Marcus Blackmore absent from $117m raising

Vitamins maker Blackmores is tapping the market to raise $117m but one key shareholder has already ruled out participating.

Vitamins maker Blackmores is looking to dive deeper into Asia, diversifying away from key market China, as it seeks to raise almost $120m via an institutional placement and share purchase plan.

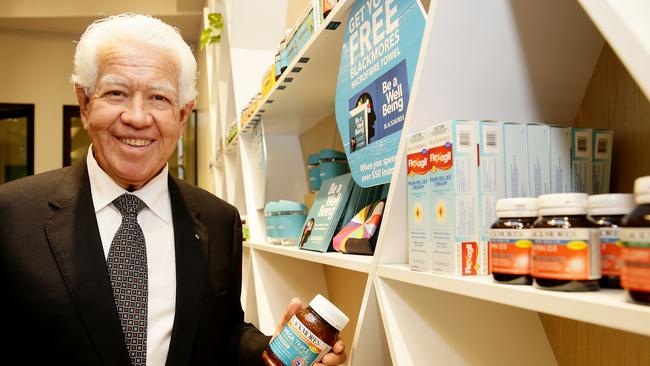

But its key and namesake shareholder, Marcus Blackmore, has ruled himself out of the raising, while maintaining he is still a “committed long-term shareholder”.

“Unfortunately I am unable to participate in the equity raising at this time, however Blackmores has been an integral part of my family since 1932 and needless to say I am absolutely committed to being a long term shareholder,” Mr Blackmore said.

“(But) I am personally pleased to support Blackmores announced capital raising. This initiative will strengthen our balance sheet, accelerate our planned Asian expansion and will allow us to continue to make our manufacturing and business processes more efficient.”

While China remains a key market for Blackmores — having delivered the company’s riches, and sent its share price soaring to highs above $210 in early 2016, well above Tuesday’s price of $78.85 — the group is now setting its sights on other countries in the region including Indonesia and India.

It comes as companies solely reliant on China trade have been exposed amid heightened trade tensions, including China’s decision to impose a punitive 80 per cent tariff on Australian barley, which cost the national economy at least $500m. Meanwhile the Asian power has suspended imports from four abattoirs in Queensland.

Chief executive Alastair Symington said Blackmores would use the proceeds from the capital raising to accelerate Asian growth and streamline its manufacturing and business processes.

“China remains a key focus for Blackmores. The company will invest to expand its organisational capabilities, drive innovation in a new ‘Modern Parenting’ product line and explore opportunities for local partnerships,” Mr Symington said.

“Blackmores will also provide increasing support for the fast growing South East Asian market to capture health and nutrition demand, and will commence a measured entry into India in the 2021 financial year.”

The efficiency program relates to an investment in supply and IT infrastructure to streamline manufacturing and business processes. Mr Symington said the program targeted $50m in gross savings a year by 2023.

“Half of these benefits will be reinvested in Blackmores’ key areas of focus including Asia,” Mr Symington said.

It is also expecting new growth to come from Indonesia, which will activate a free-trade agreement with Australia in July.

Blackmores has been struggling after it transitioned from being just a brand owner to a fully integrated vitamins company, after it bought Catelent’s factory in Braeside in Melbourne’s southeast for $43m last year.

That transition is set to cost the company about $9.5m this year.

“The equity raise will strengthen Blackmores’ balance sheet and liquidity position and provide the flexibility to pursue our key strategic priorities,” Mr Symington said.

“It will enable us to accelerate our growth initiatives in Asia and invest in our efficiency program which will help us to achieve our objective of returning Blackmores to sustainable, profitable growth.”

The raising will provide pro forma net leverage multiple of 0.7 and strengthen the company’s liquidity to $236m.

Mr Symington is expecting full-year net profit to plunge as much as 67 per cent to $17m, with the costs of transitioning from being a brand owner to manufacturer weighing on the company, as well as well coronavirus-fuelled lower shopping traffic and supply chain constraints.

Mr Symington said the COVID-19 pandemic was driving a “material increase” in demand for Blackmores’ immunity products. But that was not enough to sure up earnings.

“Immunity products constitute a small part of the portfolio and benefits are offset by a lag in

non-immunity products, partly driven by lower shopping traffic.

“Whilst our Braeside facility helped to prioritise production and quickly address the demand shift, access to some overseas sourced materials and capacity constraints at some contract manufacturers have impacted the company’s ability to meet demand in some products.”

The company hopes to raise $92m via a fully underwritten institutional placement and up to $25m via a non-underwritten share purchase plan.

The placement will result in the issuing of 1.3 million new shares, or about 7.3 per cent of the current shares on issue and be priced at $72.50 a share. This represents a discount of 8.1 per cent compared with Tuesday’s close of $78.85.

Under the share purchase plan, eligible shareholders can apply for up to $30,000 of new Blackmores shares.

“At Blackmores, we are building off 87 years of history and a key priority for us continues to be building a world-class organisation. We are a purpose-led company with a performance driven culture focused on growing and stepping up our investments to achieve this,” Mr Symington said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout