Blackmores is believed to be forging ahead with plans to sell non-core assets, hiring an adviser to offload units such as its powder-based products.

The company, which has a market value of about $1.3bn and $119m of net debt, says demand for some of its products has increased during the COVID-19 disruptions.

These include immunity products such as vitamin C and D tablets, equating to about 10 per cent of its overall range.

However, Alastair Symington, speaking after a presentation for the Macquarie Australia Conference, said sales of other products had been slowing as consumers focused on essentials during COVID-19.

Blackmores has more than 1400 products in its range and distributes to 12 markets.

However, it flagged in February that it was eager to stick to its core competencies.

Up for sale is expected to be powdered supplements.

Market analysts say that the assets are likely to sell for a nominal amount, but they are said to have generated a high level of interest from possible buyers.

The plan for Blackmores is to stick to hard and soft vitamin tablets that could be manufactured at its recently acquired Catalent factory at Braeside in Victoria.

The infant formula business was never seen as highly lucrative for Blackmores, market analysts say.

The Australian company founded and chaired by Marcus Blackmore is a category leader.

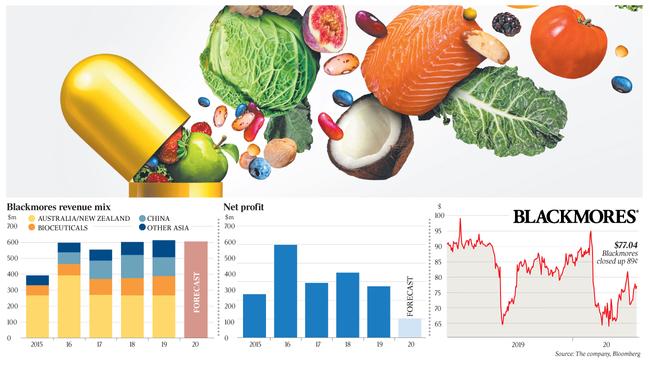

It has seen its share price soar beyond $200 in the past five years on the back of the booming demand for vitamins out of China.

However, it has since receded to about $77, as Chinese demand has eased and the space has become more competitive.