What is more remarkable is that Myer has got to this position after Covid-19 lockdowns, when dozens of its flagship stores were closed – sometimes for months on end – and the traditional retail business model was up-ended. The department store has rapidly seen its one-time advantage turn into a strategic weakness as consumers turn to specialist retailers – including big global entrants – for choice and have been increasingly shopping online.

With its high overheads, Myer has felt the brunt of this almighty shift, with its shares tumbling and holding below $1 in recent years, and strategic missteps under former management has seen the losses mount. King, a former UK department store boss, is still part way through re-engineering Myer, but the results are showing in the numbers.

In the fullness of time, Covid-19 will prove to be a silver lining that gave Myer the headroom to turbocharge its strategy of aiming for $1bn in annual online sales and make its physical stores work harder by shrinking the floorspace. The pandemic demanded more investment for online and forced negotiations with landlords over costly leases.

King points out that Myer is a top five non-food retailer in online sales in Australia, while the Covid lockdowns introduced Myer to a new mix of customers – bother old and young – that probably would not have looked at the retailer previously.

Together it’s these levers that has allowed Myer to improve sales, profits and resume paying dividends to shareholders for the first time in five years as it sits on the highest level of net cash (that is, cash minus debt) since the Global Financial Crisis.

But the Myer One loyalty program with 6.6 million members has turned into a powerful data warehouse that is actively being used to tailor promotions and discounts or redeem points, which keeps customers returning.

It is the analytics from this loyalty program that King is planning to use as his trump card as retail headwinds build around rising cost of living, particularly as interest rates rise further and start biting into discretionary spending. So too Myer’s sales are more evenly spread across categories, from women’s fashion, menswear, cosmetics, to household items. “If one comes under pressure, we can capitalise on others,” King says.

The past year saw a doubling of Myer’s net profit to $60m, helped by a 12.5 per cent increase to sales to almost $3bn. The latest results didn’t include any JobKeeper payments, although the previous year had a $58m boost, which had the one-off impact of lowering costs.

Myer paid a 1.5c-a-share dividend in the second half, taking its full year payout to 4c a share. This gives Myer a dividend yield of 6.3 per cent, coming in well ahead of cash, but only just ahead of annualised inflation. Myer shares are up 36 per cent since the start of the year in the face of a rotten broader market, but at 63c a share, they are below its potential with investors still cautious about the recovery story.

Smaller stores

King and his team have been making the painful call to rapidly reduce Myer’s store footprint by reducing the amount of floors and, in several cases, shutting down stores entirely. There have been a string of store closures, from Hornsby and Blacktown in Sydney and Knox in Melbourne. Since 2018 there’s been an 11 per cent drop in total floorspace. Expect more cuts. Frankston, outside Melbourne, has also been earmarked to close. There have also been cuts to support staff as the store network shrinks. Indeed, King and his executive team see their bonus payments determined by a measure of store productivity.

Myer is now doubling down on its online business, which is expected to hit $1bn in annual sales within the next two years. Myer online is gaining ground from specialist online rivals including Adore Beauty or Kogan.com with sales growing even as the economy reopened.

Today, online sales of $723m represent nearly 25 per cent of all Myer’s annual sales and more than 2.74 million active customers are using its site. Just three years ago Myer was doing $260m in annual sales, with the $1bn target a pipe dream. But King says the “serious step change” is to come, with Myer set to open by mid-next year its new high warehouse in Melbourne that will be staffed mostly with robots picking and packing orders for both online and store delivery.

Myer becomes the first retailer in Australia to roll out the “Geek+” series robots that are used by fashion giant Zara in the northern hemisphere to power its warehouses. The technology will lower the cost – in some cases by 30 per cent – and improve the speed of a single online order while allowing Myer to better manage its inventory into its stores.

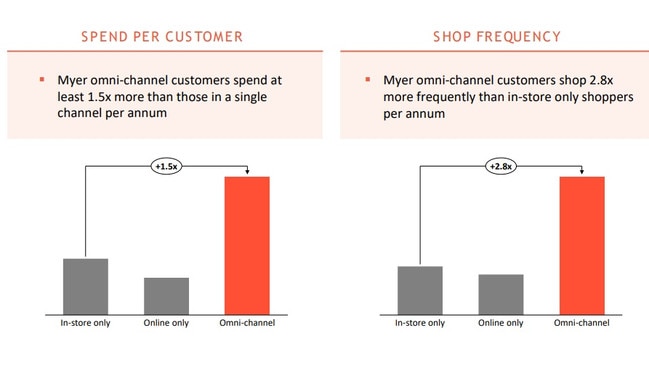

King’s belief is that Myer’s physical store network – at the right size – can thrive alongside its growing online business. Customers still want to shop in store and those who shop both in store and online spend more than 1.5 times as much as if they were using online or store as a single traffic.

“Online fuels the stores because people go online, do their research before they go into stores. And then people in stores look at the products and make a decision to order it at home,” he says.

Physical stores still represent three quarters of sales and are pulling market share. And right now King is capitalising on consumers who are the tail end of being relatively cashed-up.

Myer’s sales growth surged in the first six weeks of the new financial year to deliver the strongest start in terms of revenue in more than 15 years.

King also has a distracted competitor, with the South African owner of rival David Jones openly canvassing a sale of that department store business. Christmas is the grand final for Myer and King is confident that as long as unemployment holds low, this year will be a strong one.

RBA issues

Supply side shocks that send prices soaring, such as from pandemic or the war in Ukraine are likely to become more frequent in the future, which could makes the job of central banks all the more harder, according to an issues paper released Thursday as part of Treasurer Jim Chalmers’ review of the Reserve Bank of Australia.

The review through the issues paper has acknowledged that the RBA can only do so much to influence the economy, particularly during downturns, noting there are many factors that are outside the central bank’s remit or control.

This is important when it comes to the RBA using its blunt monetary policy tools to fight inflation that has been largely imported into the country.

“Changes to the supply capacity of the economy can push inflation higher but employment lower,” the issues paper notes.

“It is possible that supply disruptions will be more prevalent in the future, for example because of further pandemic related impacts, changes in the extent of global economic integration, geopolitical tensions or natural disasters related to climate change.”

The supply pressures mean efforts to driving down inflation could conflict with the RBA’s other aim of maintaining full employment.

The wide-ranging review, headed by former Bank of Canada deputy governor Carolyn Wilkins, marks the first detailed scrutiny of how the RBA operates.

The issues paper also raises the question of whether central banks have a role in transitioning to a low-carbon economy, which could complicate inflation targeting in coming decades.

But it is the inflation target framework that is expected to get most focus in the RBA review. Here the issue will be whether the current 2-3 per cent band continues to work well; if it should be widened; or if a more dynamic target or one that aims for economic growth is something that should be considered. In 1996, treasurer Peter Costello started the process in getting central bank governors committing to the target. He believes it is still the right range.

Meanwhile Australia’s “twin peaks” of banking regulation has also unintentionally been caught up in the review with the role of banking watchdog APRA to come under some scrutiny. Here it will look at whether monetary policy (RBA) and macroprudential policy (APRA) that can limit bank lending, work on the same page during economic downturns.

johnstone@theaustralian.com.au

In a little over two years Myer chief executive John King has shifted from talking about managing for survival to a retailer that now has a firm eye on sustainable growth.