The decision to go with a retail outsider for the newly-created executive chairman role represents another strategy shift and comes after outgoing boss John King and his team have worked wonders to stabilise Myer by putting it back into a place of financial health.

The boardroom changes also underscore how the pieces are falling into place for multibillionaire Solomon Lew, who has been playing the long game and is now closing in on 30 per cent of Myer’s register.

For much of the past decade, Lew has been quick to go into battle against Myer’s board over even small changes of direction. But through his listed company, Premier Investments, he gave Wirth his blessing, wishing her “the best in her new role”. Lew was consulted about the moves, but it is significant he supported Wirth’s initial nomination to the Myer board last November.

Lew is the nation’s most astute retailer and is yet to reveal his intentions for the ever growing Myer stake held by Premier – and looking over the next few years there is a real sniff of consolidation in the air.

One of Lew’s long-time business allies, Gary Weiss, has been promoted as deputy chairman inside the Myer boardroom as well as lead independent director to provide governance clout. Weiss is very much his own person with interests these days from Cromwell to Ardent Leisure, although it needs to be noted he spent almost two decades as a director of Premier Investments before retiring in 2018.

The first principle under the ASX good corporate governance guidelines recommends listed companies should clearly delineate the roles and responsibilities of their board and management. Myer has thrown this out the window.

Even so, there is logic in Wirth’s appointment as a chief executive and that is to turbocharge the retailer’s already well-regarded loyalty scheme, Myer One.

The coming five years will be more important than ever in using data analytics and AI in luring shoppers into its stores, and especially online, with the leverage of Myer’s loyalty program. Since taking charge, King put Myer One at the heart of his customer-first strategy to revive sale and drive – and it is working.

King tells The Australian loyalty schemes are the future of department stores and with 4.3 million active members is a leading point of difference Myer has over its rivals.

“It’s a huge opportunity that others do not have,” King says. He points out Wirth’s background in aviation draws on one of the most customer-focused and competitive industries in the world. Her appointment is about bringing loyalty and digital to the next generation of Myer customers, he says.

“We want to be at the cutting edge of what we can do in this industry.”

King gave one year’s notice over his intention to retire this coming June, giving Myer’s board plenty of time to prepare and search for a successor.

Myer’s search finished at the boardroom, where Wirth already sits. Wirth takes charge as chairman today with Ari Mervis, who was named chairman only in November, stepping down immediately.

Still, the simultaneous exit of both a chairman and a well-regarded CEO, as well as the recent appointment of a new chief financial officer, represents significant management disruption for the retailer that needs the sharpest eye possible to see it through the stalling economy.

King says Wirth “is a highly accomplished executive and has already made a significant contribution as a board director”.

“I know Olivia will bring a laser focus to customer service loyalty, data analytics, online shopping, team engagement and a rewarding in-store experience,” he says.

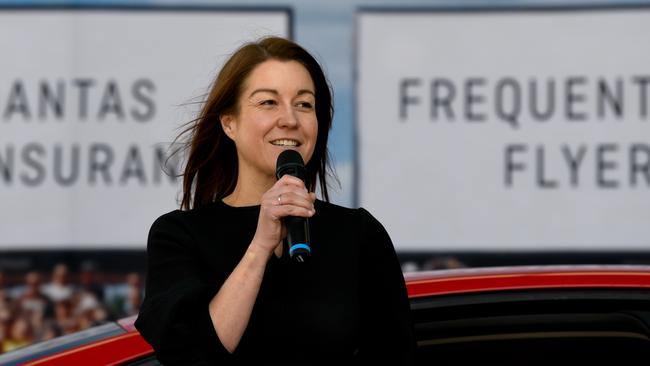

Wirth was former Qantas boss Alan Joyce’s pick for the top job and while the airline's massive reputational hits fall firmly at Joyce’s feet, she was part of the management team that took collective responsibility for the airline’s fall from grace.

She stepped down from the airline late last year, several months after Vanessa Hudson was named chief executive.

Wilson Asset Management’s Oscar Oberg, an investor in Myer, believes Wirth will bring her strong loyalty and customer experience credentials to the retailer: “John King has done a tremendous job around costs and inventory levels … and that’s now all set up for someone to drive the top line higher.”

Loyalty at the core

Qantas’ Frequent Flyer loyalty business was the only thing generating cash for the stricken airline during the Covid groundings.

It is linked to the nation’s strongest brand and ranks one of Australia’s biggest loyalty programs with more than 15 million members. Last year it generated $451m in earnings for Qantas with margins running at 20 per cent, much of this was through selling points to partners such as banks.

Myer’s loyalty program is designed to keep customers buying in store and online through offers and partner discounts. Loyalty customers spend more in stores and have the highest engagement.

The program posted record membership growth in the past year with most of the growth coming from under 35s. It recent years it has signed outside partnership with Amex and Commonwealth Bank which is now driving new revenue.

Myer’s future is based around driving online sales and sweating its existing store footprint harder. King has cut store numbers – including closing the flagship Brisbane CBD store last year – and shrunk the footprint of existing stores. A new high-tech national distribution centre will help drive more efficiencies, including speeding up online.

The backdrop for Myer remains fluid although there is more going its way with the prospect of lower interest rates from later this year boosting consumer confidence. Key rival David Jones remains badly distracted under new ownership of private equity players Anchorage. There has also been persistent talk of a merger with Myer and David Jones.

King, a former UK retail executive, signed-off on his last set of accounts before he exits June and delivered again for investors. Even with the economic slowdown, the retailer is arguably in the best shape since it listed 15 years when it was loaded up with debt and little else.

Although the numbers showed a 20 per cent drop in headline first half profit to $52m, this was at the top end of previous guidance. He reported comparable sales growth of 4.9 per cent since the start of February, this beat expectations and powered Myer’s shares almost 8 per cent higher. So far this year Myer shares are up more than 40 per cent showing how downbeat the market had been around retailers.

The numbers show Myer continues to defy the consumer slowdown, with sales and profit margins holding steady. The once weakened balance sheet is in a net cash position of $211m, so there is more cash than debt. A dividend of 3 cents a share was declared, a remarkable achievement given last decade’s dividend drought even when the economy was booming. Now it’s all up to Wirth to keep the momentum going.

johnstone@theaustralian.com.au

Myer has turned the clock back on good governance with the call to back in former Qantas frequent flyer executive Olivia Wirth into the combined role of chairman and chief executive.