Reserve Bank facing scrutiny on rates calls

The RBA board faces a new era of accountability, with Australians to be told which individual board members voted in favour of rate hikes under reform proposals.

The Reserve Bank board faces the prospect of a new era of accountability, with Australians to be told which individual board members voted in favour of rate hikes under reform proposals to be examined by the RBA review.

A three-member panel charged with conducting the first broad review of the central bank in 30 years will release an issues paper on Thursday that canvasses a wide range of potential reforms, including the appropriateness of its current inflation target, where its staff are located and policy responses to deal with price pressures caused by supply shortages.

The review, which is aimed at modernising Australia’s independent central bank, will examine its board’s structure and membership and whether the responsibility for interest-rate decisions should be hived off to a separate board staffed with monetary policy experts and professional economists.

The review panel of former Bank of Canada deputy governor Carolyn Wilkins, ANU economics professor Renee Fry‑McKibbin, and former leading public servant Gordon de Brouwer will consider whether the RBA should follow the lead of other central banks and publish the “voting history for individual board members” or if published minutes should mention opposing views, without attribution.

After the Reserve Bank failed to meet its inflation mandate for five years leading into the pandemic, the review will consider whether the 2-3 per cent target should be lowered – or even scrapped altogether.

The paper makes the case for the RBA to refashion its approach to monetary policy in a more volatile world where inflation is increasingly driven by supply shocks from pandemics, more frequent natural disasters caused by climate change and an increasingly fragile geopolitical environment. In a move likely to highlight concerns about maintaining an independent central bank, the review panel will also consider how monetary policy can incorporate a more active role for governments and regulators in managing economic downturns when rates are already near zero.

The current board, which also has responsibility for overseeing the broader operations of the bank, is made up of people from a range of backgrounds including business, academia and the not-for-profit sector.

The issues paper notes that other central banks separate policy-setting responsibilities to another board “with a narrower composition of mainly monetary policy experts and professional economists”.

The panel will seek to assess the RBA’s culture – a difficult task reliant on the thoughts of current and former bank employees.

Jim Chalmers said the government had an “important opportunity through the Reserve Bank review to ensure that Australia’s central bank is as strong and effective as possible”.

“It’s vital that Australians are part of this process, and that a diverse range of perspectives are heard,” the Treasurer said.

“I encourage Australians to read the issues paper out today and provide their feedback during the consultation period.”

The central bank has come under an unparalleled level of scrutiny and criticism this year following its “embarrassing” failure to foresee this year’s surge in inflation.

RBA governor Philip Lowe has faced calls for his resignation after he assured Australians as recently as November last year that rates would stay at virtually zero until 2024.

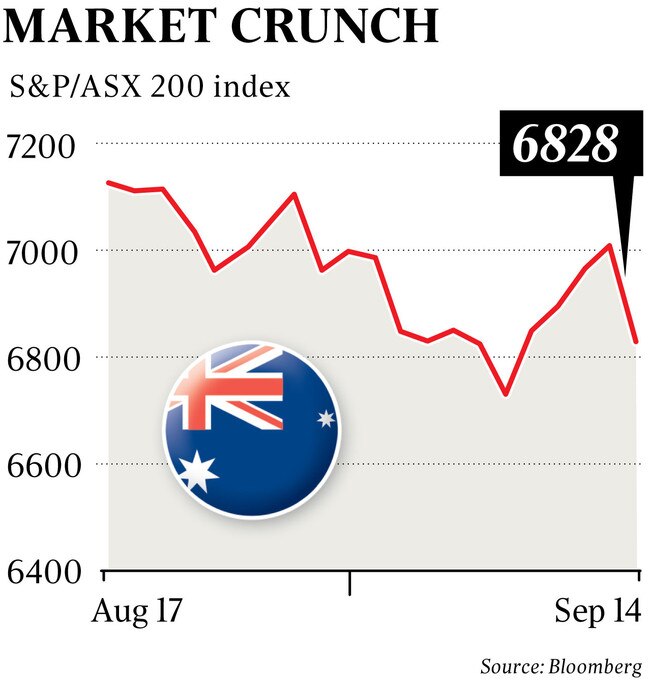

Instead, Dr Lowe from May has delivered the fastest series of rate hikes since the 1990s, bringing the cash rate from 0.1 to 2.35 per cent in five months.

Central banks around the world have struggled to control an inflationary surge sparked by supply shortages triggered by the Covid-19 pandemic and energy price spikes driven by Russia’s invasion of Ukraine.

Dr Lowe last week signalled his intention to slow the pace of monetary policy tightening. Investors, however, on Wednesday marked up the chance of another double rate hike at the upcoming October meeting from 60 to 80 per cent.

Even before the pandemic and the invasion of Ukraine, the RBA failed to meet its inflation mandate in the five years leading up to the health crisis, with consumer price growth averaging 1.75 per cent, against an annual average of 2.5 per cent in the preceding 25 years.

The paper points to a structural decline in interest rates across the developed world that has limited the ability of the RBA to “use its policy interest rate to support the economy to achieve its inflation objective during economic downturns”.

The review panel notes that many of the RBA’s overseas peers have conducted reviews of their monetary policy arrangements in recent years.

“These reviews have tended to affirm their inflation-targeting arrangements but embed greater flexibility to focus on reducing volatility in economic activity and employment in the short-run,” the review says.

Opposition Treasury spokesman Angus Taylor, in a speech to the Australian Banking Association on Thursday, will say that the review was warranted, but will warn that it is also important that it “doesn’t get distracted from the core objectives”.

“With rising interest rates weighing heavily on the minds of Australian families and household budgets, it is essential the RBA’s mandate remain laser focused on containing inflation,” Mr Taylor will say.

“We don’t want to see the containment of inflation, containment that underpins a strong economy, diluted with new objectives.”

The Reserve Bank, since the 1990s, has used changes in interest rates to stimulate or dampen demand.

But that approach may no longer be fit for purpose when the economic disruptions are to do with supply and production, the review panel says.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout