Blackmores warns of coronavirus hit as half-year profit falls

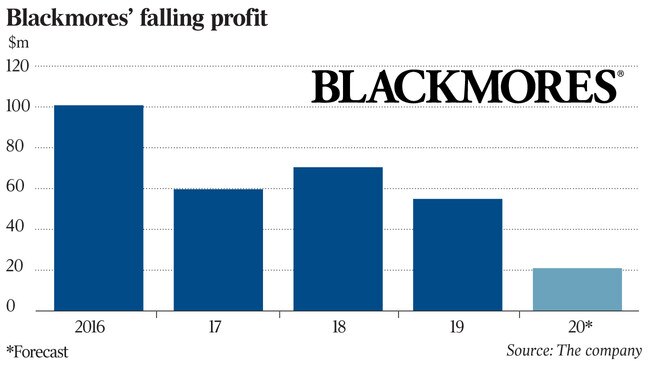

The vitamins maker targets a return to growth within three years, but the coronavirus could wipe up to 68pc off its full-year profit.

Blackmores chief executive Alastair Symington is confident he can return the vitamins maker to profit growth within three years, after he warned the deadly coronavirus could wipe up to 68 per cent off the company’s full-year earnings.

Mr Symington unveiled a four-step plan on Tuesday, aimed at achieving “sustainable profit growth” by 2023 with a focus on rejuvenating its Australian operations and tailoring products for the Indonesian and Indian markets.

It comes has Blackmores’ net profit dived 47 per cent to $18.2m for the six months to December 31, in line with the earnings downgrade Mr Symington issued two weeks ago.

He said the second half was expected to be challenging after the outbreak of the coronavirus, which has killed more than 2600 people and infected tens of thousands and more.

“There are two issues with coronavirus,” Mr Symington told The Australian.

“One is the fact that we see a slowdown of sales in China and that’s due mostly to poor access to freight, transportation for consumers to access products on the online platform. And the platforms have been shut down since Chinese New Year.

“Then there is the labelling change that we are in the middle of and the impact that coronavirus has had on that changeover.”

Mr Symington is now expecting full-year net profit to be in the range of $17m to $21m, compared with $53m in 2019.

Blackmores shares were down 1.69 per cent to $68.54 in lunchtime trade on Tuesday, compared with a 1.2 per cent drop across the broader market.

Weighing further on second half profit is Blackmores’ transition from being just a brand owner to a fully integrated vitamins company, after it bought Catelent’s factory in Braeside in Melbourne’s southeast for $43m last year.

Mr Symington said the he expected the factory to wipe about $9.5m off full-year earnings.

“The Braeside facility is in good shape. The challenge that we have is as we look at the mix of products going through that facility, we see a cost impact in the second half.”

Mr Symington said Braeside would be a key part of the company’s refreshed strategy and he did not regret the acquisition despite the initial challenges.

“For us, to be fully integrated, vertically manufacturing means we have control of the supply of our products when we know Australian made and Australian owned has a lot of provenance, so that’s something we believe is really the right thing to do.

“We are also starting to share the intellectual property that exists within Braeside, so when we talk about focusing on Indonesia and India being a key part of our strategy, that gives us the ability to develop products for those unique cultural groups, which if you go to contract manufacturers you may not be able to access.”

For example, Mr Symington said Braeside was Halal certified, which would help Blackmores gain a foothold in Indonesia and its 250 million consumers.

He said the challenges Blackmores had faced in the past two to three years included “no significant investment in China” and “uncompetitive gross margins due to poor mix” and “lack of pricing to cover costs”.

The new strategy aims to address those challenges and also includes the ‘Modern Career Woman in China’ program, a partnership with Tsinghua University that involves tailoring products for women in China.

“In terms of the career woman, she’s a working mum who not only makes decisions for her immediate family but for her parents, her partner’s parents and there is lot of social pressure for women in China, and based on the paper we have with Tsinghua University, they’re highly stressed.

“So the ability for them to find products that they feel can work for themselves and their families is really important.

“The nice thing is, if we can develop products for the modern career woman in China, and they’re the most discerning consumer in the world, and we then take products into markets back into Australia, into South-East Asia, we fell like that’s going to work with a broader consumer base as well.”

Overall, the strategy — which includes stripping out $50m worth of costs — is expected to return Blackmores to profit growth by 2023 with a 15 per cent EBIT margin target, Mr Symington said.

“We are confident with the strategy we have outlined that we will see profit sustainably grow over the next three years.

“In the past we have seen profit up and down a bit, but we aim to provide more consistency to our shareholders and to the market.”

Morgans analyst Belinda Moore said Blackmores’ leadership was managing everything within its control and the new strategy made sense.

“The important point from here is it’s pretty much an entirely new management team that are very focused on turning this business around and realising its potential throughout the Asia Pacific over the next three years,” Ms Moore said.

“In the short-term there is still some obvious downside risk over the coronavirus, which continues spread into other markets which is concerning. But certainly I think the strategy that they’ve unveiled makes strategic sense and there is lots of buckets of upside and growth.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout