$47bn lost as yuan war looms

Rattled investors wiped another $47 billion off the ASX after the US labelled China a ‘currency manipulator’.

Rattled investors wiped another $47 billion off the Australian sharemarket as global trade tensions stepped up a notch after the US labelled China a “currency manipulator”, an accusation strongly denied by Beijing.

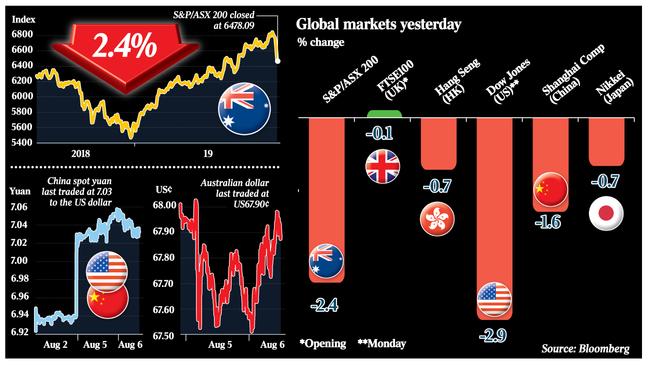

In its biggest one-day fall in 10-months, Australia’s benchmark S&P/ASX 200 share index fell 2.4 per cent to 6478.1 points but it bounced off its 100-day moving average line that has held since January.

Technology stocks bore the brunt of the selldown, while currency-exposed stocks including Macquarie and CSL were also hit. Resource stocks opened lower but recovered lost ground through the session.

The local bourse has fallen 5.4 per cent on a daily closing basis — erasing $110 billion of value from a market that peaked at over $2 trillion since it reached a record high of 6875.5 a week ago — capping a stunning 21 per cent rise this year as central bank easing drove bond yields down to record lows.

But Bell Potter’s Richard Coppleson said he was “relaxed” about the latest sharemarket shock.

“All it takes is US to put out the olive branch and up it goes again,” he said.

Market sentiment came back from the brink after the People’s Bank of China moved to stabilise its currency via a slightly stronger-than-expected fixing rate of 6.9683 to the US dollar after the offshore yuan surged to a decade high of 7.14 per US dollar after the trade war flared up again last week.

With US S&P 500 index futures turning up 0.9 per cent in Asian trading after a 1.9 per cent intraday fall, losses in regional sharemarkets proved limited compared to a 2.4 per cent fall in Australia.

China’s Shanghai Composite fell 1.6 per cent, Japan’s Nikkei 225 lost 0.7 per cent, Korea’s KOSPI index lost 1.5 per cent, Taiwan’s TAIEX lost 0.3 per cent, Singapore’s FTSE Straits Times index fell 0.8 per cent and the Hang Seng index fell 0.7 per cent. European shares opened slightly higher last night, with London up 0.1 per cent by mid-morning.

Bell Potter’s Mr Coppleson said shares were unlikely to go into a bear market — normally defined as a peak-to-trough fall of 20 per cent in an index — from here.

Interest rates are set to remain low and the latest escalation of the two-year trade stoush was “not at this stage an all-out war” that would lead the global economy and markets into a recession, in his view.

Citi’s chief economist Greater China, Li-Gang Liu, said the PBoC might be intending to dampen one-way depreciation expectations and thereby contain capital outflow risks.

“In case external pressures escalate further, we still believe the PBoC would be willing to see a weaker RMB to offset the tariffs, given the narrowing domestic policy room,” he said. “In the near term, we believe weak market sentiment will tend to weigh on the RMB and risky China assets.”

But the PBoC last night said the recent yuan depreciation was decided by market forces and China wouldn’t seek competitive depreciation or use its currency as a tool to cope with the trade dispute.

China intends to keep the yuan stable at a reasonable, balanced level, it added.

The PBoC also warned that the US accusation could seriously hurt the international financial order, trade and economic recovery and the currency system, leading to global financial turbulence.

In practical terms, the “currency manipulator” designation is “largely symbolic” it is likely to make little difference, given how far US-China trade tensions have already escalated, according to Westpac senior currency strategist Sean Callow.

“The acts don’t explicitly authorise tariffs as punishment for currency manipulators,” he said.

“The fact that President Trump has imposed substantial tariffs on China without the manipulator designation is testament to the expanded powers on trade policy successive congresses have delegated to the White House over many years.”

Citi’s Mr Liu said the US determination was “largely toothless” but since the US was working to treat currency undervaluation as akin to a subsidy, it would be important to watch the progress on the proposed change that would allow the US Department of Commerce to determine if additional tariffs can be imposed.

“Overall, we believe the potential penalties are a shadow of the steps the US has already taken against China,” he said. “The risk of full-scale trade war is on the rise.”

Investors had been bracing for the worst after the currency-manipulator accusation from US Treasury Secretary Steven Mnuchin and a barrage of anti-China tweets from President Trump triggered big falls in the US, with the flagship S&P 500 diving 3 per cent — its biggest fall this year.

While shares have rallied this year alongside strong gains in some traditional safe havens like bonds and gold, investors began to dump shares last week after the US announced it will next month impose a 10 per cent tariff on the remaining $300 billion ($441bn) of Chinese goods currently untaxed.

The risk-sensitive Australian dollar dived to US67.50c — marking its lowest point in a decade, apart from the January flash crash — before climbing back to US68c with help from steady RBA policy.

And in an encouraging sign for the short-term at least, 10-year US Treasury bond yields bounced 10 basis points to 1.77 per cent after dropping to an almost three-year low of 1.67 per cent.

Equivalent Australian bond yields hit a new record low of 0.968 per cent — below the official cash rate for the first time since 2012 — before bouncing to 1.04 per cent.

Spot gold hit a six-year high of $US1474.93 per ounce before easing to $US1462.60, while the Japanese yen hit a seven-month high of 105.52 to the US dollar before bouncing to 107.09.

AMP Capital’s head of investment strategy and chief economist, Shane Oliver, said a further sell-off in shares and rally in bond markets was likely in the short term as the trade war continued to escalate and global markets moved into a seasonally weak part of the year.

“However, providing we are right and recession is avoided, a major bear market in shares where shares fall 20 per cent and a year later are down another 20 per cent or so is unlikely,” he said.

“We regard the fall in sharemarkets as another correction rather than the start of a bear market.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout