ACCC hits out at NSW’s $11bn toll road sale to Transurban

The decision by the NSW government to award control of Sydney motorway WestConnex to incumbent Transurban for $11bn has been criticised by the competition regulator.

The decision by the NSW government to award control of Sydney motorway WestConnex to incumbent Transurban for $11bn has been criticised by the competition regulator for missing the chance to introduce a new rival that could challenge the company’s monopoly over the state’s toll roads.

Transurban and its investment partners gained full ownership of WestConnex on Monday and the company now runs seven of the state’s nine toll road concessions and 15 of 19 nationwide, raising concern over its dominance in the sector.

While the NSW government won a full price selling the remaining 49 per cent stake for $11.1bn, its decision not to prioritise competition across the state’s toll roads may pose longer-term problems for taxpayers and road users, according to the Australian Competition & Consumer Commission.

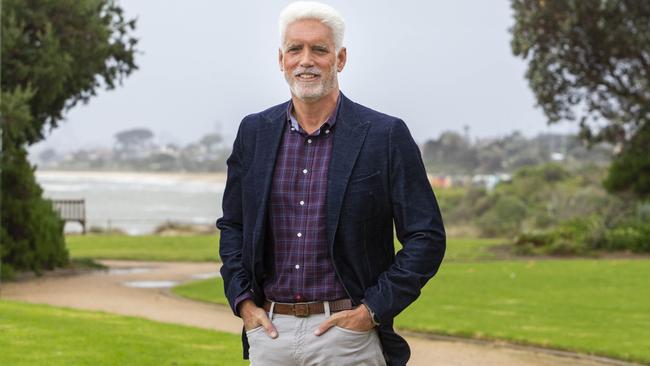

“It’s been our view that government could create a competitive environment if it wanted to by making sure there’s a couple of toll road owners and they’ve obviously chosen not to do that. And now it makes it very hard for someone to compete against Transurban,” ACCC chairman Rod Sims said.

“They’ve taken the higher price that Transurban has offered but in the long term it makes it hard for anyone to compete and you lose that competitive tension. That’s the trade-off for governments. They are taking the money now rather than worrying about the longer-term strategic issues. That’s particularly disappointing, but in this case it’s their call.”

The WestConnex sale was split into two tranches of equal 24.5 per cent stakes in a bid by the government to maximise competition with the Transurban-led consortium the winner of both. The other competitor, IFM and its Dutch partner APG, had fallen out of the contest at a late stage, leaving Transurban as the sole bidder.

A deal in 2018 for Transurban to share traffic data with its rivals satisfied the ACCC that others could successfully compete for new toll road concessions. Mr Sims said there were no competition issues with the latest WestConnex deal, but lamented that there was not a greater number of bidders at the table.

“The competition we’re concerned about is one strictly in the hands of government. We wanted to make sure bidders in future will have access to the traffic data and that helps, but it doesn’t completely solve the problem.”

Transurban argues it has no pricing power as the amount it can charge for tolls is set by the state government, while the road should not be thought of as a monopoly because there are alternative routes available for road users.

“Tolling is set by the government and we just follow the toll rules set under the concession agreement,” Transurban chief executive Scott Charlton said on Monday. “There was a significant competitor in IFM and APG that were in there but at the end of the day it’s up to government. We ran our own race.”

Mr Charlton also said a spike in major infrastructure deals and takeover bids was sparked by listed assets being undervalued, with private investors and superannuation funds racing to grab a foothold in toll roads, airports and energy networks across Australia.

The toll road giant led a consortium backed by superannuation funds for WestConnex, while Canadian infrastructure giant Brookfield swooped on Monday with a $9.6bn raid on power grid owner AusNet. Sydney Airport has secured a $23.6bn bid from retirement players, while Spark Infrastructure accepted a $5.2bn takeover offer.

“I think whenever there’s a disconnect between the listed market and long-term view of value that these guys obviously are prepared to step in and have a go,” Mr Charlton told The Australian, referring to superannuation investors.

“Covid has obviously caused some levels of disconnect which has allowed them to come in and realise long-term value.

“These guys are investing 30, 40, 50 years and sometimes the listed market can be a bit short term, which is a shame. These are just great assets – and very scarce – and when there’s that disconnect they swoop in.”

The payday for the 33km motorway, combined with the original 51 per cent stake sold for $9.26bn in 2018, hands the state government $20.4bn from selling off Australia’s largest infrastructure project. Cash from the sale will be invested in the NSW Generations Fund – the state’s sovereign wealth fund – before being used to retire an equivalent amount of debt.

The stronger than expected $11.1bn windfall for the remaining 49 per cent adds to a major privatisation drive by the NSW government, with big state-run power networks previously sold off including Ausgrid, TransGrid and Endeavour Energy as part of an asset-recycling scheme.

“This transaction continues our successful asset recycling strategy, which has been the cornerstone of our record $108.5bn infrastructure pipeline that has built and upgraded schools, hospitals, road and rail across the state,” NSW Treasurer Dominic Perrottet said.

“This sale is part of our prudent, long-term strategy to bolster the state’s finances, while also supporting the NSW economy by investing in job-creating projects that will drive our Covid economic recovery.”

Transurban said it would launch a $4.2bn-plus equity raising to pay for the acquisition along with $1.41bn in cash for an overall $5.56bn outlay for its 50 per cent stake. Some $3.97bn of the $4.2bn will be raised through a one-for-nine rights issue at a price of $13 per security, representing an 8.3 per discount to Transurban’s last closing price on September 17.

Transurban has also agreed to a $250m share placement to AustralianSuper, a partner in its consortium, at $13.07 a share in addition to the superannuation giant taking up its full entitlement under the deal.

No additional debt funding is required by the consortium. The deal to acquire full control of the toll road is expected to generate $600m in additional capital releases until 2025.

Transurban’s partners in the Sydney Transport Partners consortium include AustralianSuper, Abu Dhabi Investment Authority and Canadian Pension Plan Investment Board, while Canada’s CDPQ will become a new member of the group.

CDPQ will provide 20.5 per cent of the funding for Monday’s deal in exchange for a 10 per cent stake in the consortium, while CPPIB will remain at 10.5 per cent.

Transurban, which remains in a trading halt, expects to pay 15c per security to shareholders for the six months to December 31, 2021, in line with the first-half distribution.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout