Josh Frydenberg urges Australians not to overreact to turmoil on markets

Josh Frydenberg says Australians shouldn’t overreact as he moved to smooth concerns the US-China trade war could hurt retirees.

Josh Frydenberg has urged Australians not to overreact to the turmoil on world markets as he moved to smooth concerns the US-China trade war could hurt Australian retirees and the government’s budget surplus.

The Treasurer said this morning the government was concerned about the US-China trade war but noted that Australia’s superannuation funds were still performing well and the nation was still on track to achieve a surplus.

“We shouldn’t overreact,” the Treasurer told ABC radio.

He comments came as Mr Frydenberg’s Liberal predecessor Peter Costello warned market gyrations could hurt superannuation savings if tensions between Washington and Beijing continue.

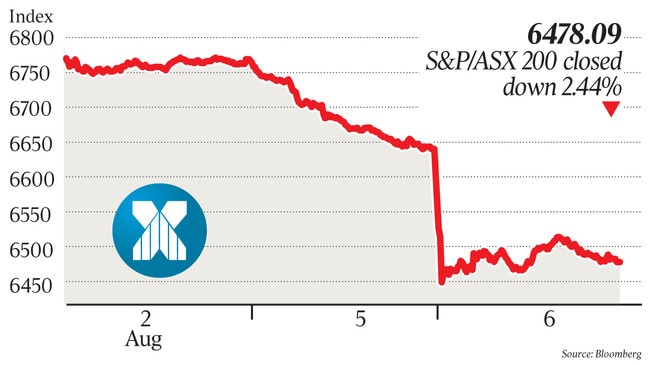

The ASX 200 share index endured the biggest fall in the region yesterday closing down 2.4 per cent — bringing two-day losses to $86 billion.

However world markets recovered overnight with the Dow Jones Industrial Average climbing 312 points or 1.2 per cent, pointing to a potential recovery on Australian markets this morning.

Mr Frydenberg said the government’s policies remained on track. “The Australian government would like cool heads to prevail and we will continue to take the necessary action domestically, including the tax cuts, to ensure the economy continues to grow.

“Superannuation returns have been averaging above five per cent in the last year.

“People who’ve had money in super, money in managed funds, have done much better if they’ve had money in the bank.”

Mr Frydenberg also made clear he intends to deliver the long-promised surplus regardless of the US-China trade war.

“We’ll still deliver a surplus next year. Absolutely determined to do that,” he said.

Opposition Treasury spokesman Jim Chalmers said the Morrison government’s economic management has left Australia “dangerously exposed” by the trade conflict between the United States and China.

“The government should not pretend that all of Australia’s economic challenges are global in nature or imposed on us from outside our shores,” Dr Chalmers said.

“The last three days of stock market volatility does not explain the last few years of weakness in our own domestic economy in Australia and it doesn’t excuse six years of inaction on the economy from this third term Liberal government.

“The Morrison government’s inaction on the economy has left Australia dangerously exposed.

“The Prime Minister and the Treasurer are in denial about our home grown weaknesses and that is why they have absolutely no idea and absolutely no plan to turn the economy around.”

Dr Chalmers said the biggest economic challenges Australia faced were “home grown”.

“Our biggest challenges are slowing growth at home, stagnant wages, high household debt, unemployment and underemployment, slowing employment growth, declining living standards,” he said.

Costello’s warning to retirees as markets hit

Mr Costello warned retirees their savings will be eroded if the trade war between the world’s two largest economies escalates further, as the Reserve Bank yesterday issued further downgrades for growth and jobs.

After the biggest one-day drop in blue-chip stocks in almost a year, the former treasurer and Future Fund chairman urged the US and China to come to the negotiating table for the sake of the global economy, and called on Beijing to speed up efforts to float its exchange rate.

“Unless the parties can sit down and actually sensibly negotiate, I think you are going to have a lot of uncertainty and a lot more gyrations on global markets in the weeks which are ahead,” Mr Costello told The Australian.

“The Chinese currency would be better if it were more flexible; we have argued for a long time that China should move to more of a market system.”

While prices in financial markets last night foreshadowed a modest rebound in equity prices, the benchmark S&P/ASX 200 share index endured the biggest fall in the region yesterday and closed down 2.4 per cent — bringing two-day losses to $86 billion.

“Australian retirees have lost money,” Mr Costello said, adding that it was important not to “overhype two days of trading”. “Superannuation funds have lost money. If this were to continue, this will affect Australian savings and ultimately will affect the budget.”

US President Donald Trump’s move to brand China a “currency manipulator” extended the financial turmoil that has gripped stock markets since Chinese authorities “weaponised” their currency on Monday, depreciating the yuan to the weakest level since the global financial crisis.

Beijing’s competitive currency devaluation was taken following America’s threat of another wave of tariffs to be imposed on $US300bn worth of Chinese imports, due to commence on September 1.

RBA governor Philip Lowe said the “increased uncertainty” generated by the trade and technology disputes was affecting investment and “means that the risks to the global economy remain tilted to the downside”.

Dr Lowe revised down the Reserve Bank’s outlook for growth in 2019, from 2.75 to 2.5 per cent, and backed away from earlier forecasts that the jobless rate, running at 5.2 per cent in June, would fall below 5 per cent in the near term. He said a more realistic timeline was a “couple of years”.

The Reserve Bank board yesterday kept the official cash rate on hold at a record low of 1 per cent, following the back-to-back cuts in June and July. “The board will continue to monitor developments in the labour market closely and ease monetary policy further if needed to support sustainable growth in the economy and the achievement of the inflation target over time,” Dr Lowe said.

Local technology stocks were the hardest hit yesterday following steep falls among China-exposed US tech giants Apple, Microsoft and Alphabet.

Citi economists in Singapore and Hong Kong issued a statement warning “the risk of full-scale trade war is on the rise”.

“We expect the US to raise tariffs on the $300bn from 10 to 25 per cent as soon as next month, which could drag down China’s GDP growth by additional 0.75 percentage points,” the Citi statement said. US Treasury Secretary Steven Mnuchin said America would refer China to the IMF, although Citi warned the action was “largely toothless”.

Senior IG Markets analyst Kyle Rodda said: “It’s definitely panic stations in the market right now. Risk is being cast-off in favour of safety, as investors remain in the ‘sell-now, ask questions later’ mentality.”

China’s Shanghai Composite fell 1.6 per cent; Japan’s Nikkei 225 lost 0.7 per cent; Korea’s KOSPI index lost 1.5 per cent; Taiwan’s TAIEX lost 0.3 per cent; Singapore’s FTSE Straits Times index fell 0.7 per cent and the Hang Seng index also fell 0.7 per cent.

The Australian dollar has fallen steadily from above US70c since the middle of July to US67.5c yesterday, the lowest since the financial crisis.

The weaker exchange rate helped power a record monthly trade surplus of $8bn in June, powered by surging iron ore and coal exports and flatlining imports.

JPMorgan economist Tom Kennedy said: “The string of record monthly trade surpluses reported through the first half of the year means the current account is poised to report the first quarterly surplus since 1975.

“Export shipment volumes from major Australia ports are back at record highs and continue to signal Chinese demand for iron ore and coal is still robust.”

For the June quarter, the trade surplus surged to $19.7bn, a $5.2bn improvement on the March quarter. Westpac economist Andrew Hanlan said: “The key positive was iron ore, which rose further on the spike in global prices following the supply shock in Brazil.”

Over the course of 2019, the RBA has repeatedly downgraded its outlook for growth and inflation, while revising down its assessment for the “neutral” rate of unemployment to 4.5 per cent from 5 per cent earlier this year.

Macquarie Bank senior economist Justin Fabo argued the RBA was likely to reduce the official cash rate again in October and November. “They are almost certain to cut again,” Mr Fabo said. “The implied path for the cash rate has again shifted lower, with the terminal rate now at 0.4 per cent.”

Ahead of the RBA’s quarterly economic statement on Friday, Dr Lowe pointed to a “turnaround” in the Sydney and Melbourne housing markets. “Mortgage rates are at record lows and there is strong competition for borrowers of high credit quality,” he said.