales tipped as being on the agenda at Telstra involve its healthcare IT assets and it recently sold its Silicon Valley-based company Ooyala, which it acquired in 2014 for $US270m.

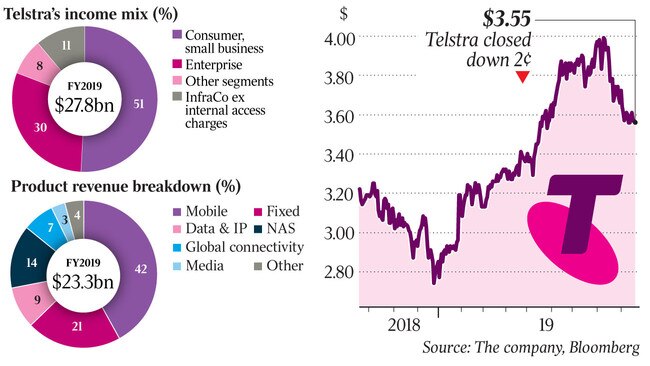

Telstra’s annual net profit for the 2019 financial year fell 40 per cent to $2.1bn, as mobile market improvements offset challenges from the National Broadband Network.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout