Following the $20bn sale of Sydney toll road operator WestConnex, the market is turning its attention to what could next be put on the block by the New South Wales government.

The Western Harbour Tunnel – a second Sydney Harbour crossing to be built at a cost of between $8bn and $10bn – is the obvious contender, given that a scoping study by investment bank Citi has already been undertaken on the yet-to-be built asset.

One option could be packaging up the crossing with the existing harbour tunnel and harbour bridge toll assets for sale, although the thinking is that plan may find it hard to gain support.

Also on the agenda could be the sale of the remaining interests in the NSW electricity distribution assets that the government still owns.

The NSW government sold a 99-year lease for half of Ausgrid to AustralianSuper and IFM for $16bn in 2016.

A 50.4 per cent stake in its other electricity distribution business, Endeavour Energy, was also sold to a Macquarie-led consortium for $7.62bn.

The thinking is those deals would need to be something that could only happen after the state election in 2023.

Expectations are that further asset privatisations are unlikely to be far from the mind of the NSW government as it wrestles with a major financial hit brought about by the global Covid-19 pandemic.

But for now, the $11.1bn it will reap from the latest sale of the 49 per cent stake in WestConnex this week that it still owned will be no doubt welcomed at what market analysts believe is a fair price.

One of the interesting parts of the announced sale by NSW government of the remaining stake of WestConnex is that one of the buyers of the 49 per cent interest was Canadian fund CDPQ, a newcomer to the Transurban consortium.

CDPQ is providing 20.5 per cent of the funding for Monday’s deal in exchange for a 10 per cent stake in the consortium at a time it has been looking at many acquisition targets in Australia.

Other consortium members are the AustralianSuper and the Abu Dhabi Investment Authority.

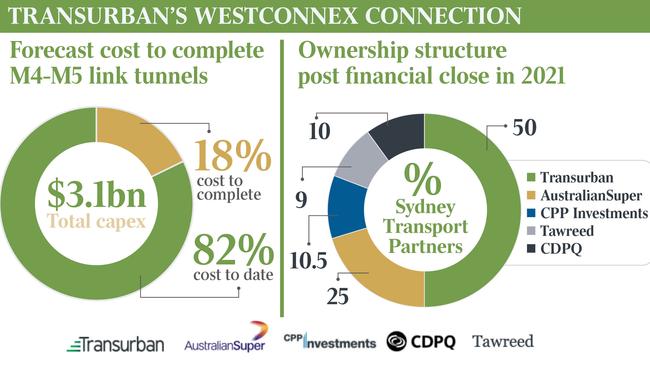

The consortium, known as Sydney Transport Partners, consists of Transurban, which owns 50 per cent of WestConnex.

AustralianSuper owns 20.5 per cent, Canada Pension Plan Investment Board 10.5 per cent, the Abu Dhabi Investment Authority with 10 per cent and CDPQ, with 10 per cent.

Before the latest transaction, the government owned 49 per cent of WestConnex, Transurban had 25.5 per cent, AustralianSuper and CPPIB both had 10.5 per cent and ADIA 4.5 per cent.

As earlier reported by DataRoom, CPPIB was not expected to increase its exposure to WestConnex further due to toll roads.

But the emergence of Canada’s CDPQ as the newest member of the Transurban-led consortium buying WestConnex is no big surprise, according to market experts.

The Canadian pension fund had bid for WestConnex when 51 per cent was for sale in 2018 as part of the Netflow consortium including Plenary and Cintra, which were unsuccessful in the auction.

It also teamed up with one of the underbidders to vie for the Queensland Motorways Network in 2014 that was won by Transurban.

This year, CDPQ bought a 15 per cent interest in the Indiana Toll Road in the United States from IFM, which continues to own more than 70 per cent of the 252km toll road.

Transurban confirmed on Monday that its consortium had purchased the remaining 49 per cent interest in Sydney’s 33km motorway project WestConnex that it does not own for $11.1bn.

The price was more than the $9.26bn it paid for the 51 per cent interest in 2018 due to the fact that most of the network is built, with no risk surrounding construction or delays.

It is understood that in the end, Transurban was the sole competitor in the auction after IFM and its bidding partner APG did not lob a final offer, after they were earlier expected to line up.

The 49 per cent stake was to be sold in two separate tranches, but with only one bidder, the sale was announced all at once.

Transurban’s $4.2bn equity raising through an entitlement offer and a placement to fund its share of the transaction is now underway.

The entitlement offer to secure $3.97bn sees shares sold at $13 each, an 8.3 per cent discount to Friday’s closing price of $14.18.

AustralianSuper will secure a $250m stake through a share placement at $13.07 in addition to the country’s largest superannuation provider taking up its full entitlement under the offer.

Bids were due for the first tranche on Thursday September 9 in the latest WestConnex process advised by Citi and RBC with the outcome of the first tranche to be announced on Friday.

Working for Transurban are Barrenjoey Capital Partners, Morgan Stanley and UBS.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout