Treasury Wine Estates boss Tim Ford to uncork China survival plan

TWE boss Tim Ford is on Monday expected to reveal his strategy to replace more than $500m in sales snuffed out by China’s high tariff wall.

Treasury Wine Estates boss Tim Ford is on Monday expected to reveal his strategy to replace more than $500m in sales snuffed out by China’s decision to erect a high tariff wall against Australian wine.

The winemaker plans to redirect much of the premium wine once shipped to Chinese ports to markets in North America, North Asia and Europe.

But it could come with potential redundancy and restructuring costs for its sprawling Chinese operations if Mr Ford decides to put the China business into hibernation until the dire relations between Canberra and Beijing improve.

The winemaker is also believed to operate a number of short-term contracts with growers, so it can quickly reduce the volume of grapes it is contracted to buy, easing financial pressure on the group.

Treasury Wines is pinning its hopes on being able to reallocate as much as 40 per cent of the wine typically exported to China to other countries including Japan, Hong Kong, Britain and the US, though this would mainly be for prestige labels such as Penfolds rather than its long tail of cheap commercial wine such as Rawson’s Retreat.

Mr Ford will front investors in a series of presentations likely to kick off today, calling for caution in the face of the unprecedented trade war launched against Australia’s $45bn wine sector last week.

He will make it clear that Treasury Wine is not a distressed seller and will not dump excess supplies on the local market to depress prices.

Mr Ford, who has only been at the helm since taking over from Michael Clarke in July, is keen to throw a spotlight on the company’s balance sheet strength as the owner of iconic brands such as Penfolds, Wolf Blass, Wynns and Lindeman’s. This allows it to hold on to its premium wines, allowing them to mature further and gain value.

Treasury Wine could keep hundreds of thousands of cases on its books, if required, as it seeks a new home for the top-end wines that normally would find a home on Chinese banquet tables or restaurants.

Australia remains one of the largest markets for the Penfolds brands and could easily absorb more of its top luxury brands.

Locked in meetings over the weekend at Treasury Wine’s Melbourne headquarters, the board late on Sunday was yet to sign off on the strategy as management reacted to Friday’s news of a 169.3 per cent tariff on its wine exports to China.

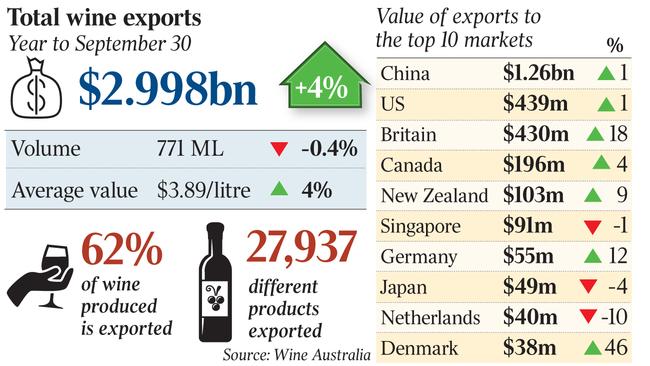

The fresh outbreak of trade hostilities between Beijing and Canberra has threatened the viability of the $1.3bn of Australian wine sold to China each year, with a large slice of that market held by Treasury Wine.

The high tariff walls, with some winemakers facing an impost as high as 212.1 per cent, could destroy the most profitable arm of Treasury Wine’s business and the engine of its recent dynamic growth.

Treasury Wine had been preparing for being shut out of China for a number of months before the tariff announcement on Friday.

The company had war-gamed various scenarios but was hoping to avoid the worst case scenario of a punitive tariff so high that it would force an exit from the Chinese market.

Now Mr Ford is facing that reality and is looking down the barrel of not only a 30 per cent cut to group earnings and 80 per cent to earnings out of Asia, but also significant profit falls at its Australian and New Zealand regions as excess supply from winemakers floods the market.

Treasury Wines will be anxious not to start a price war but might be dragged into one anyway as competitors dump excess stock.

Shares in Treasury Wine fell more than 11 per cent on Friday to $9.23 before being placed into a trading halt after China’s Ministry of Commerce announced the tariffs beginning at the weekend.

Earlier this month Bank of America analyst David Errington forecast a likely shutdown of the Chinese market.

“In our forecast earnings, we now consider it realistic to factor in China being lost as a market for Australian wine producers,” Mr Errington wrote.

“For fiscal 2022 and beyond, we now factor in zero sales and earnings being contributed to Treasury Wine from China, which has led to a 25 per cent cut to our forecast 2022 EBIT, and a 30 per cent cut to our forecast 2023 EBIT.”

However, Mr Errington said of the 4.1 million cases of wine expected to have been exported to China in 2023 as many as 1.5 million cases could find a home elsewhere.

“Our bullish view toward Treasury Wine has largely been based on a positive view toward the luxury wine market and the strength of the Penfolds brand —– particularly in its upper Bin/iconic wines.

“Without the Chinese market, growth expectations remain — but it has been slowed and/or delayed. Opportunities remain for Treasury Wine to sell its high end wines to other markets.”

UBS analyst Aryan Norozi wrote earlier this month that Treasury could redirect wine to other regions but the success and margin impact was unknown.

“Reallocation of wine to other regions by Treasury Wine and competitors may place downward pressure on pricing,” Mr Norozi said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout